- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A193250

Is Linked (KOSDAQ:193250) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Linked Inc. (KOSDAQ:193250) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Linked

What Is Linked's Debt?

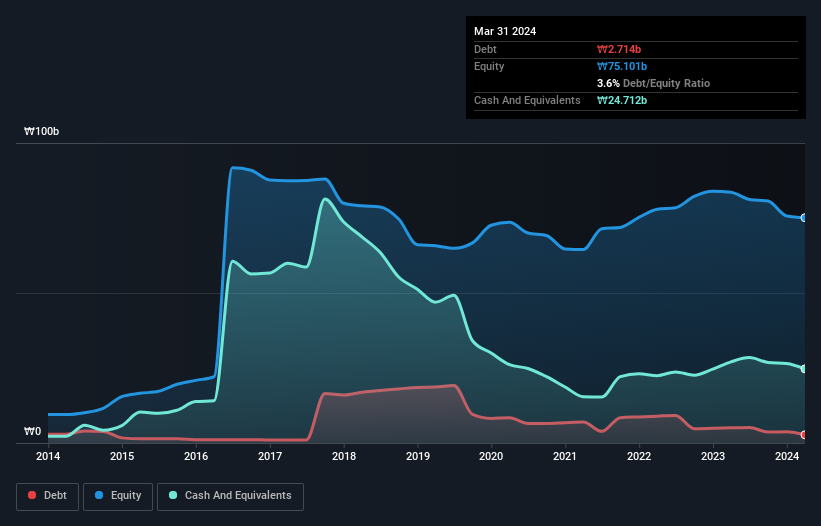

As you can see below, Linked had ₩2.71b of debt at March 2024, down from ₩5.05b a year prior. But on the other hand it also has ₩24.7b in cash, leading to a ₩22.0b net cash position.

A Look At Linked's Liabilities

Zooming in on the latest balance sheet data, we can see that Linked had liabilities of ₩8.74b due within 12 months and liabilities of ₩71.4m due beyond that. On the other hand, it had cash of ₩24.7b and ₩3.70b worth of receivables due within a year. So it can boast ₩19.6b more liquid assets than total liabilities.

This luscious liquidity implies that Linked's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that Linked has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Linked's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Linked had a loss before interest and tax, and actually shrunk its revenue by 37%, to ₩18b. That makes us nervous, to say the least.

So How Risky Is Linked?

Although Linked had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of ₩235m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. The next few years will be important as the business matures. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Linked that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A193250

Linked

Engages in the development of smartphone and IT core components in South Korea.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

IonQ: Exceptional Technology but Valuation Far Ahead of Financial Reality

GE Vernova (GEV): Data Center Electrification and "Angstrom-Scale" Grid Demand Fuel a Powerhouse Outlook

Taiwan Semiconductor Manufacturing Co. (TSM): AI Giga-Cycle Drives Record Revenue and the Arrival of the "Angstrom Era"

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks