- South Korea

- /

- Tech Hardware

- /

- KOSDAQ:A192440

What Do The Returns On Capital At Spigen Korea (KOSDAQ:192440) Tell Us?

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So while Spigen Korea (KOSDAQ:192440) has a high ROCE right now, lets see what we can decipher from how returns are changing.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Spigen Korea is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.21 = ₩76b ÷ (₩404b - ₩48b) (Based on the trailing twelve months to September 2020).

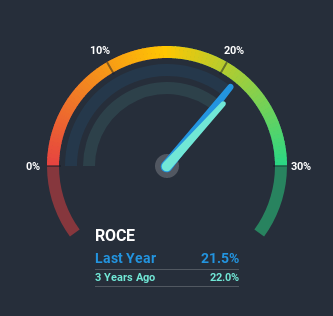

Therefore, Spigen Korea has an ROCE of 21%. In absolute terms that's a great return and it's even better than the Tech industry average of 6.5%.

See our latest analysis for Spigen Korea

Above you can see how the current ROCE for Spigen Korea compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

How Are Returns Trending?

When we looked at the ROCE trend at Spigen Korea, we didn't gain much confidence. While it's comforting that the ROCE is high, five years ago it was 33%. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

What We Can Learn From Spigen Korea's ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Spigen Korea is reinvesting for growth and has higher sales as a result. In light of this, the stock has only gained 32% over the last five years. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

Spigen Korea does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored...

Spigen Korea is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

If you decide to trade Spigen Korea, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A192440

Spigen KoreaLtd

Engages in manufacture, wholesale, and retail of accessories for small mobile devices and electronic devices in South Korea, rest of Asia, Europe, North America, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026