- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A033240

Jahwa Electronics. Co., Ltd (KRX:033240) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Unfortunately for some shareholders, the Jahwa Electronics. Co., Ltd (KRX:033240) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

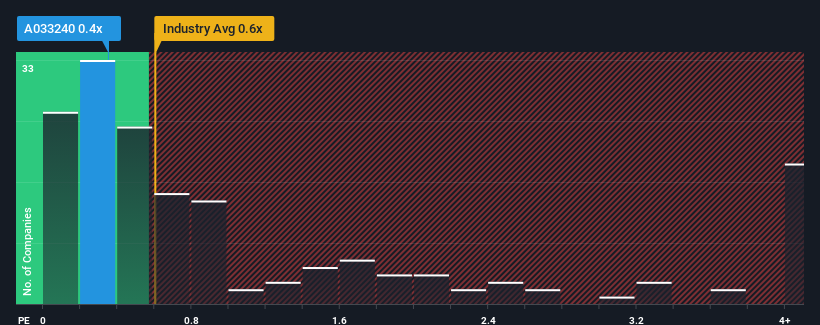

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Jahwa Electronics' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Korea is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Jahwa Electronics

How Jahwa Electronics Has Been Performing

With revenue growth that's superior to most other companies of late, Jahwa Electronics has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Jahwa Electronics will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Jahwa Electronics?

The only time you'd be comfortable seeing a P/S like Jahwa Electronics' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 91%. The latest three year period has also seen an excellent 108% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 4.4% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

In light of this, it's curious that Jahwa Electronics' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Following Jahwa Electronics' share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Jahwa Electronics' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Jahwa Electronics that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A033240

Jahwa Electronics

Manufactures and sells precision electronic components in South Korea and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026