- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets show resilience, with U.S. small-cap indexes like the S&P MidCap 400 and Russell 2000 climbing significantly, attention is shifting towards Asia's tech sector, which continues to attract interest due to its innovative potential and dynamic growth opportunities. In such a vibrant market environment, strong stocks often exhibit robust fundamentals and adaptability to evolving economic landscapes, making them particularly appealing amid ongoing technological advancements in the region.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 28.67% | 35.10% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of ₩4.32 trillion.

Operations: The company focuses on producing and distributing printed circuit boards (PCBs) globally.

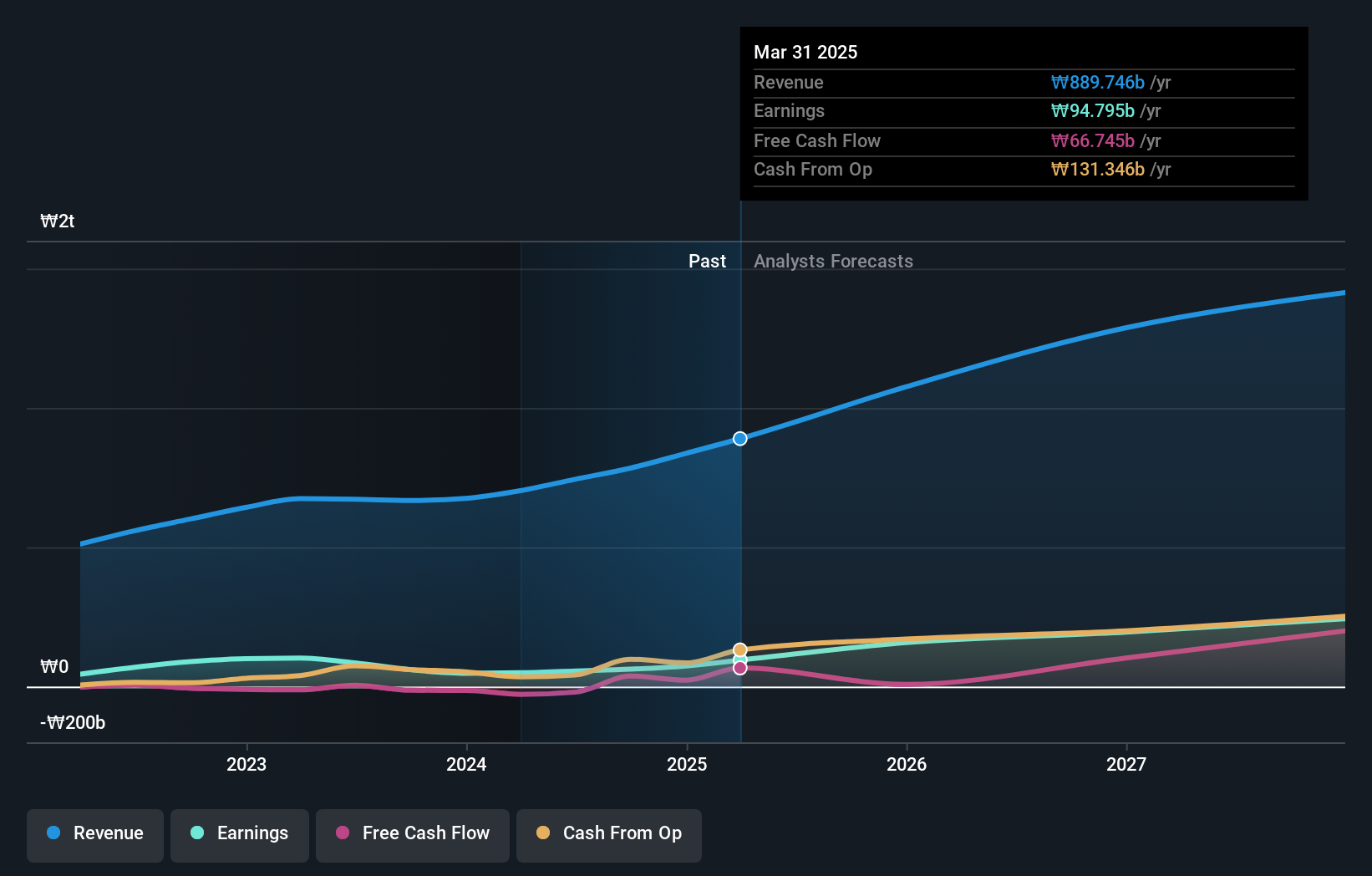

ISU Petasys, a contender in Asia's high-growth tech sector, demonstrates robust financial health with earnings projected to surge by 27.8% annually. This growth outpaces the general Korean market's 21% increase and is further highlighted by a significant revenue uptick at 16.9% per year, surpassing the market average of 6.6%. Despite a highly volatile share price recently, ISU Petasys maintains strong fundamentals with high-quality earnings and an impressive return on equity forecast at 30.7%. However, it faces challenges such as high debt levels and shareholder dilution over the past year. These factors make ISU Petasys a noteworthy study in balancing rapid growth potential against financial stability risks in the dynamic tech landscape of Asia.

- Click here to discover the nuances of ISU Petasys with our detailed analytical health report.

Gain insights into ISU Petasys' past trends and performance with our Past report.

Victory Giant Technology (HuiZhou)Co.Ltd (SZSE:300476)

Simply Wall St Growth Rating: ★★★★★★

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. is a company engaged in the production and development of printed circuit boards, with a market capitalization of approximately CN¥130.34 billion.

Operations: Victory Giant Technology primarily generates revenue through its PCB Manufacturing segment, which accounts for approximately CN¥11.97 billion.

