- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

Samsung Electronics (KOSE:A005930): Evaluating Valuation After Subtle Share Price Moves

Reviewed by Simply Wall St

Samsung Electronics (KOSE:A005930) Stock: What’s Behind the Recent Moves?

If you’ve been watching Samsung Electronics (KOSE:A005930) lately, you might have noticed some interesting shifts in the stock price, even in the absence of a dramatic headline event. For investors trying to decide what to do next, these subtle changes can raise questions about whether the market is signaling something underneath the surface, such as a new opportunity, a risk, or simply business as usual.

Over the past year, Samsung’s shares have delivered steady progress, returning over 10%, with a strong push of 19% in the past 3 months. Short-term volatility has been offset by longer-term growth, and while the last month saw minor declines, the bigger picture hints at momentum building across the tech sector. Alongside annual gains in both revenue and net income, the backdrop for Samsung’s stock continues to evolve.

Now, with this year’s price movement and performance in mind, is Samsung Electronics truly undervalued compared to its future growth, or is the current market price telling us it is all already factored in?

Most Popular Narrative: 13.8% Undervalued

According to the most widely followed analyst narrative, Samsung Electronics is currently undervalued by nearly 14% compared to its fair value estimate. This view incorporates expectations of future growth and profitability, discounting back at a rate of 8.39%.

“Samsung's successful ramp and leadership in next-generation process technologies, most notably HBM3E and ongoing transition to HBM4, plus 2nm foundry process, are solidifying customer wins (e.g., major $16.5B order with Tesla) and expanding addressable markets, improving utilization and setting up higher medium-term earnings growth and gross margins.”

Curious how bold projections are shaping this bullish target? The narrative hints at multi-year margin expansion and a surge in advanced chip volumes. What exactly drives such a high conviction? Interested in the quantitative engine behind this fair value? Here is what underlies the optimism and the critical numbers backing up the analysts’ estimate.

Result: Fair Value of ₩82,693 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical tensions or intensified competition could quickly shift the outlook. These factors can serve as powerful catalysts that might challenge today’s optimistic narrative.

Find out about the key risks to this Samsung Electronics narrative.Another View: Discounted Cash Flow

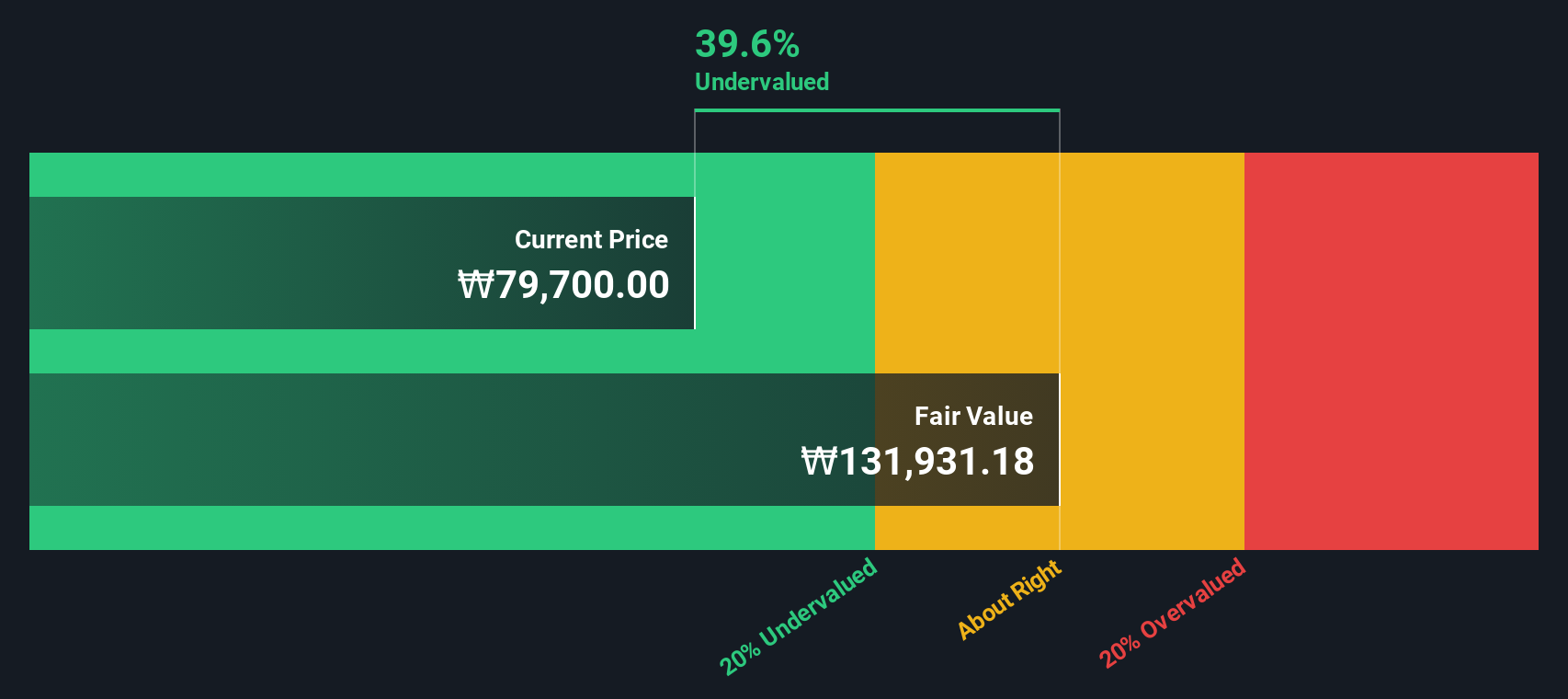

Looking through another lens, our DCF model suggests Samsung Electronics is even more undervalued than the consensus target implies. But can two different methods both be right, or is one missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Samsung Electronics Narrative

If you see things differently or want to dig into the details on your own terms, you can piece together your own narrative. No more than a few minutes needed. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Samsung Electronics.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Make your next smart move by using these hand-picked ways to uncover standout companies and investment themes with real potential:

- Zero in on remarkable value using undervalued stocks based on cash flows and find stocks where market prices may lag behind true financial strength.

- Discover game-changers in artificial intelligence by checking out AI penny stocks and see which companies are shaping tomorrow’s tech landscape.

- Increase your passive income with dividend stocks with yields > 3% for access to stocks that offer reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives