- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this dynamic environment, identifying high-growth tech stocks requires a keen eye for companies that demonstrate strong innovation potential and resilience in the face of economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.85% | 25.26% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1208 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

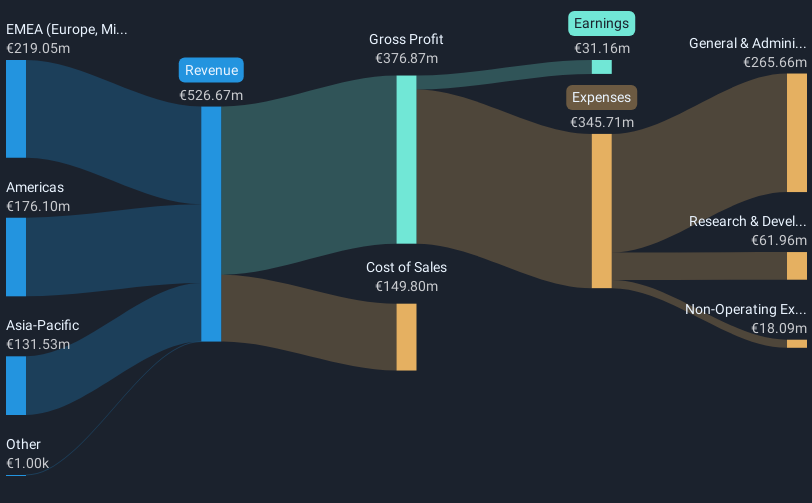

Overview: Lectra SA offers industrial intelligence solutions across the fashion, automotive, and furniture sectors globally, with a market cap of €1.09 billion.

Operations: The company generates revenue from providing industrial intelligence solutions across the Americas (€176.10 million), Asia-Pacific (€131.53 million), and EMEA regions (€219.05 million).

Lectra, a software firm navigating the competitive landscape of tech innovation, is poised for robust growth with an expected earnings increase of 23.1% annually. This outpaces the French market's forecast of 13.2%, underscoring its potential in a tough environment marked by a recent -8.1% dip in earnings last year compared to the industry average growth of 18.1%. Despite these challenges, Lectra's strategic focus on enhancing its product offerings and operational efficiency is evident from its R&D commitment, which remains integral to fostering technological advancements and sustaining long-term competitiveness in the digital cutting space. The company recently projected revenues between €550 million and €600 million for 2025, reflecting confidence in their refined business strategies amidst executive changes and a proposed dividend increase to €0.40 per share, signaling strong financial health and shareholder value orientation.

- Click here and access our complete health analysis report to understand the dynamics of Lectra.

Explore historical data to track Lectra's performance over time in our Past section.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

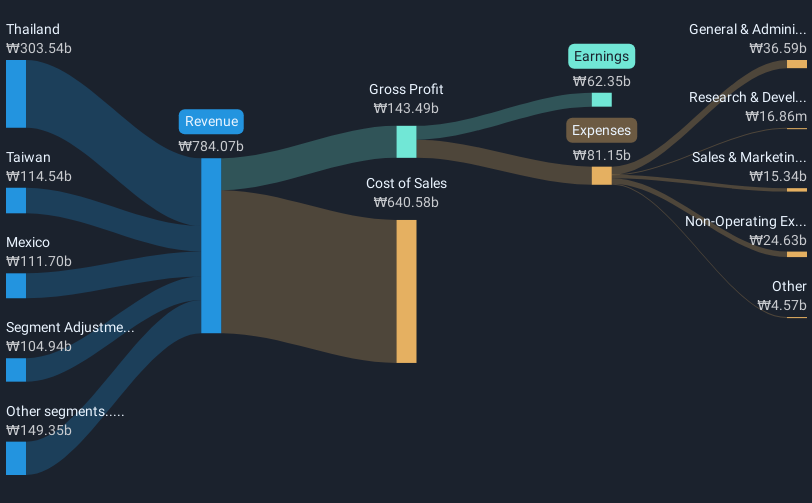

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs), with a market cap of ₩2.69 trillion.

Operations: ISU Petasys focuses on the global production and distribution of printed circuit boards (PCBs), generating revenue of approximately ₩784.07 billion from this segment.

ISU Petasys is distinguishing itself in the tech sector with a notable 43.8% projected annual earnings growth, outpacing the broader Korean market's 25.9%. This growth trajectory is supported by a robust R&D investment strategy, crucial for maintaining its competitive edge in electronics. Despite challenges from a volatile share price and high debt levels, the company's revenue is also expected to rise at an impressive rate of 18.2% annually, exceeding the market average of 9%. With earnings having increased by 2.9% over the past year against an industry decline of 3.5%, ISU Petasys is strategically positioned to leverage its technological advancements for sustained future growth.

- Delve into the full analysis health report here for a deeper understanding of ISU Petasys.

Understand ISU Petasys' track record by examining our Past report.

Healios K.K (TSE:4593)

Simply Wall St Growth Rating: ★★★★★☆

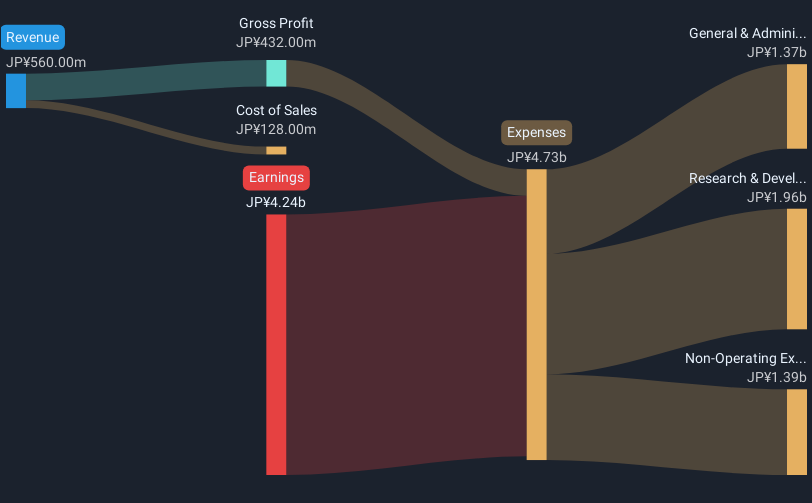

Overview: Healios K.K. focuses on the research, development, manufacture, and sale of cell therapy and regenerative medicine products across Japan, Europe, and the United States with a market capitalization of ¥37.96 billion.

Operations: Specializing in cell therapy and regenerative medicine, Healios K.K. operates across Japan, Europe, and the United States. The company is involved in research and development as well as manufacturing and sales within these regions.

Healios K.K. is steering towards profitability with a projected revenue growth of 35.7% annually, outpacing the Japanese market average of 4.2%. This growth is bolstered by strategic alliances, such as the recent collaboration with Akatsuki Therapeutics to enhance research in immune cell therapies, signaling a strong push into innovative treatment options for cancer. Moreover, the company's commitment to R&D is evident from its involvement in advanced projects like eNK cells development, supported by AMED for industrialization of regenerative medicine—a move that could revolutionize cancer therapy modalities and position Healios as a pioneer in biotech innovations.

- Dive into the specifics of Healios K.K here with our thorough health report.

Evaluate Healios K.K's historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 1208 High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives