- Mexico

- /

- Auto Components

- /

- BMV:NEMAK A

Nemak S. A. B. de C. V (BMV:NEMAKA) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Nemak, S. A. B. de C. V. (BMV:NEMAKA) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Nemak S. A. B. de C. V

What Is Nemak S. A. B. de C. V's Debt?

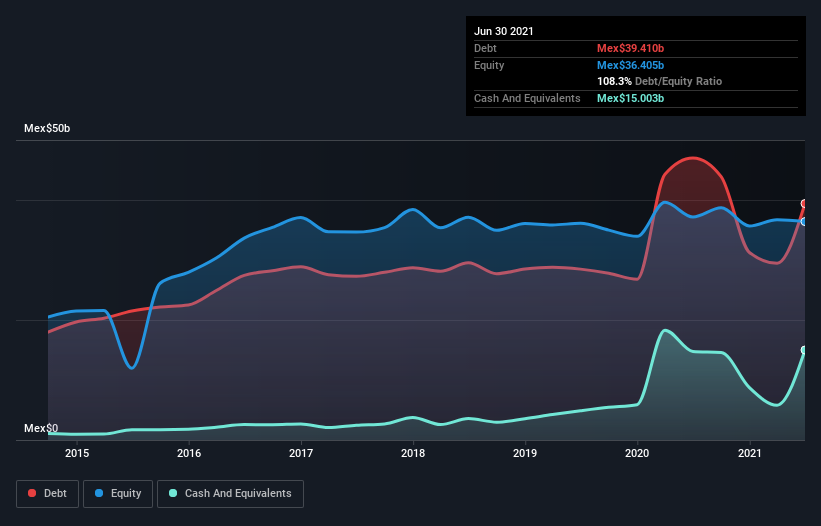

You can click the graphic below for the historical numbers, but it shows that Nemak S. A. B. de C. V had Mex$39.4b of debt in June 2021, down from Mex$47.0b, one year before. On the flip side, it has Mex$15.0b in cash leading to net debt of about Mex$24.4b.

How Healthy Is Nemak S. A. B. de C. V's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Nemak S. A. B. de C. V had liabilities of Mex$31.0b due within 12 months and liabilities of Mex$41.0b due beyond that. On the other hand, it had cash of Mex$15.0b and Mex$10.5b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by Mex$46.5b.

The deficiency here weighs heavily on the Mex$19.4b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Nemak S. A. B. de C. V would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Nemak S. A. B. de C. V's net debt is sitting at a very reasonable 1.9 times its EBITDA, while its EBIT covered its interest expense just 5.0 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Pleasingly, Nemak S. A. B. de C. V is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 607% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Nemak S. A. B. de C. V can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Nemak S. A. B. de C. V recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Neither Nemak S. A. B. de C. V's ability to handle its total liabilities nor its interest cover gave us confidence in its ability to take on more debt. But its EBIT growth rate tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Nemak S. A. B. de C. V is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Nemak S. A. B. de C. V that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Nemak S. A. B. de C. V, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nemak S. A. B. de C. V might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:NEMAK A

Nemak S. A. B. de C. V

Develops, manufactures, and sells aluminum components for e-mobility, structure and chassis, and ICE powertrain applications to the automotive industry in North America, Europe, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives