- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A302430

What Innometry Co., Ltd.'s (KOSDAQ:302430) 29% Share Price Gain Is Not Telling You

The Innometry Co., Ltd. (KOSDAQ:302430) share price has done very well over the last month, posting an excellent gain of 29%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

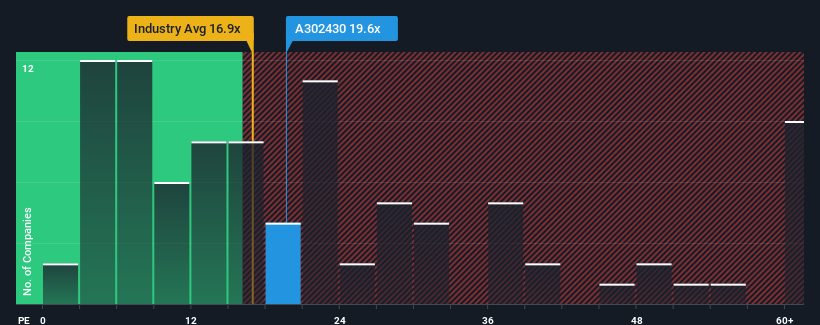

Since its price has surged higher, Innometry's price-to-earnings (or "P/E") ratio of 19.6x might make it look like a sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 14x and even P/E's below 6x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Innometry has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Innometry

Is There Enough Growth For Innometry?

In order to justify its P/E ratio, Innometry would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 300%. The strong recent performance means it was also able to grow EPS by 143% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's about the same on an annualised basis.

With this information, we find it interesting that Innometry is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

The Bottom Line On Innometry's P/E

Innometry shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Innometry currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Innometry that you need to be mindful of.

If these risks are making you reconsider your opinion on Innometry, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A302430

Innometry

Manufactures and sells X-ray inspection systems in South Korea.

Flawless balance sheet with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026