- Malta

- /

- Real Estate

- /

- MTSE:MSC

Don't Buy Main Street Complex p.l.c. (MTSE:MSC) For Its Next Dividend Without Doing These Checks

Main Street Complex p.l.c. (MTSE:MSC) stock is about to trade ex-dividend in 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, Main Street Complex investors that purchase the stock on or after the 29th of August will not receive the dividend, which will be paid on the 12th of September.

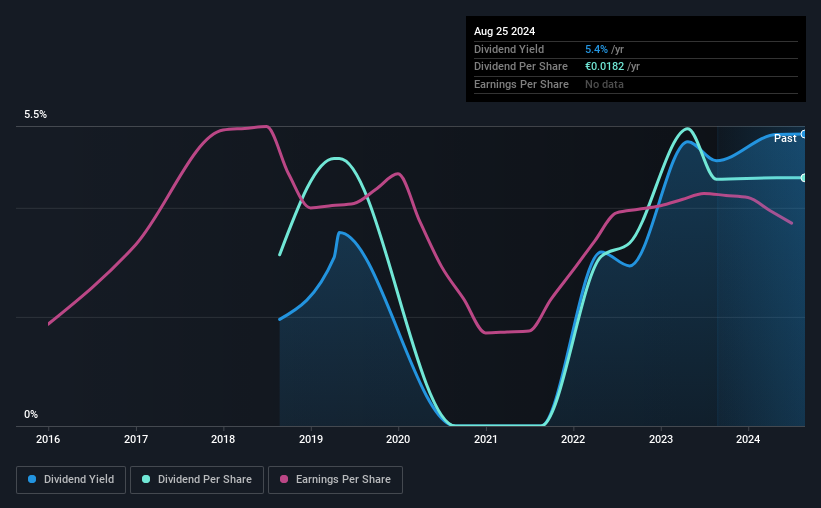

The company's next dividend payment will be €0.0054 per share, on the back of last year when the company paid a total of €0.018 to shareholders. Based on the last year's worth of payments, Main Street Complex has a trailing yield of 5.4% on the current stock price of €0.34. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Main Street Complex

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Main Street Complex distributed an unsustainably high 112% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the past year it paid out 113% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

As Main Street Complex's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

Click here to see how much of its profit Main Street Complex paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's not encouraging to see that Main Street Complex's earnings are effectively flat over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last six years, Main Street Complex has lifted its dividend by approximately 6.4% a year on average.

To Sum It Up

Is Main Street Complex an attractive dividend stock, or better left on the shelf? It's been unable to generate earnings growth, yet is paying out an uncomfortably high percentage of both its profits (112%) and cash flow (113%) as dividends. Bottom line: Main Street Complex has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

Although, if you're still interested in Main Street Complex and want to know more, you'll find it very useful to know what risks this stock faces. In terms of investment risks, we've identified 4 warning signs with Main Street Complex and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:MSC

Main Street Complex

Operates and manages the Main Street Shopping Complex located in Paola, Malta.

Excellent balance sheet slight.