- South Korea

- /

- Entertainment

- /

- KOSDAQ:A293490

Exploring 3 High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

The South Korea stock market has moved higher in four straight sessions, improving almost 80 points or 3.1 percent along the way, with the KOSPI now sitting just above the 2,590-point plateau. Despite a soft global forecast suggesting potential profit-taking ahead, certain tech stocks are showing promising growth potential amidst these fluctuating market conditions. In this article, we explore three high-growth tech stocks in South Korea that stand out due to their innovative capabilities and resilience in a dynamic economic landscape.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.74% | 35.66% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩19.28 billion.

Operations: ALTEOGEN Inc. focuses on biotechnology, primarily generating revenue from long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars. The company reported ₩90.79 billion in revenue from its biotechnology segment.

Alteogen's recent approval by the Ministry of Food and Drug Safety for Tergase®, a high-purity recombinant hyaluronidase, underscores its potential in diverse medical applications beyond traditional markets. This innovation is pivotal as it transitions Alteogen into a commercial-stage entity, enhancing its growth trajectory in biotech. Financially, Alteogen's revenue growth is impressive at 64.2% annually, outpacing the South Korean market average of 10.4%. Moreover, earnings are expected to surge by 99.5% per year, positioning it well above industry norms despite current unprofitability. These figures reflect Alteogen’s robust investment in R&D which fuels its pipeline and market expansion prospects, signaling promising avenues for future growth in biotechnology sectors reliant on advanced drug delivery systems.

- Delve into the full analysis health report here for a deeper understanding of ALTEOGEN.

Evaluate ALTEOGEN's historical performance by accessing our past performance report.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JNTC Co., Ltd. specializes in the production of connectors, hinges, and tempered glass products in South Korea with a market cap of ₩980.44 billion.

Operations: JNTC Co., Ltd. generates revenue primarily through the manufacturing and sales of mobile parts, amounting to ₩402.99 billion. The company operates in South Korea, focusing on connectors, hinges, and tempered glass products.

JNTC's trajectory in South Korea's tech landscape is marked by a robust revenue forecast, expected to increase at 18.1% annually, outstripping the national average growth of 10.4%. This surge is backed by significant R&D investments, which have been pivotal in maintaining its competitive edge; notably, its R&D expenses are substantial, ensuring continuous innovation and adaptation in a rapidly evolving market. Moreover, JNTC has recently become profitable, with earnings projected to expand by an impressive 51.9% per year. These financial indicators not only reflect JNTC’s strong market position but also hint at potential for sustained growth amidst fierce industry competition and technological advancements.

Kakao Games (KOSDAQ:A293490)

