- Mexico

- /

- Food and Staples Retail

- /

- BMV:CHDRAUI B

These 4 Measures Indicate That Grupo Comercial Chedraui. de (BMV:CHDRAUIB) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Grupo Comercial Chedraui, S.A.B. de C.V. (BMV:CHDRAUIB) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Grupo Comercial Chedraui. de's Net Debt?

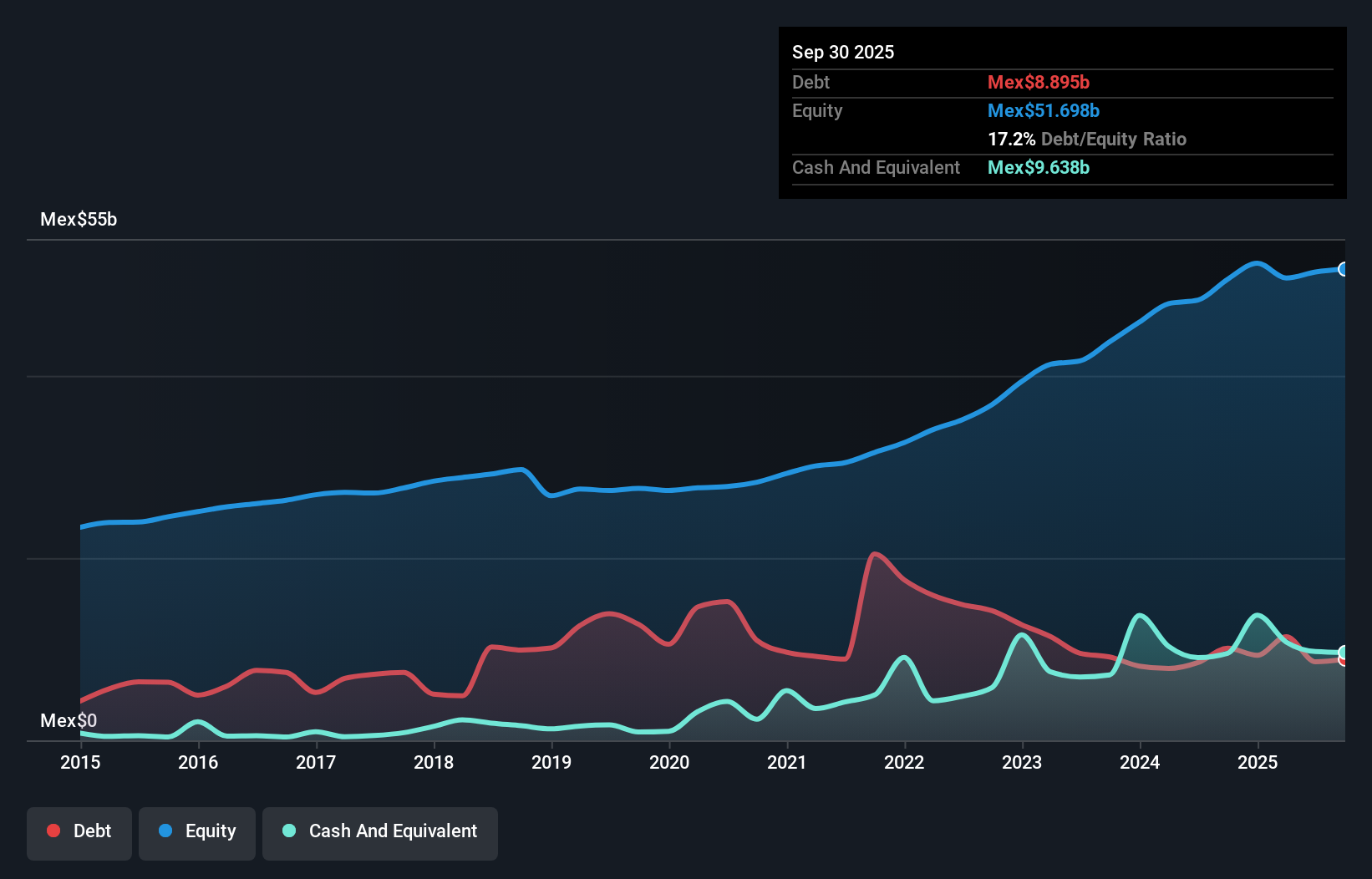

You can click the graphic below for the historical numbers, but it shows that Grupo Comercial Chedraui. de had Mex$8.89b of debt in September 2025, down from Mex$10.1b, one year before. But it also has Mex$9.64b in cash to offset that, meaning it has Mex$743.1m net cash.

How Strong Is Grupo Comercial Chedraui. de's Balance Sheet?

The latest balance sheet data shows that Grupo Comercial Chedraui. de had liabilities of Mex$43.5b due within a year, and liabilities of Mex$60.4b falling due after that. On the other hand, it had cash of Mex$9.64b and Mex$6.82b worth of receivables due within a year. So it has liabilities totalling Mex$87.5b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of Mex$125.0b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. While it does have liabilities worth noting, Grupo Comercial Chedraui. de also has more cash than debt, so we're pretty confident it can manage its debt safely.

Check out our latest analysis for Grupo Comercial Chedraui. de

Unfortunately, Grupo Comercial Chedraui. de saw its EBIT slide 5.0% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Grupo Comercial Chedraui. de can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Grupo Comercial Chedraui. de may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Grupo Comercial Chedraui. de actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

Although Grupo Comercial Chedraui. de's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of Mex$743.1m. The cherry on top was that in converted 111% of that EBIT to free cash flow, bringing in Mex$21b. So we are not troubled with Grupo Comercial Chedraui. de's debt use. Over time, share prices tend to follow earnings per share, so if you're interested in Grupo Comercial Chedraui. de, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:CHDRAUI B

Grupo Comercial Chedraui. de

Operates self–service and real estate stores in Mexico and the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026