- Mexico

- /

- Industrials

- /

- BMV:KUO B

Investors more bullish on Grupo KUO. de (BMV:KUOB) this week as stock rises 7.5%, despite earnings trending downwards over past year

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. For example, the Grupo KUO, S.A.B. de C.V. (BMV:KUOB) share price is up 11% in the last 1 year, clearly besting the market decline of around 2.4% (not including dividends). So that should have shareholders smiling. In contrast, the longer term returns are negative, since the share price is 8.4% lower than it was three years ago.

The past week has proven to be lucrative for Grupo KUO. de investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for Grupo KUO. de

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Grupo KUO. de actually saw its earnings per share drop 55%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We haven't seen Grupo KUO. de increase dividend payments yet, so the yield probably hasn't helped drive the share higher. Revenue actually dropped 14% over last year. Usually that correlates with a lower share price, but let's face it, the gyrations of the market are sometimes only as clear as mud.

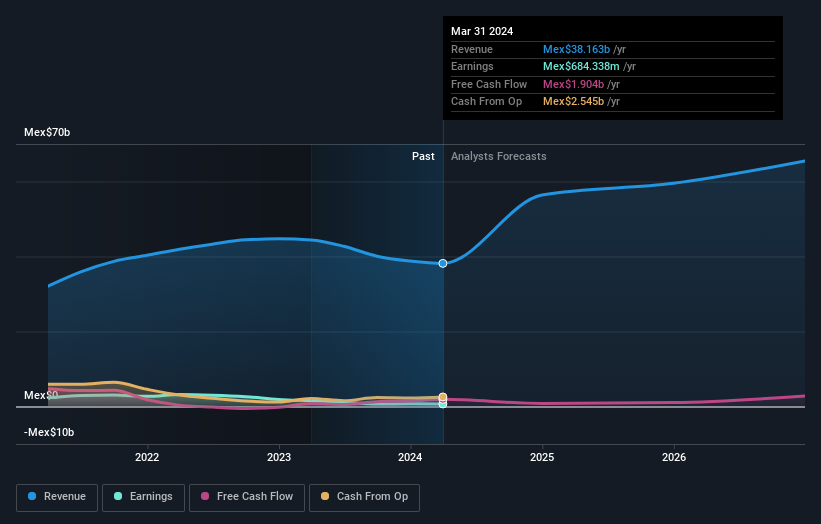

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Grupo KUO. de stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Grupo KUO. de's TSR for the last 1 year was 13%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Grupo KUO. de shareholders have received a total shareholder return of 13% over the last year. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 0.4% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Grupo KUO. de has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:KUO B

Grupo KUO. de

Through its subsidiaries, manufactures and sells consumer products, plastics, chemical products, and auto parts in Mexico, the United States, Spain, Belgium, and China.

Flawless balance sheet and good value.