- South Korea

- /

- Communications

- /

- KOSDAQ:A211270

Is Asia Pacific Satellite Inc.'s (KOSDAQ:211270) Latest Stock Performance A Reflection Of Its Financial Health?

Most readers would already be aware that Asia Pacific Satellite's (KOSDAQ:211270) stock increased significantly by 24% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to Asia Pacific Satellite's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Asia Pacific Satellite

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Asia Pacific Satellite is:

9.7% = ₩9.8b ÷ ₩101b (Based on the trailing twelve months to September 2024).

The 'return' is the yearly profit. That means that for every ₩1 worth of shareholders' equity, the company generated ₩0.10 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Asia Pacific Satellite's Earnings Growth And 9.7% ROE

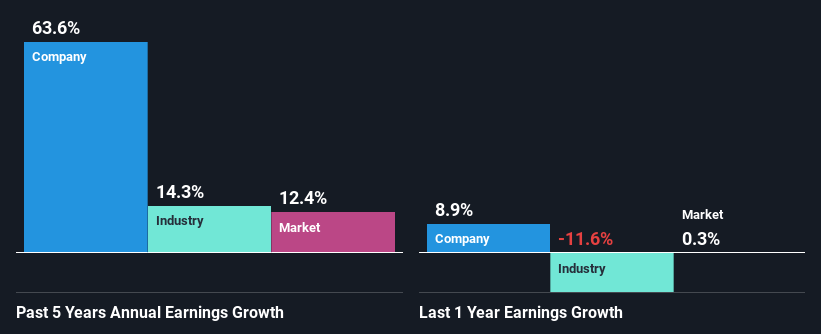

On the face of it, Asia Pacific Satellite's ROE is not much to talk about. Although a closer study shows that the company's ROE is higher than the industry average of 5.7% which we definitely can't overlook. Even more so after seeing Asia Pacific Satellite's exceptional 64% net income growth over the past five years. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Hence, there might be some other aspects that are causing earnings to grow. Such as- high earnings retention or the company belonging to a high growth industry.

We then compared Asia Pacific Satellite's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 14% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Asia Pacific Satellite's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Asia Pacific Satellite Efficiently Re-investing Its Profits?

Conclusion

In total, we are pretty happy with Asia Pacific Satellite's performance. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. To know the 2 risks we have identified for Asia Pacific Satellite visit our risks dashboard for free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A211270

Asia Pacific Satellite

Develops and manufactures satellite communication devices worldwide.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives