- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

High Growth Tech Stocks In Asia Including Samsung Electronics

Reviewed by Simply Wall St

As global markets navigate mixed performances with large-cap tech companies driving gains, the Asian tech sector remains a focal point for investors eyeing growth opportunities amid easing U.S.-China trade tensions. In this environment, identifying high-growth tech stocks in Asia involves looking for companies that capitalize on technological advancements and robust consumer demand while demonstrating resilience to broader economic shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 32.80% | 35.57% | ★★★★★★ |

| Suzhou TFC Optical Communication | 33.73% | 34.36% | ★★★★★★ |

| Accton Technology | 24.08% | 28.54% | ★★★★★★ |

| Zhongji Innolight | 28.22% | 29.75% | ★★★★★★ |

| Fositek | 36.93% | 47.79% | ★★★★★★ |

| Eoptolink Technology | 37.03% | 32.46% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Samsung Electronics (KOSE:A005930)

Simply Wall St Growth Rating: ★★★★☆☆

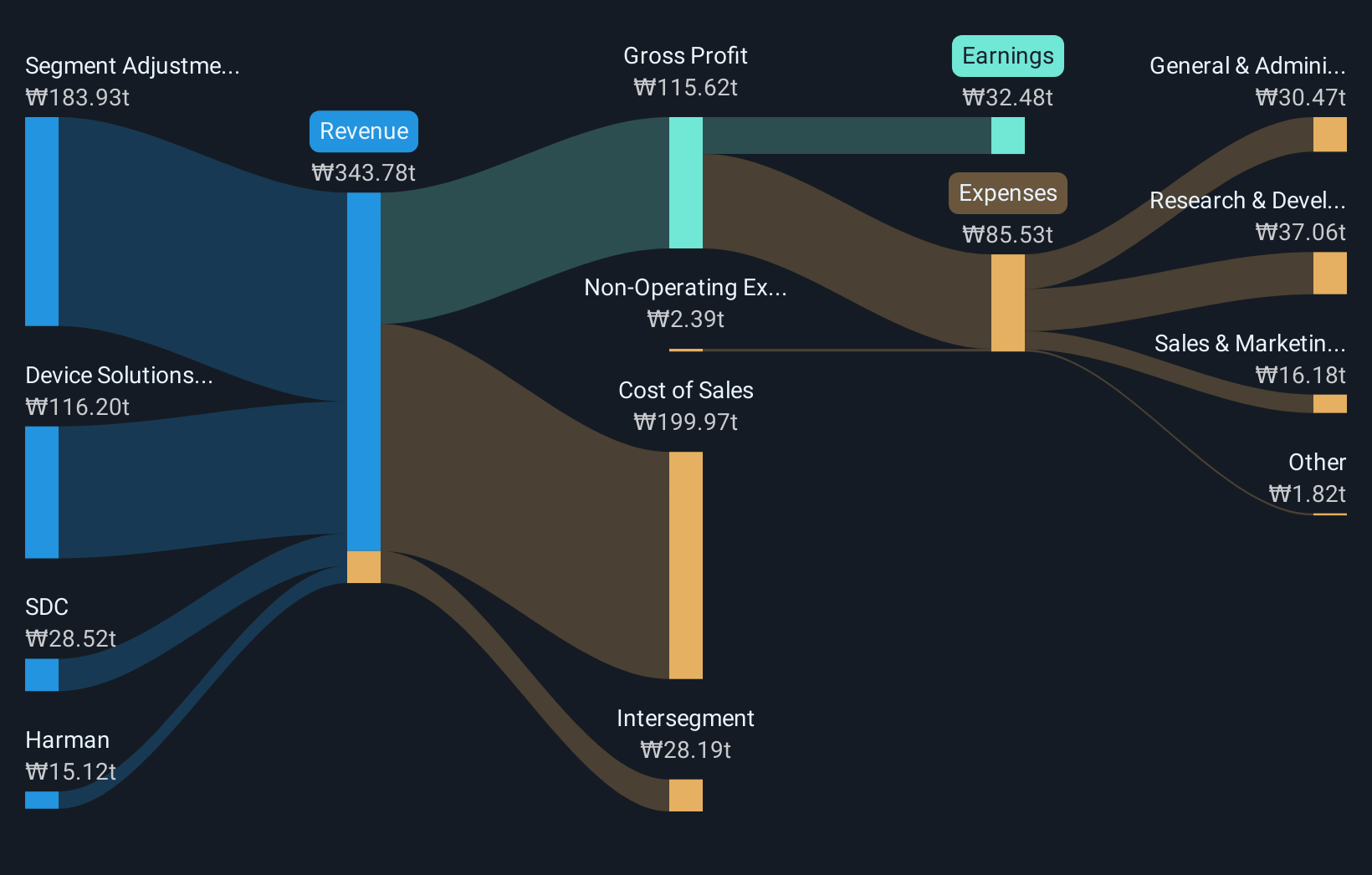

Overview: Samsung Electronics Co., Ltd. operates globally in consumer electronics, IT and mobile communications, and device solutions, with a market cap of ₩723.16 trillion.

Operations: Samsung Electronics generates revenue primarily from its Device Solutions (DS) segment, which contributes ₩116.20 billion, and SDC, which adds ₩28.52 billion. Harman also plays a role with ₩15.12 billion in revenue.

Samsung Electronics' strategic alliance with NVIDIA to construct an AI-driven semiconductor factory marks a significant leap in integrating intelligent computing within chip manufacturing. This collaboration, leveraging over 50,000 NVIDIA GPUs, is set to revolutionize semiconductor production through predictive maintenance and process enhancements. Notably, Samsung's commitment extends beyond hardware; its recent patent infringement case involving OLED technologies resulted in a $191.4 million penalty, underscoring the high stakes in protecting innovative tech developments. These initiatives reflect Samsung's aggressive pursuit of advanced manufacturing capabilities and intellectual property defense essential for maintaining its competitive edge in the fast-evolving tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Samsung Electronics.

Examine Samsung Electronics' past performance report to understand how it has performed in the past.

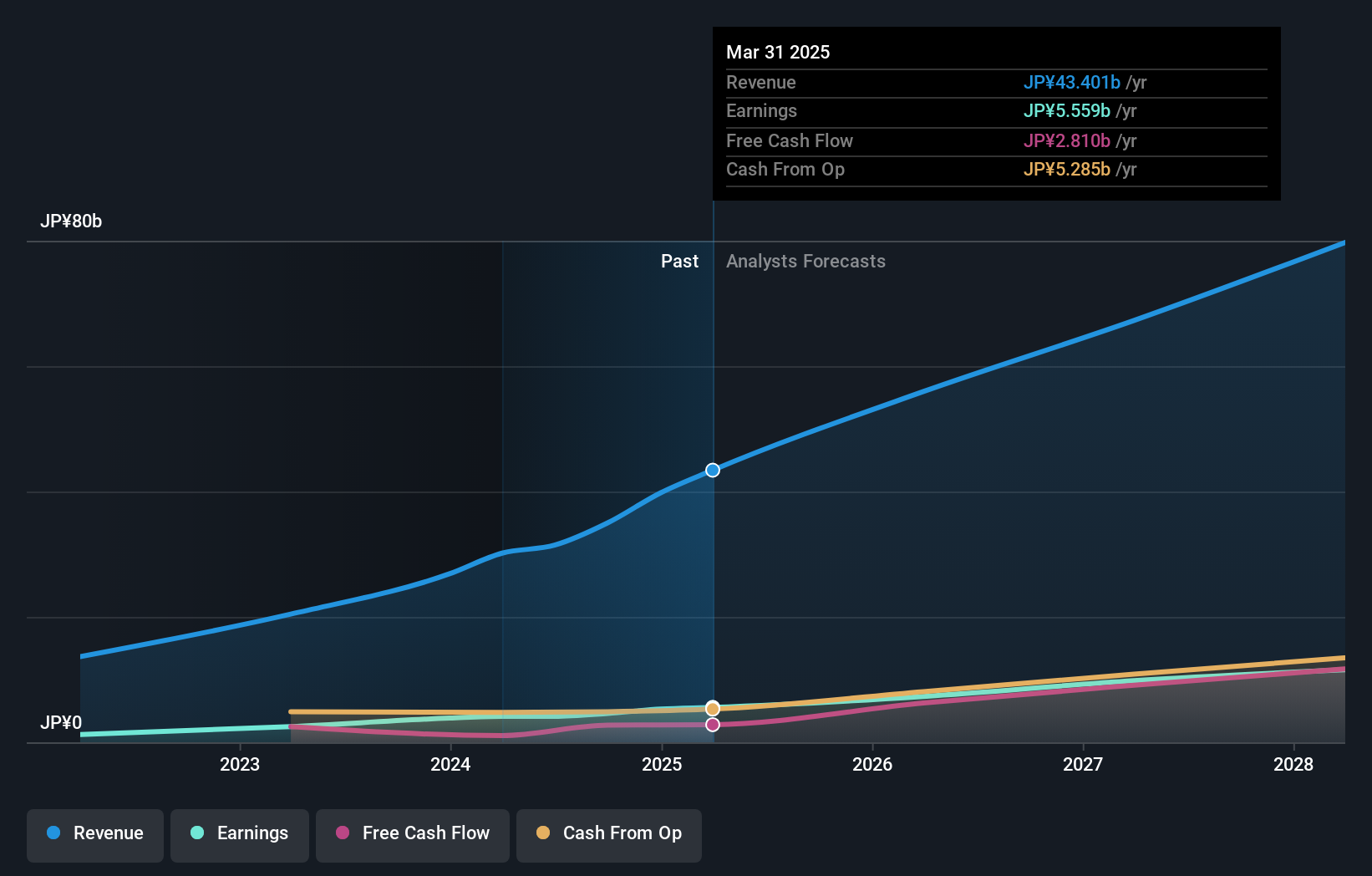

TechMatrix (TSE:3762)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TechMatrix Corporation operates in the information infrastructure and application service sector in Japan, with a market capitalization of ¥87.77 billion.

Operations: The company focuses on providing information infrastructure and application services in Japan. It operates with a market capitalization of ¥87.77 billion, engaging in diverse revenue streams within the tech industry.

TechMatrix, amidst a dynamic tech landscape in Asia, showcases robust growth with its earnings forecast to surge by 16.1% annually, outpacing the Japanese market's average of 7.7%. This performance is underpinned by significant R&D investments that have catalyzed innovations across its operations. With a projected revenue increase of 11.6% per year—double the national rate—the firm leverages these advancements to enhance its competitive edge significantly. Notably, TechMatrix's strategic focus on high-quality earnings and a strong return on equity anticipated at 20.9%, positions it well for sustained financial health and industry leadership, despite recent executive changes impacting its board structure.

- Dive into the specifics of TechMatrix here with our thorough health report.

Gain insights into TechMatrix's past trends and performance with our Past report.

COVER (TSE:5253)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COVER Corporation operates a VTubers distribution platform in Japan, focusing on video and music content, with a market cap of ¥120.14 billion.

Operations: The company generates revenue primarily through its VTubers distribution platform, which focuses on video and music content in Japan. With a market capitalization of ¥120.14 billion, the business leverages digital media to engage audiences and monetize content effectively.

COVER, thriving in the high-growth tech sector in Asia, demonstrates a robust trajectory with its earnings and revenue significantly outpacing regional averages. With an annualized revenue growth rate at 14%, and earnings expanding by 20.9% per year, the company's aggressive investment in R&D has proven fruitful, amounting to substantial yearly expenditures that fuel innovation and market competitiveness. Particularly noteworthy is COVER's strategic pivot towards software as a service (SaaS) models, which not only enhances customer retention through subscriptions but also promises sustained revenue streams. This forward-thinking approach, coupled with a strong return on equity forecasted at 29.5%, positions COVER favorably within its industry landscape despite fierce competition and varying market dynamics.

- Unlock comprehensive insights into our analysis of COVER stock in this health report.

Assess COVER's past performance with our detailed historical performance reports.

Make It Happen

- Click this link to deep-dive into the 175 companies within our Asian High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives