- Mexico

- /

- Auto Components

- /

- BMV:NEMAK A

The five-year loss for Nemak S. A. B. de C. V (BMV:NEMAKA) shareholders likely driven by its shrinking earnings

Nemak, S. A. B. de C. V. (BMV:NEMAKA) shareholders should be happy to see the share price up 10% in the last week. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 76% in that time. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

While the last five years has been tough for Nemak S. A. B. de C. V shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Nemak S. A. B. de C. V

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Nemak S. A. B. de C. V became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 5.0% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

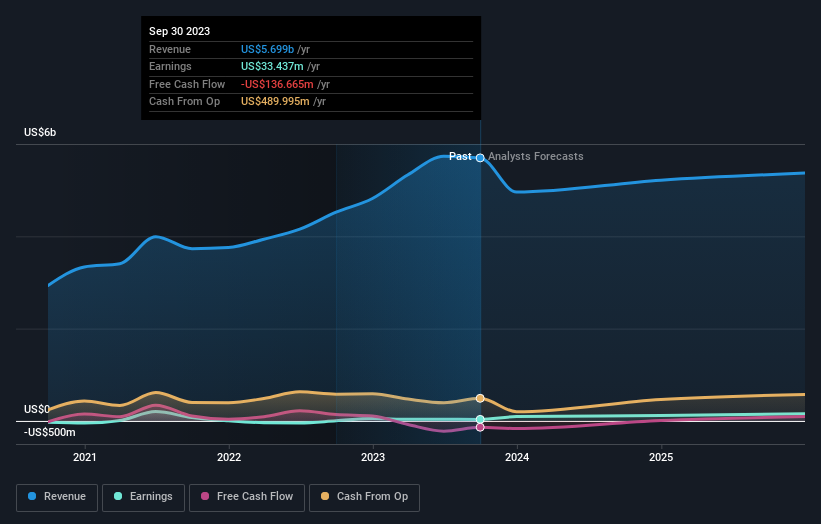

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Nemak S. A. B. de C. V has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Nemak S. A. B. de C. V in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Nemak S. A. B. de C. V's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Nemak S. A. B. de C. V's TSR of was a loss of 73% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Nemak S. A. B. de C. V shareholders are down 39% for the year, but the market itself is up 0.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Nemak S. A. B. de C. V is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nemak S. A. B. de C. V might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:NEMAK A

Nemak S. A. B. de C. V

Develops, manufactures, and sells aluminum components for e-mobility, structure and chassis, and ICE powertrain applications to the automotive industry in North America, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026