- South Korea

- /

- Communications

- /

- KOSDAQ:A189300

Top 3 KRX Stocks Estimated To Be Undervalued In October 2024

Reviewed by Simply Wall St

The South Korean market has remained flat over the last week but is up 4.1% over the past year, with earnings expected to grow by 29% annually in the coming years. In this context, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential growth opportunities within a stable yet promising market environment.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩2870.00 | ₩5453.33 | 47.4% |

| PharmaResearch (KOSDAQ:A214450) | ₩225000.00 | ₩423233.18 | 46.8% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7580.00 | ₩14888.99 | 49.1% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩76900.00 | ₩149599.07 | 48.6% |

| TSE (KOSDAQ:A131290) | ₩52500.00 | ₩99656.08 | 47.3% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩50800.00 | ₩90505.76 | 43.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1577.00 | ₩2925.55 | 46.1% |

| Global Tax Free (KOSDAQ:A204620) | ₩3895.00 | ₩6408.90 | 39.2% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45200.00 | ₩75356.62 | 40% |

Underneath we present a selection of stocks filtered out by our screen.

Intellian Technologies (KOSDAQ:A189300)

Overview: Intellian Technologies, Inc. is a company that provides satellite antennas and terminals both in South Korea and internationally, with a market cap of ₩530.77 billion.

Operations: The company generates revenue from telecommunication equipment sales amounting to ₩271.45 billion.

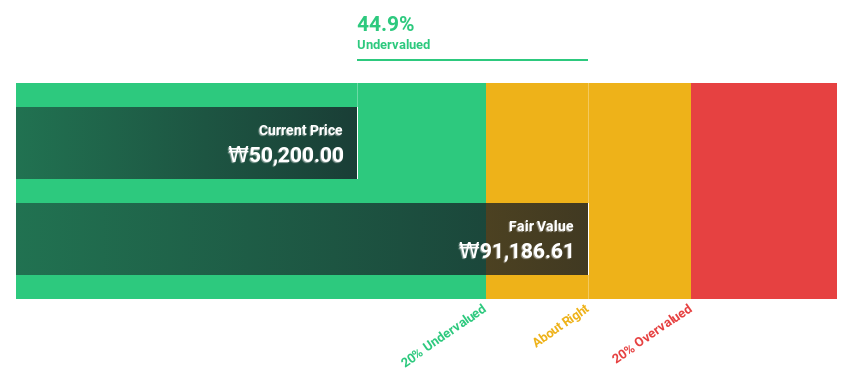

Estimated Discount To Fair Value: 43.9%

Intellian Technologies is trading at ₩50,800, significantly below its estimated fair value of ₩90,505.76, suggesting it is undervalued based on cash flows. The company has completed a share buyback program worth KRW 4.99 billion, enhancing shareholder value. Revenue growth is forecast at 33.4% annually, outpacing the market's 10.3%, with earnings expected to grow rapidly by 89.53% per year and profitability anticipated within three years.

- Our comprehensive growth report raises the possibility that Intellian Technologies is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Intellian Technologies.

Vuno (KOSDAQ:A338220)

Overview: Vuno Inc. is a medical artificial intelligence solution development company with a market cap of ₩428.45 billion.

Operations: The company generates revenue from its artificial intelligence medical software production, amounting to ₩20.42 billion.

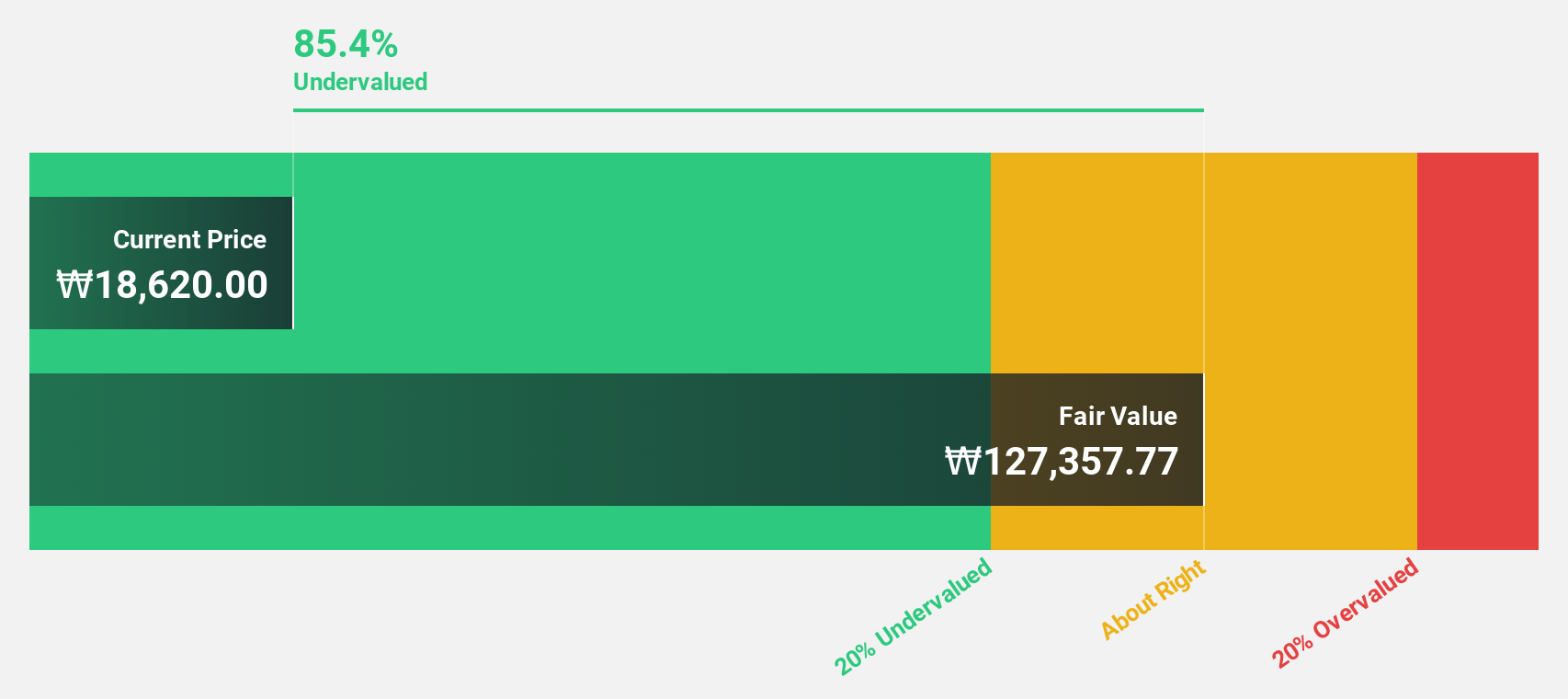

Estimated Discount To Fair Value: 11.3%

Vuno is trading at ₩30,850, below its estimated fair value of ₩34,779.03. Revenue growth is projected at 40.4% annually, surpassing the Korean market's 10.3%, with earnings expected to grow substantially by 110.92% per year and profitability anticipated within three years. Although shareholders experienced dilution in the past year, Vuno's return on equity is forecast to be very high in three years' time at 114.3%.

- The growth report we've compiled suggests that Vuno's future prospects could be on the up.

- Click here to discover the nuances of Vuno with our detailed financial health report.

Sejin Heavy Industries (KOSE:A075580)

Overview: Sejin Heavy Industries Co., Ltd. is a South Korean company that manufactures and sells shipbuilding equipment, with a market cap of ₩430.92 billion.

Operations: Sejin Heavy Industries generates revenue primarily from the manufacturing and sale of shipbuilding equipment in South Korea.

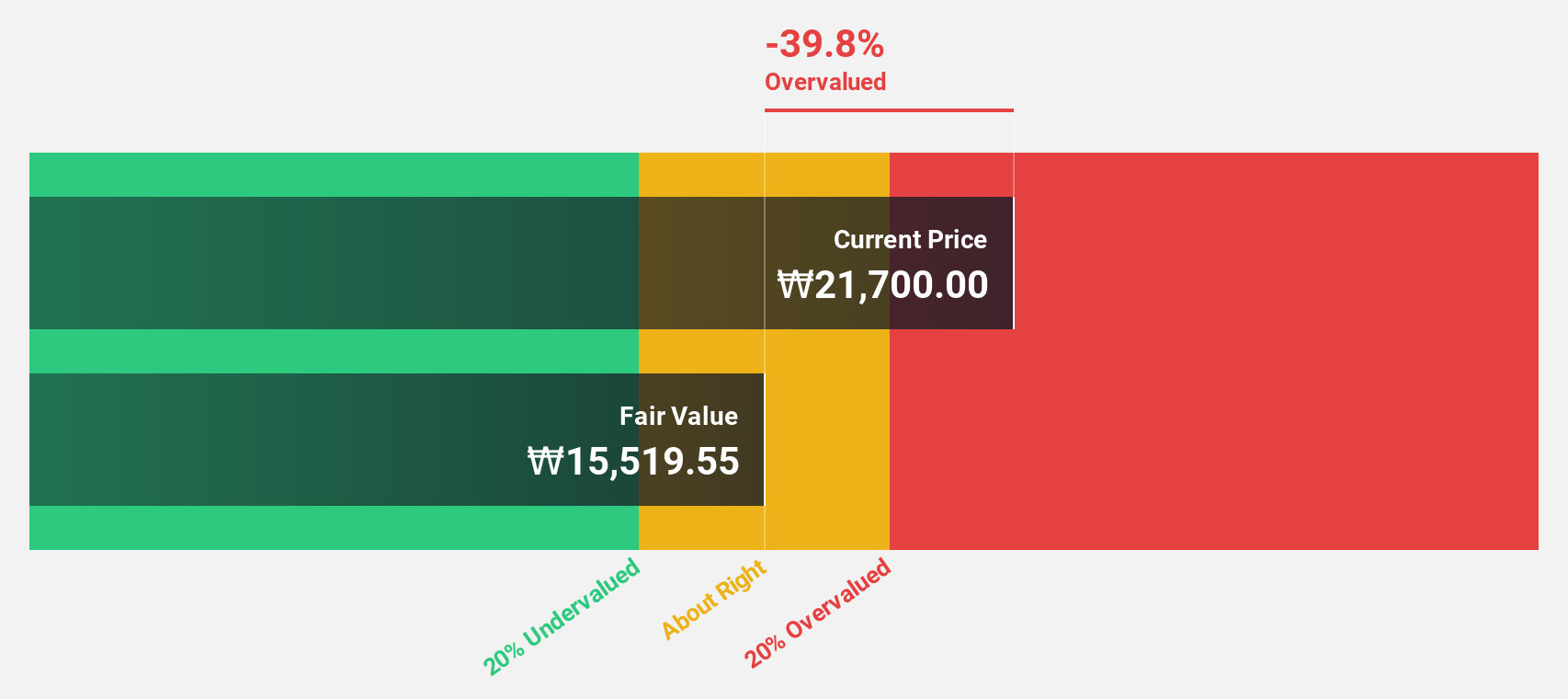

Estimated Discount To Fair Value: 49.1%

Sejin Heavy Industries is trading at ₩7,580, significantly below its estimated fair value of ₩14,888.99. Despite past shareholder dilution and low current profit margins of 2.7%, the company’s earnings are forecast to grow substantially at 62.92% annually over the next three years, outpacing the Korean market's growth rate of 29.4%. However, interest payments are not well covered by earnings and the dividend yield of 2.64% lacks coverage by earnings or free cash flows.

- Upon reviewing our latest growth report, Sejin Heavy Industries' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Sejin Heavy Industries.

Key Takeaways

- Reveal the 33 hidden gems among our Undervalued KRX Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A189300

Intellian Technologies

Provides satellite antennas and terminals in South Korea and internationally.

Undervalued with high growth potential.