- China

- /

- Semiconductors

- /

- SHSE:688052

Discover 3 Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate expectations and economic shifts, Asian markets continue to capture investor attention with their unique growth opportunities. In this environment, companies with high insider ownership often stand out as potential investment candidates, as they may signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.1% |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's dive into some prime choices out of the screener.

Korea Circuit (KOSE:A007810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Korea Circuit Co., Ltd. is involved in the production and sale of printed circuit boards globally, with a market cap of ₩961.79 billion.

Operations: Korea Circuit Co., Ltd. generates revenue through its global production and sale of printed circuit boards.

Insider Ownership: 13.4%

Korea Circuit is positioned for growth with its revenue expected to increase by 11.6% annually, outpacing the Korean market. The company is projected to achieve profitability within three years, reflecting above-average market growth. Despite trading at a 16.2% discount to fair value, its return on equity forecast remains modest at 17.3%. The stock's recent volatility and lack of substantial insider trading activity may warrant cautious consideration for investors focused on stability and insider confidence.

- Navigate through the intricacies of Korea Circuit with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Korea Circuit's share price might be on the expensive side.

Suzhou Novosense Microelectronics (SHSE:688052)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Novosense Microelectronics Co., Ltd. operates in the semiconductor industry, focusing on designing and manufacturing microelectronic components, with a market cap of CN¥25.33 billion.

Operations: Suzhou Novosense Microelectronics Co., Ltd. generates revenue from its semiconductor operations, specifically through the design and manufacture of microelectronic components.

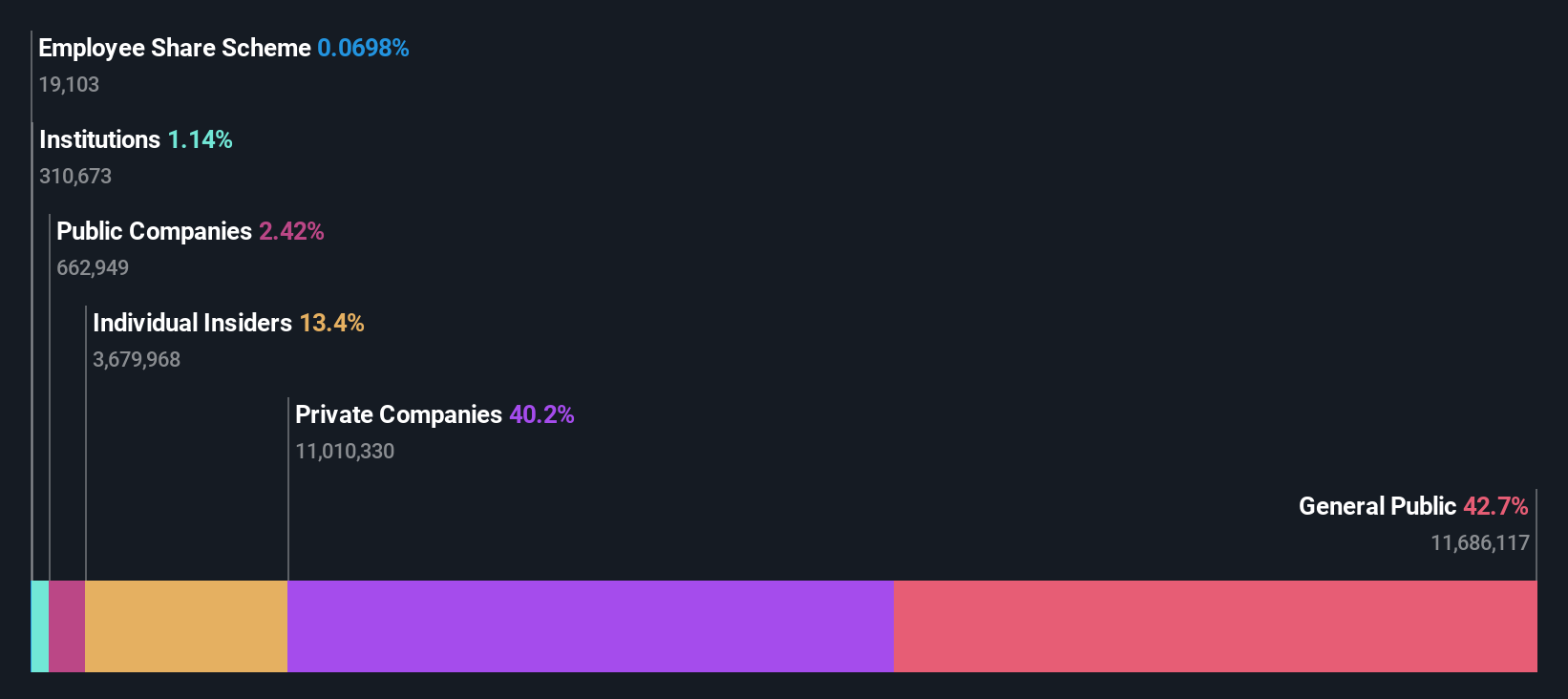

Insider Ownership: 22.1%

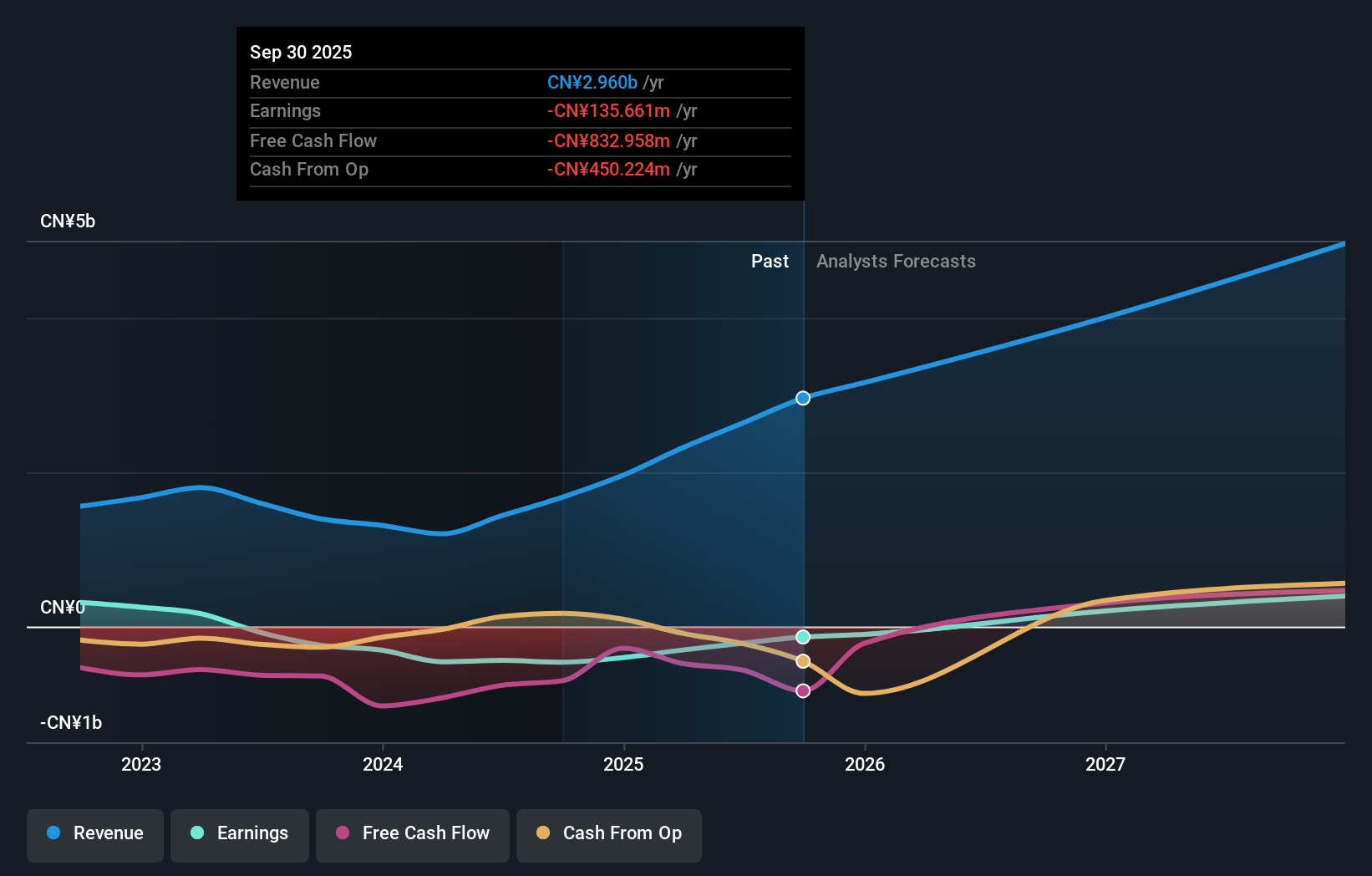

Suzhou Novosense Microelectronics is poised for growth, with revenue projected to expand by 23.5% annually, surpassing the Chinese market average. The company is on track to achieve profitability within three years, indicating robust growth potential. Recently, it completed a follow-on equity offering of HK$2.21 billion and introduced advanced LED driver ICs for automotive applications. Despite a current net loss reduction from CNY 407.7 million to CNY 140.49 million year-over-year, insider trading activity remains minimal.

- Delve into the full analysis future growth report here for a deeper understanding of Suzhou Novosense Microelectronics.

- Our valuation report here indicates Suzhou Novosense Microelectronics may be overvalued.

Jiangsu Shuangxing Color Plastic New Materials (SZSE:002585)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Shuangxing Color Plastic New Materials Co., Ltd. operates in the production and sale of color plastic films, with a market cap of CN¥7.91 billion.

Operations: Jiangsu Shuangxing Color Plastic New Materials Co., Ltd. generates its revenue primarily from the production and sale of color plastic films.

Insider Ownership: 29.7%

Jiangsu Shuangxing Color Plastic New Materials is projected to grow revenue by 15.1% annually, slightly above the Chinese market average. Despite a current net loss of CNY 222.89 million for the first nine months of 2025, the company is expected to become profitable in three years, indicating potential for substantial growth. Insider trading activity has been minimal recently, and Return on Equity is forecasted to remain low at 4.5% in three years.

- Dive into the specifics of Jiangsu Shuangxing Color Plastic New Materials here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Jiangsu Shuangxing Color Plastic New Materials shares in the market.

Make It Happen

- Explore the 642 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688052

Suzhou Novosense Microelectronics

Suzhou Novosense Microelectronics Co., Ltd.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026