- South Korea

- /

- Gas Utilities

- /

- KOSE:A267290

Kyungdong City Gas' (KRX:267290) Earnings Offer More Than Meets The Eye

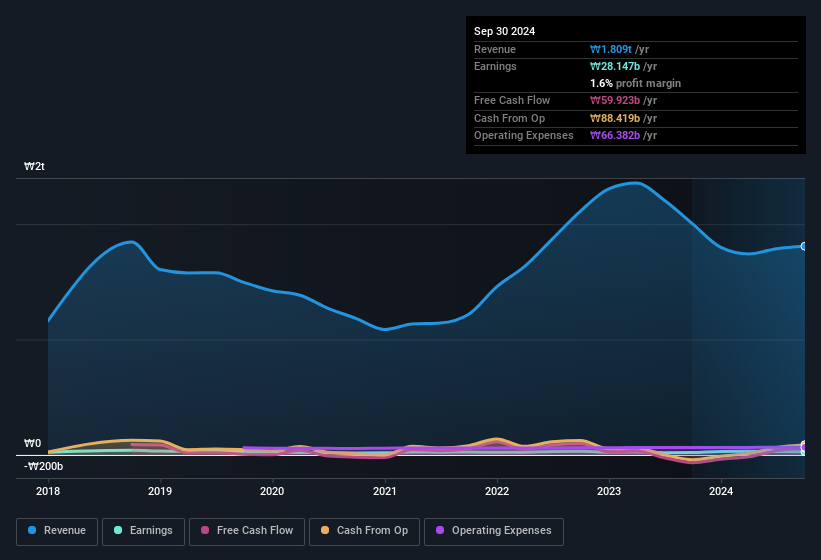

Kyungdong City Gas Co., Ltd's (KRX:267290) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

See our latest analysis for Kyungdong City Gas

Zooming In On Kyungdong City Gas' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to September 2024, Kyungdong City Gas had an accrual ratio of -0.14. Therefore, its statutory earnings were quite a lot less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of ₩60b, well over the ₩28.1b it reported in profit. Notably, Kyungdong City Gas had negative free cash flow last year, so the ₩60b it produced this year was a welcome improvement. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Kyungdong City Gas.

How Do Unusual Items Influence Profit?

Surprisingly, given Kyungdong City Gas' accrual ratio implied strong cash conversion, its paper profit was actually boosted by ₩2.2b in unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. If Kyungdong City Gas doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Kyungdong City Gas' Profit Performance

Kyungdong City Gas' profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. After taking into account all these factors, we think that Kyungdong City Gas' statutory results are a decent reflection of its underlying earnings power. If you'd like to know more about Kyungdong City Gas as a business, it's important to be aware of any risks it's facing. You'd be interested to know, that we found 1 warning sign for Kyungdong City Gas and you'll want to know about it.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Kyungdong City Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A267290

Kyungdong City Gas

Engages in the manufacture and supply of liquefied natural gas through a network of pipelines.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026