- Luxembourg

- /

- Capital Markets

- /

- BDL:REINI

Should the Higher Dividend Approval Prompt Action From Reinet Investments S.C.A (BDL:REINI) Investors?

Reviewed by Simply Wall St

- Reinet Investments S.C.A. has approved a cash dividend of €0.37 per share, to be paid on 17 September 2025.

- This increase in dividend highlights the company's commitment to returning value to shareholders and likely signals management's confidence in its financial position.

- We'll examine how the dividend approval shapes investor expectations for Reinet Investments S.C.A.'s income appeal and capital allocation priorities.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Reinet Investments S.C.A's Investment Narrative?

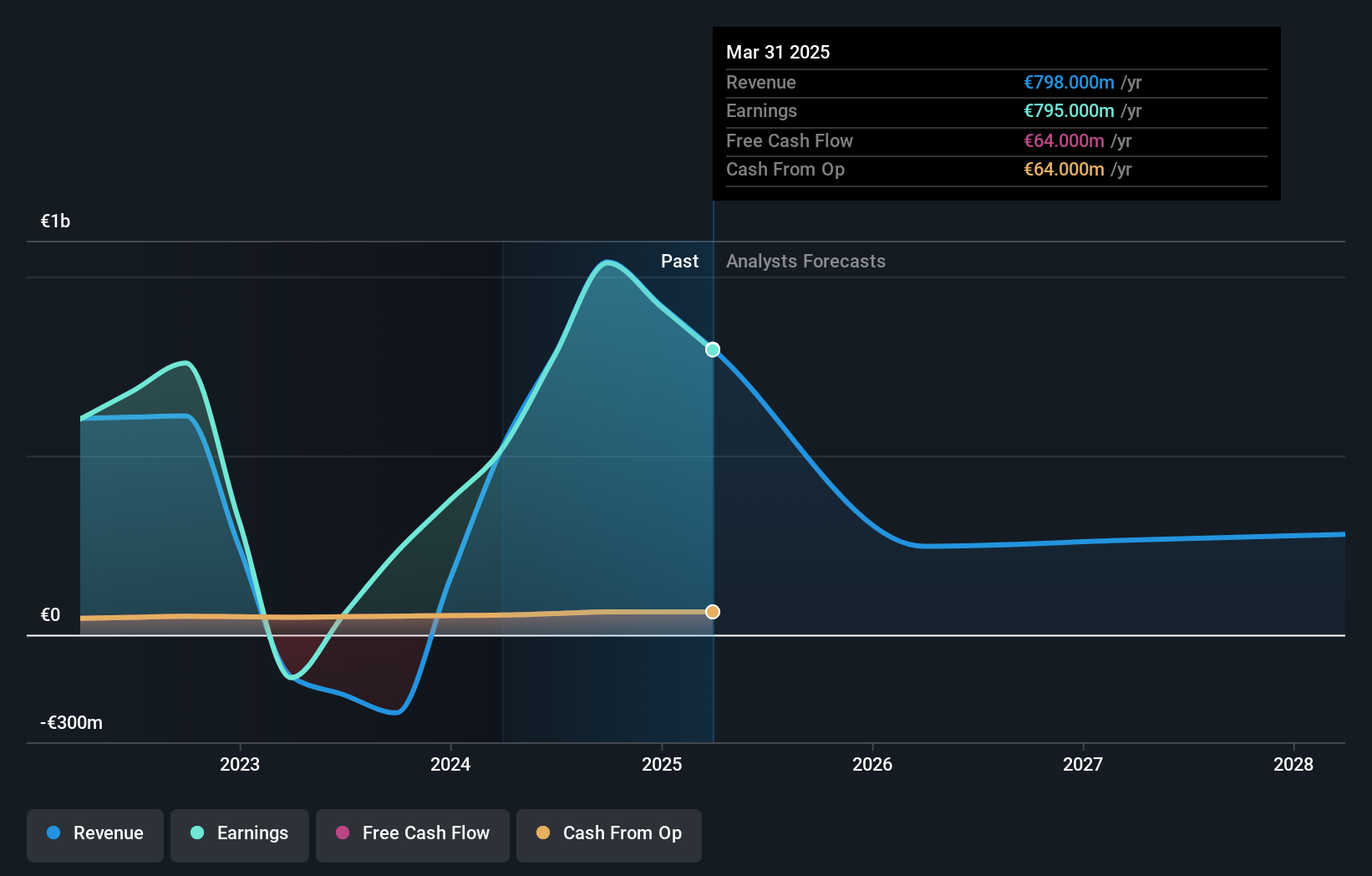

To be a shareholder in Reinet Investments S.C.A., you really have to believe in its ability to unlock value from its substantial portfolio holdings and disciplined capital allocation, even as the business faces meaningful cyclical and structural challenges. The latest dividend approval, following several recent increases, certainly feels like a clear affirmation from management that underlying cash flow strength remains robust for now. While this move adds to Reinet’s near-term income appeal and may lift sentiment among those prioritizing yield, it does not seem likely to materially change the short-term catalysts or ease the biggest risks at play, particularly the possible sale of its significant stake in Pension Insurance Corporation, which could have a far-reaching impact on both balance sheet strength and future revenue streams. For now, the dividend action is a positive signal, but the story remains focused on whether Reinet can redeploy capital to offset declining revenue forecasts and manage asset concentration risks.

But, some uncertainties around the potential sale of key assets remain that investors should watch. Despite retreating, Reinet Investments S.C.A's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Reinet Investments S.C.A - why the stock might be worth over 2x more than the current price!

Build Your Own Reinet Investments S.C.A Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reinet Investments S.C.A research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Reinet Investments S.C.A research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reinet Investments S.C.A's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BDL:REINI

Reinet Investments S.C.A

Operates as a securitization vehicle in Luxembourg.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives