- South Korea

- /

- Marine and Shipping

- /

- KOSE:A044450

Investors In KSS Line Ltd. (KRX:044450) Should Consider This, First

Dividend paying stocks like KSS Line Ltd. (KRX:044450) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

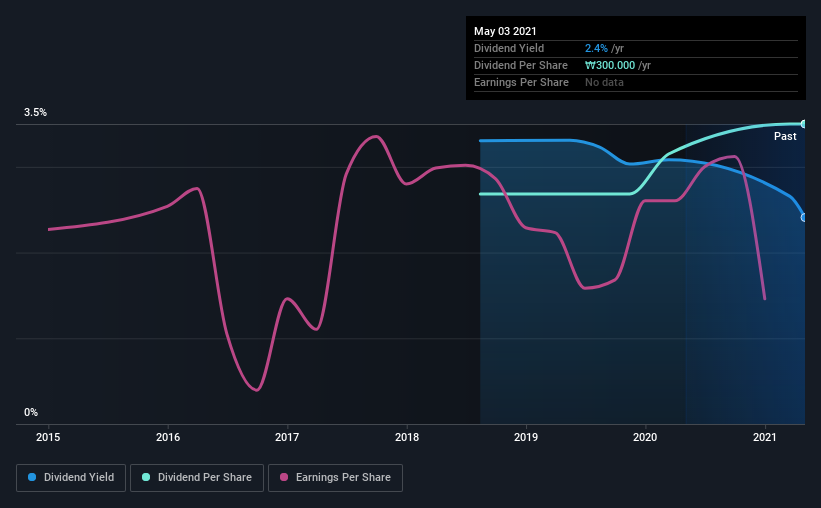

Some readers mightn't know much about KSS Line's 2.4% dividend, as it has only been paying distributions for the last three years. Many of the best dividend stocks typically start out paying a low yield, so we wouldn't automatically cut it from our list of prospects. Some simple analysis can reduce the risk of holding KSS Line for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. KSS Line paid out 51% of its profit as dividends, over the trailing twelve month period. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Unfortunately, while KSS Line pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Remember, you can always get a snapshot of KSS Line's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past three-year period, the first annual payment was ₩230 in 2018, compared to ₩300 last year. Dividends per share have grown at approximately 9.3% per year over this time.

KSS Line has been growing its dividend at a decent rate, and the payments have been stable despite the short payment history. This is a positive start.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. KSS Line's earnings per share have shrunk at 10% a year over the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and KSS Line's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that KSS Line's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. KSS Line gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. Earnings per share have been falling, and the company has a relatively short dividend history - shorter than we like, anyway. There are a few too many issues for us to get comfortable with KSS Line from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 3 warning signs for KSS Line (1 shouldn't be ignored!) that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KSS Line might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A044450

KSS Line

Provides marine transportation services for liquefied petroleum gas and petrochemical products in South Korea and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026