Simply Wall St Growth Rating: ★★★★☆☆

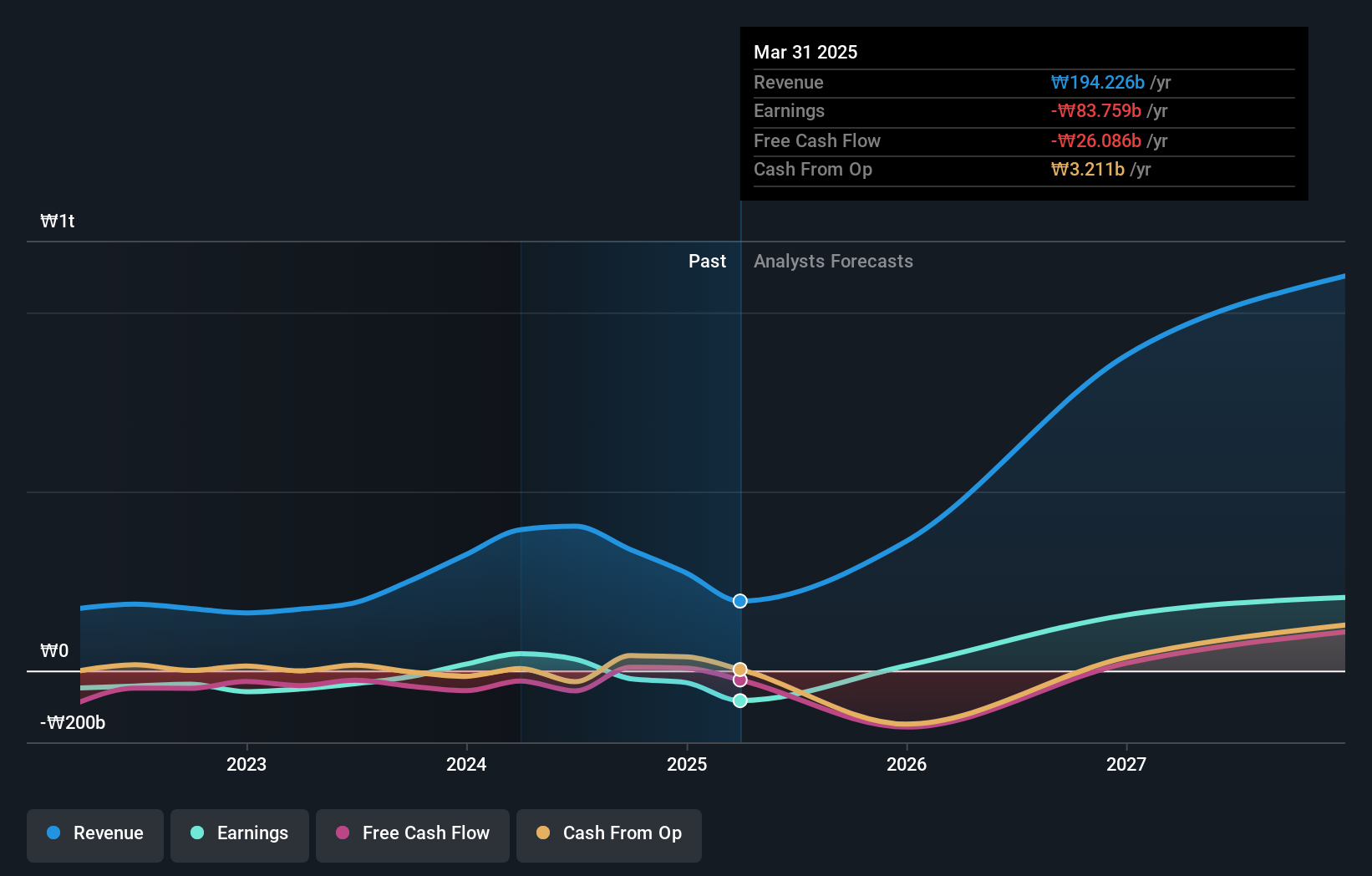

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide, with a market cap of ₩1.36 trillion.

Operations: Kakao Games Corporation generates revenue primarily from its computer graphics segment, which reported ₩986.72 billion. The company focuses on providing a diverse range of gaming experiences across mobile and PC platforms for a global audience.

Kakao Games, amidst a flurry of activity including a notable private placement, is positioning itself uniquely within South Korea's tech sector. The company's revenue is expected to grow by 10.6% annually, slightly outpacing the national tech growth rate of 10.4%. This growth is underpinned by substantial R&D investments which have fueled an impressive forecasted earnings increase of 110.6% per year. These financial maneuvers not only enhance its market stance but also reflect a strategic push towards sustainability and innovation in gaming technologies, leveraging recent capital infusions from significant transactions like the issuance of convertible bonds valued at KRW 270 billion.

- Click here and access our complete health analysis report to understand the dynamics of Kakao Games.

Gain insights into Kakao Games' past trends and performance with our Past report.

Summing It All Up

- Reveal the 49 hidden gems among our KRX High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kakao Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A293490

Kakao Games

Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide.

Good value with reasonable growth potential.