- China

- /

- Electronic Equipment and Components

- /

- SHSE:688127

Exploring High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets experience a rebound with cooling inflation and strong bank earnings propelling U.S. stocks higher, the focus has shifted to high growth tech stocks as potential drivers for portfolio enhancement. In this context, identifying a good stock involves assessing its ability to thrive amid current economic conditions, such as robust financial performance and adaptability in a dynamic market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

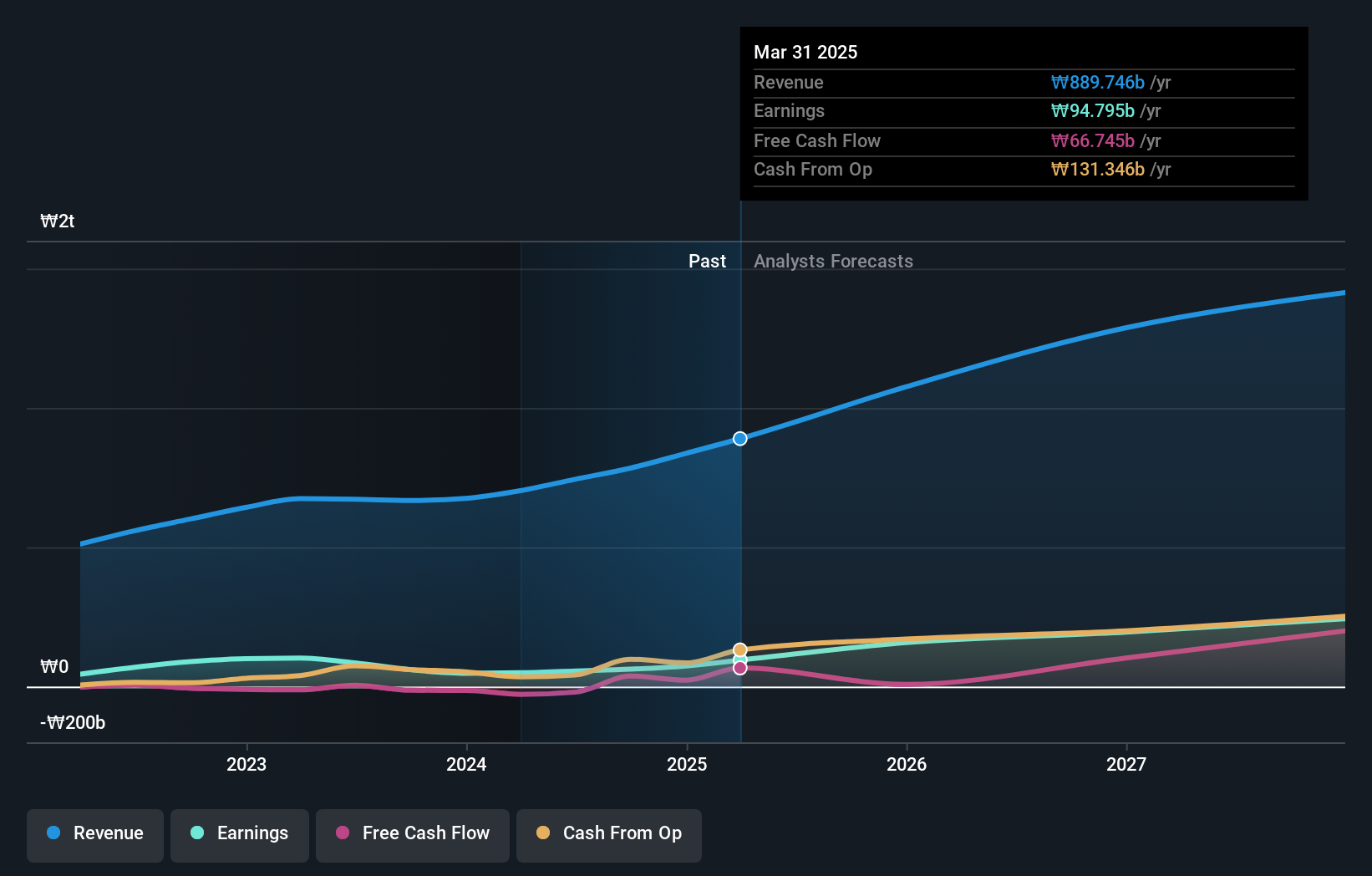

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of approximately ₩1.77 billion.

Operations: The company generates revenue primarily through the manufacture and sale of printed circuit boards, amounting to approximately ₩784.07 billion. With a market capitalization of around ₩1.77 trillion, ISU Petasys operates on a global scale in the PCB industry.

ISU Petasys has demonstrated robust financial performance with an impressive annual earnings growth forecast at 45.1%, significantly outpacing the broader Korean market's 28.9%. This growth is supported by a strong return on equity projected at 27.5% in three years, indicating efficient management and profitable investment returns. Despite a high level of debt, the company's strategic focus on innovation is evident from its recent follow-on equity offering aimed at funding expansion efforts, totaling KRW 549.82 billion. The firm’s commitment to R&D and expansion into new tech frontiers could potentially sustain its revenue growth rate of 19.1% annually, which already surpasses the national average of 9.3%.

- Click here to discover the nuances of ISU Petasys with our detailed analytical health report.

Examine ISU Petasys' past performance report to understand how it has performed in the past.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

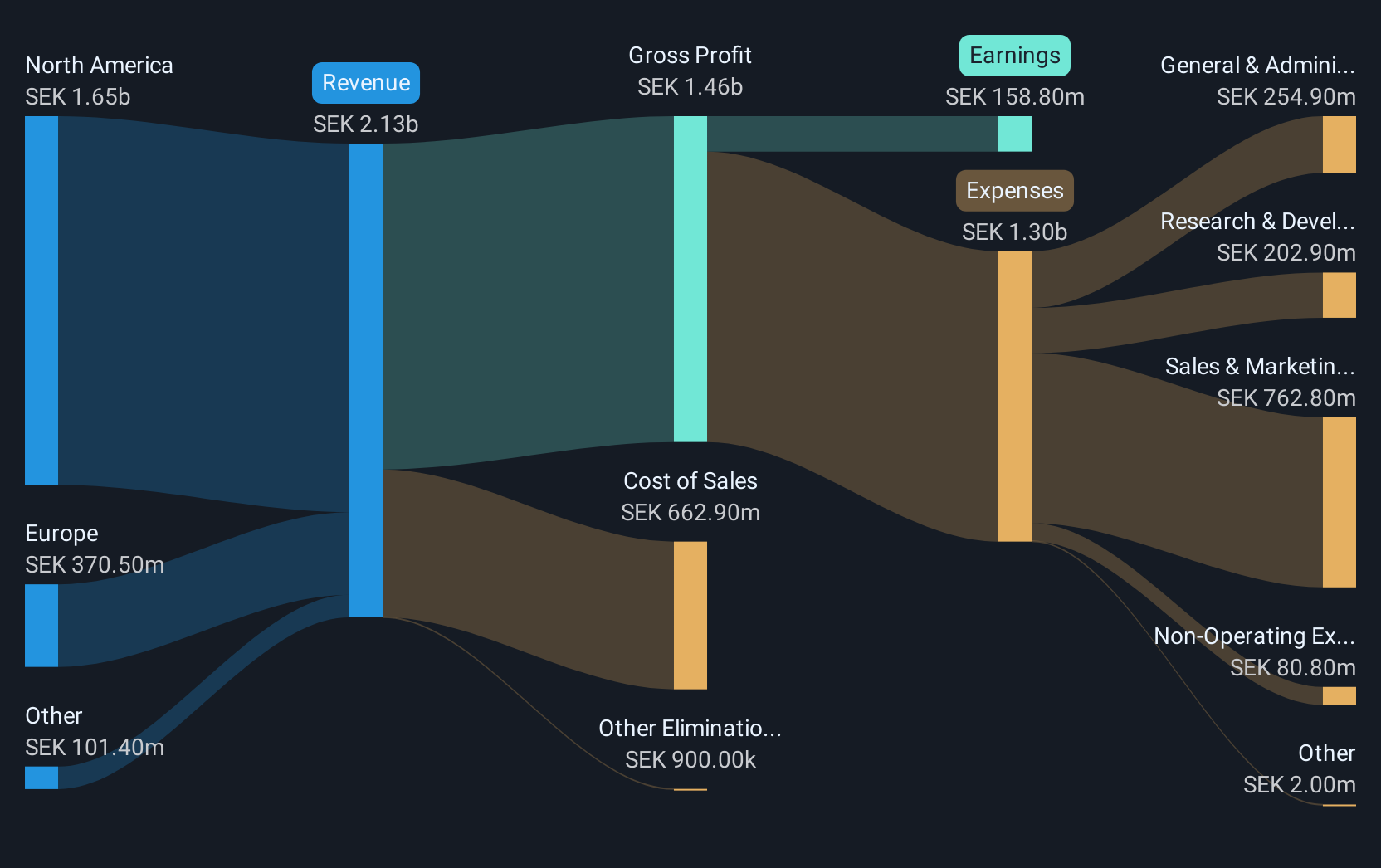

Overview: Dynavox Group AB (publ) is involved in the development and sale of assistive technology products for communication, operating both in Sweden and internationally, with a market capitalization of SEK7.29 billion.

Operations: Dynavox Group generates revenue primarily from its computer hardware segment, totaling SEK1.86 billion. The company focuses on assistive technology products for communication across Swedish and international markets.

Dynavox Group's recent performance underscores its upward trajectory in the tech sector, with a notable increase in quarterly sales to SEK 483 million from SEK 424 million year-over-year and a rise in net income to SEK 45 million from SEK 35 million. This financial growth is complemented by an ambitious R&D strategy, as evidenced by their participation in industry events like the Redeye Medtech & Diagnostics Event, signaling a commitment to innovation. With earnings expected to surge by approximately 34.9% annually and revenue projected to grow at 14.3% per year, Dynavox not only outpaces the Swedish market's growth but also demonstrates robust potential amidst its tech peers. Such dynamics are pivotal for maintaining competitiveness and driving future expansions within high-tech industries.

- Dive into the specifics of Dynavox Group here with our thorough health report.

Gain insights into Dynavox Group's past trends and performance with our Past report.

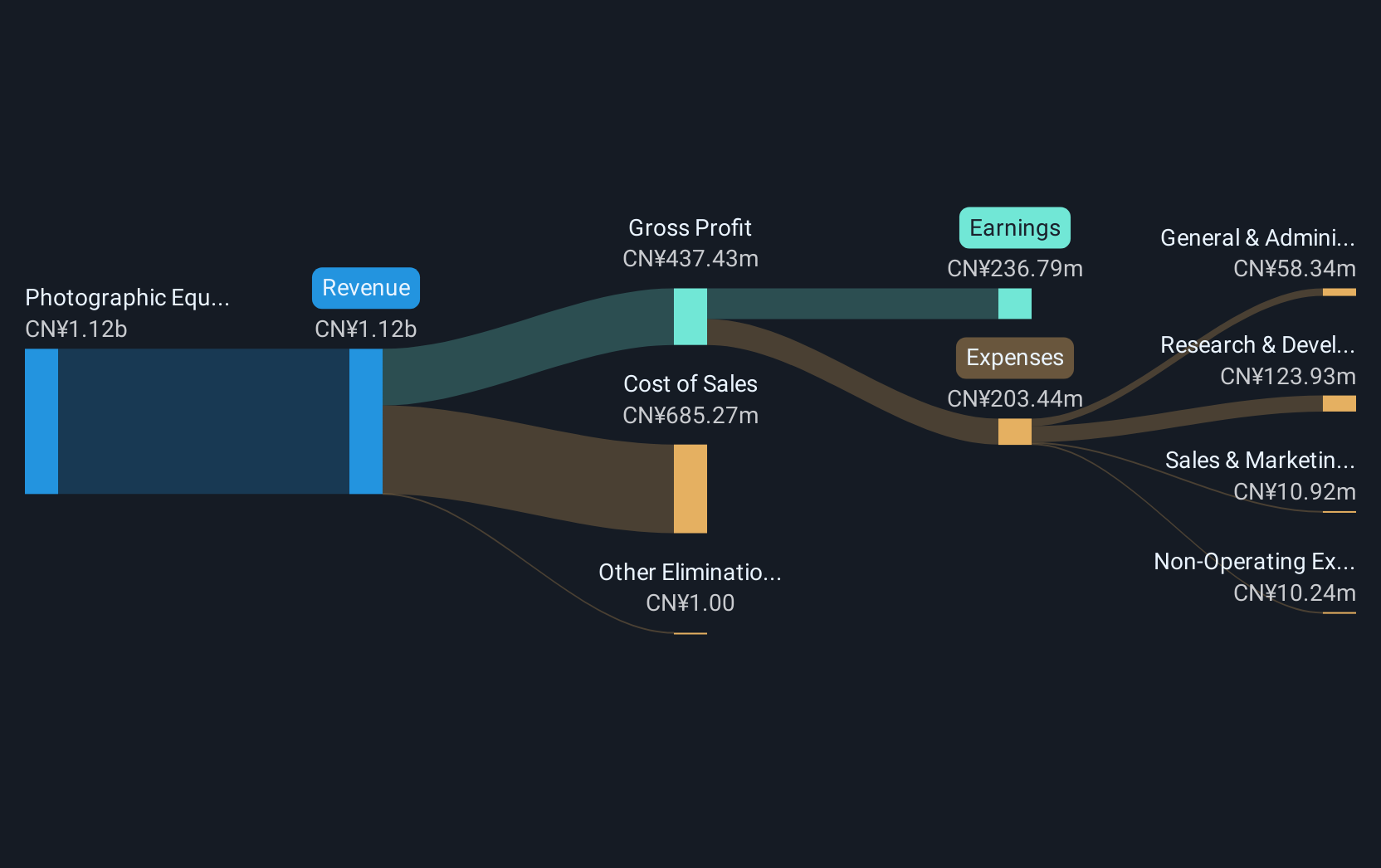

Zhejiang Lante Optics (SHSE:688127)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Lante Optics Co., Ltd. is a Chinese company that specializes in the manufacturing and sale of optical products, with a market capitalization of approximately CN¥11.02 billion.

Operations: Lante Optics focuses on the production and distribution of optical products, primarily generating revenue from photographic equipment and supplies, amounting to CN¥1.05 billion. The company's financial structure emphasizes cost efficiency within its manufacturing processes.

Zhejiang Lante Optics has demonstrated robust growth, with its revenue soaring to CNY 786.31 million from CNY 490.2 million year-over-year, a significant leap that underscores its expanding market presence. This financial uplift is supported by a sharp increase in net income to CNY 161.58 million from CNY 91.81 million, reflecting efficient operational execution and market adaptation. The company's commitment to innovation is evident in its R&D investments, aligning with industry trends towards enhanced technological offerings and customer-centric solutions. With earnings projected to grow by 23% annually, Zhejiang Lante Optics is not only outpacing many peers but also setting a strong footing for sustained future growth within the competitive tech landscape.

Key Takeaways

- Navigate through the entire inventory of 1225 High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Lante Optics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688127

Solid track record with excellent balance sheet.