- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

High Growth Tech Stocks To Watch In South Korea September 2024

Reviewed by Simply Wall St

South Korea's market is currently influenced by significant changes in import and export prices, with July figures showing a 9.8 percent increase in import prices and a 12.9 percent rise in export prices year-on-year. In this dynamic economic environment, identifying high-growth tech stocks requires careful consideration of their ability to innovate and adapt to shifting market conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

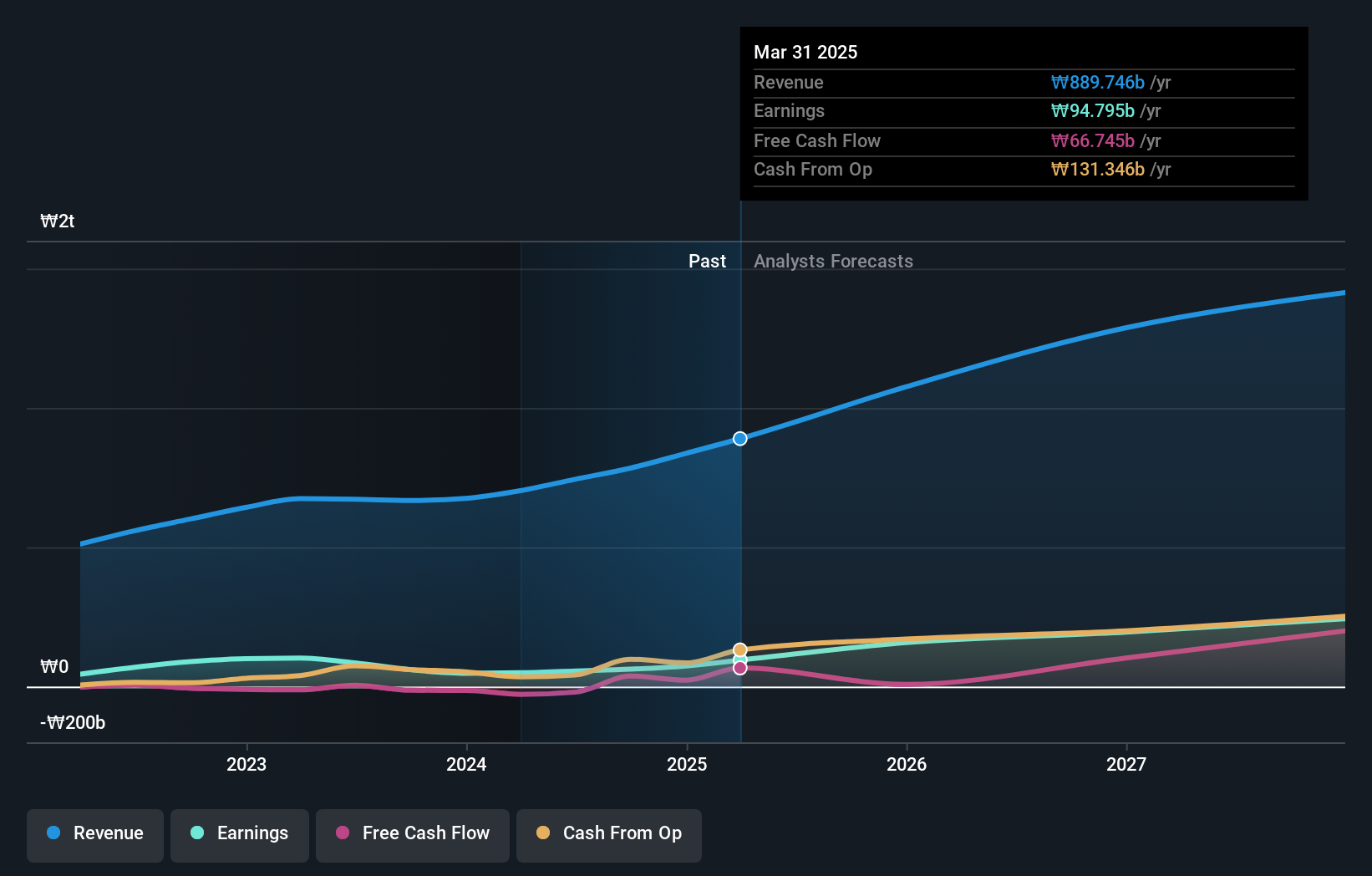

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩16.97 billion.

Operations: ALTEOGEN Inc. generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion. The company focuses on developing innovative biopharmaceutical products, including long-acting biobetters and proprietary antibody-drug conjugates.

ALTEOGEN's recent MFDS approval for Tergase® underscores its innovative edge in the biotech sector, leveraging proprietary Hybrozyme™ Technology to achieve over 99% purity in recombinant hyaluronidase. This product's potential applications span beyond dermal filler removal to include local anesthetic solutions and orthopedic pain management, indicating diverse revenue streams. The company's R&D expenses reflect a robust commitment to innovation, with significant investment driving expected annual revenue growth of 64.2%, outpacing the market average of 10.4%. Earnings are projected to surge by 99.46% annually, positioning ALTEOGEN for substantial future profitability and market impact.

- Unlock comprehensive insights into our analysis of ALTEOGEN stock in this health report.

Examine ALTEOGEN's past performance report to understand how it has performed in the past.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. manufactures and sells printed circuit boards (PCBs) worldwide, with a market cap of ₩2.32 billion.

Operations: ISU Petasys generates revenue primarily through the manufacture and sale of printed circuit boards (PCBs), amounting to ₩743.88 billion. The company operates on a global scale, catering to diverse markets with its PCB products.

ISU Petasys, a prominent player in the tech sector, has shown significant growth prospects with an expected annual profit growth rate of 44.5%, outpacing the South Korean market average of 29.1%. The company's revenue is forecasted to grow at 19% per year, indicating strong performance relative to the market's 10.4%. Notably, their R&D expenses have been substantial, reflecting a commitment to innovation that could drive future profitability and industry impact.

- Dive into the specifics of ISU Petasys here with our thorough health report.

Gain insights into ISU Petasys' historical performance by reviewing our past performance report.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, develops and produces protein-based drugs for oncology treatment in South Korea and has a market cap of ₩40.28 trillion.

Operations: Celltrion, Inc. focuses on developing and producing protein-based drugs primarily for oncology treatment in South Korea. The company generates revenue mainly from Bio Medical Supply (₩3.54 trillion) and Chemical Drugs (₩507 billion).

Celltrion's revenue is expected to grow at an impressive 25.5% per year, significantly outpacing the South Korean market average of 10.4%. The company has been proactive in expanding its portfolio, with recent approvals like SteQeyma® for multiple chronic inflammatory diseases and ZYMFENTRA® gaining preferred status on Cigna's formulary. Despite a net profit margin decrease from 23.8% to 12.1%, earnings are forecasted to surge by 59.6% annually, reflecting strong future growth potential bolstered by substantial R&D investments and strategic share repurchases amounting to ₩75.89 billion this year.

- Click to explore a detailed breakdown of our findings in Celltrion's health report.

Understand Celltrion's track record by examining our Past report.

Taking Advantage

- Navigate through the entire inventory of 49 KRX High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with excellent balance sheet.