- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

Does Samsung Electronics Co., Ltd. (KRX:005930) Have A Good P/E Ratio?

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). To keep it practical, we'll show how Samsung Electronics Co., Ltd.'s (KRX:005930) P/E ratio could help you assess the value on offer. What is Samsung Electronics's P/E ratio? Well, based on the last twelve months it is 15.82. That means that at current prices, buyers pay ₩15.82 for every ₩1 in trailing yearly profits.

Check out our latest analysis for Samsung Electronics

How Do I Calculate Samsung Electronics's Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Samsung Electronics:

P/E of 15.82 = ₩50100.000 ÷ ₩3165.921 (Based on the year to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each ₩1 of company earnings. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does Samsung Electronics Have A Relatively High Or Low P/E For Its Industry?

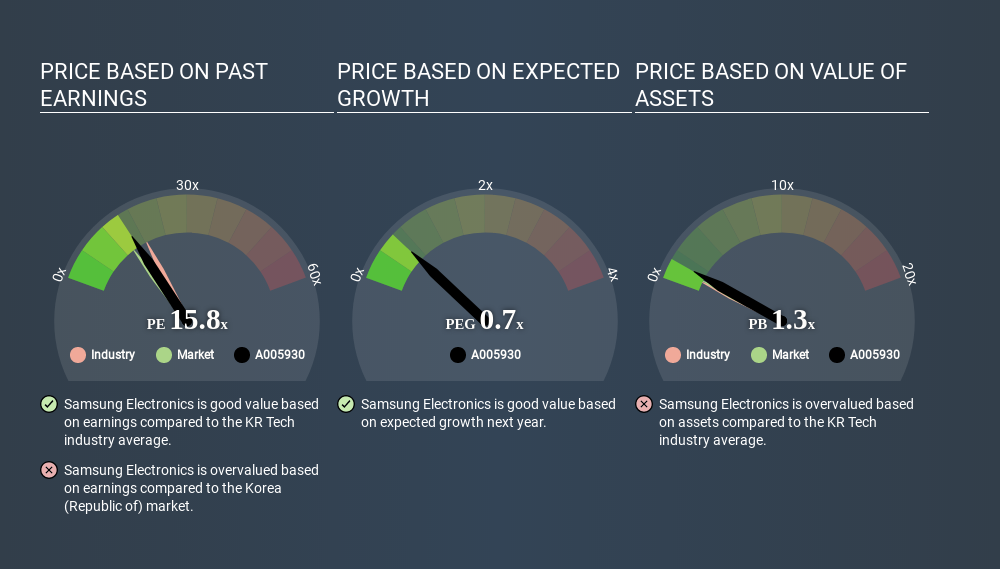

The P/E ratio essentially measures market expectations of a company. If you look at the image below, you can see Samsung Electronics has a lower P/E than the average (18.4) in the tech industry classification.

This suggests that market participants think Samsung Electronics will underperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. When earnings grow, the 'E' increases, over time. That means even if the current P/E is high, it will reduce over time if the share price stays flat. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Samsung Electronics shrunk earnings per share by 51% over the last year.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting Samsung Electronics's P/E?

Samsung Electronics has net cash of ₩93t. This is fairly high at 28% of its market capitalization. That might mean balance sheet strength is important to the business, but should also help push the P/E a bit higher than it would otherwise be.

The Verdict On Samsung Electronics's P/E Ratio

Samsung Electronics has a P/E of 15.8. That's higher than the average in its market, which is 14.2. Falling earnings per share is probably keeping traditional value investors away, but the relatively strong balance sheet will allow the company time to invest in growth. Clearly, the high P/E indicates shareholders think it will!

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course you might be able to find a better stock than Samsung Electronics. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026