- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

Samsung Electronics (KOSE:A005930): Assessing Valuation After a Powerful Multi‑Month Share Price Rally

Reviewed by Simply Wall St

Samsung Electronics (KOSE:A005930) has quietly added another strong month to its rally, with the stock up about 10% over the past month and roughly 35% in the past 3 months.

See our latest analysis for Samsung Electronics.

Zooming out, Samsung’s 1 year total shareholder return above 100 percent, alongside a powerful year to date share price gain, suggests momentum is still very much building as investors reassess its growth and semiconductor leverage.

If Samsung’s run has you rethinking where the next winners could emerge, now is a good time to scout other high growth tech and chip names via high growth tech and AI stocks.

But after such a powerful re rating, plus double digit revenue and earnings growth, is Samsung still trading below its fundamental value, or are investors already paying up for all that future upside?

Most Popular Narrative Narrative: 17% Undervalued

Samsung Electronics latest close of ₩107,600 sits meaningfully below the most followed narrative fair value estimate of ₩129,604, framing the stock as still discounted despite its powerful run.

Expansion into high margin business segments such as automotive semiconductors, central HVAC, digital health platforms, and AI integrated solutions through M&A and organic investments is aimed at diversifying revenue, reducing cyclicality, and offering structural margin enhancement and earnings stability. Industry pricing for memory and storage products is now rebounding, with inventory normalized and potential for supply tightness in legacy DRAM/NAND. This is expected to translate into stronger financial results (revenue and margin recovery) as pricing improvements flow through to ASPs and earnings in coming quarters.

Curious how a richer product mix, recovering chip prices, and a punchy future earnings multiple come together to justify that higher fair value tag? The full narrative breaks down the growth runway, margin lift, and valuation leap that underpin this target, and spells out exactly what has to go right for that upside to hold.

Result: Fair Value of ₩129,604 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stiff competition across memory and foundry, along with persistently high R&D and capex needs, could compress margins and blunt the anticipated earnings recovery.

Find out about the key risks to this Samsung Electronics narrative.

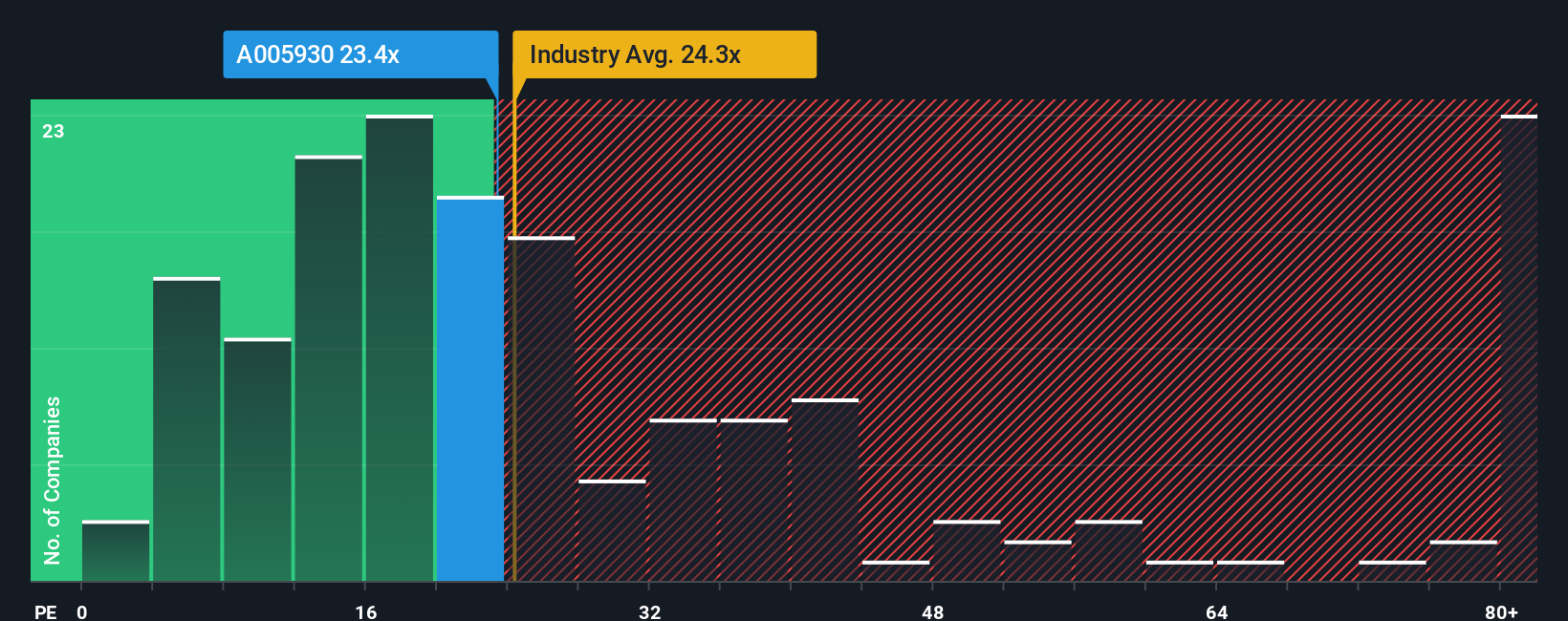

Another Lens on Value

Despite the upbeat narrative on fair value, the earnings based valuation screens tell a more demanding story. Samsung trades on a 24.6x price to earnings ratio, richer than both the Asian tech sector at 22.2x and its peer group around 14.7x, even though our fair ratio implies the market could justify paying closer to 47.9x in time. That leaves investors weighing potential upside from a rerating against the risk that expectations are already stretched if growth or margins wobble.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsung Electronics Narrative

If you see the story playing out differently, or simply want to sanity check the numbers yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Samsung Electronics.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St screener to uncover fresh ideas that match your style before the market moves without you.

- Consider potential multi baggers early by scanning these 3629 penny stocks with strong financials that already show solid financial underpinnings instead of speculative hype.

- Explore the intersection of medicine and machine learning through these 29 healthcare AI stocks, where innovation and real world demand may combine for powerful growth stories.

- Seek reliable income opportunities with these 13 dividend stocks with yields > 3%, focusing on businesses offering yields above 3 percent while maintaining balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion