Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that International Hotel Investments p.l.c. (MTSE:IHI) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for International Hotel Investments

What Is International Hotel Investments's Net Debt?

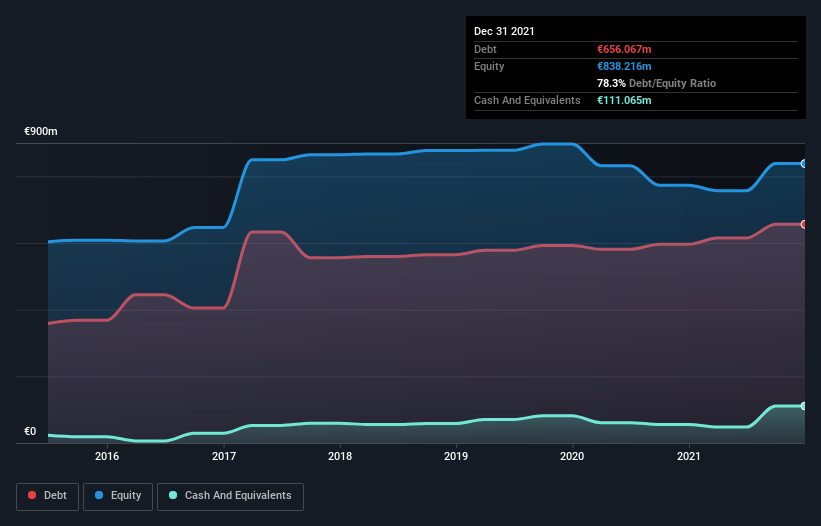

You can click the graphic below for the historical numbers, but it shows that as of December 2021 International Hotel Investments had €656.1m of debt, an increase on €596.1m, over one year. However, it does have €111.1m in cash offsetting this, leading to net debt of about €545.0m.

How Healthy Is International Hotel Investments' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that International Hotel Investments had liabilities of €105.4m due within 12 months and liabilities of €751.7m due beyond that. Offsetting this, it had €111.1m in cash and €32.3m in receivables that were due within 12 months. So its liabilities total €713.7m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €363.3m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, International Hotel Investments would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since International Hotel Investments will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year International Hotel Investments wasn't profitable at an EBIT level, but managed to grow its revenue by 41%, to €129m. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, International Hotel Investments still had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at €4.1m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. It's fair to say the loss of €28m didn't encourage us either; we'd like to see a profit. And until that time we think this is a risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that International Hotel Investments is showing 2 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:IHI

International Hotel Investments

Engages in the ownership, development, and operation of hotels, leisure facilities, and other activities related to the tourism industry and commercial centres.

Low with questionable track record.

Market Insights

Community Narratives