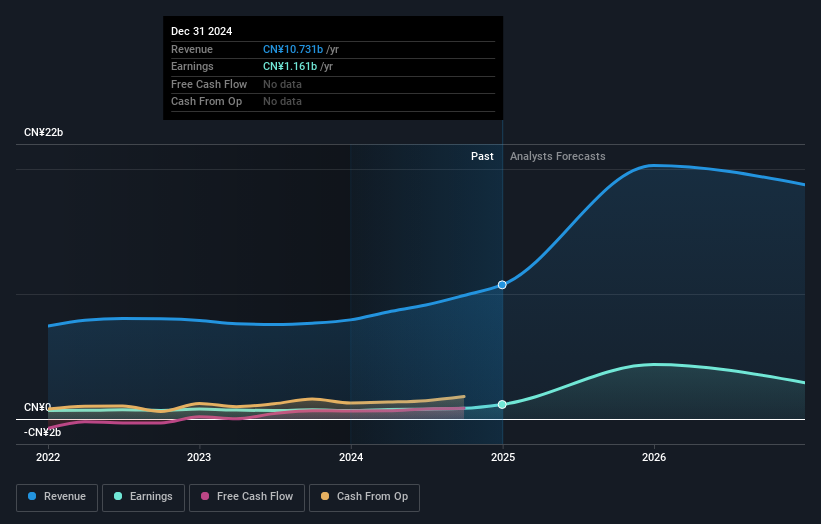

Victory Giant Technology (HuiZhou) Co., Ltd. is capturing attention with its impressive financial metrics and strategic market moves. In the first quarter of 2025, the company reported a surge in revenue to CNY 4.31 billion, up from CNY 2.39 billion year-over-year, reflecting a robust growth trajectory. This performance was underscored by a net income leap to CNY 920.65 million from CNY 209.61 million, indicating an earnings growth rate that significantly outpaces the broader Chinese market's average. Additionally, recent strategic acquisitions have bolstered its market position, as evidenced by multiple firms acquiring a collective stake of nearly 3% for CNY 1.7 billion, enhancing both liquidity and shareholder value while potentially expanding operational synergies across tech sectors.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market capitalization of ¥795.45 billion.

Operations: OMRON generates revenue through its industrial automation, device and module solutions, social systems, and healthcare divisions. The company focuses on diverse technological solutions catering to various industries worldwide.

OMRON's recent strategic partnership with Japan Activation Capital underscores its proactive approach in securing growth avenues, reflecting a broader trend of Japanese tech firms leveraging alliances to enhance market presence. Despite a modest annual revenue growth rate of 4.1%, OMRON's earnings are projected to surge by 25.3% annually, outpacing the general market's expansion. This robust earnings trajectory is supported by significant R&D investments, aligning with industry demands for innovative automation solutions. Moreover, the company’s commitment to shareholder returns remains evident with consistent dividend payouts projected at JPY 104 per share for the upcoming fiscal year, reinforcing its financial stability amidst dynamic market conditions.

- Unlock comprehensive insights into our analysis of OMRON stock in this health report.

Understand OMRON's track record by examining our Past report.

Where To Now?

- Click here to access our complete index of 484 Asian High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives