- China

- /

- Communications

- /

- SHSE:600990

High Growth Tech Stocks To Watch This December 2024

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the Nasdaq Composite reaching new heights while small-cap indices like the Russell 2000 lag behind, investors are closely watching economic indicators such as inflation and labor market data that hint at potential shifts in monetary policy. In this environment, identifying high-growth tech stocks requires careful consideration of their ability to outperform amidst broader market volatility and capitalize on technological advancements.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

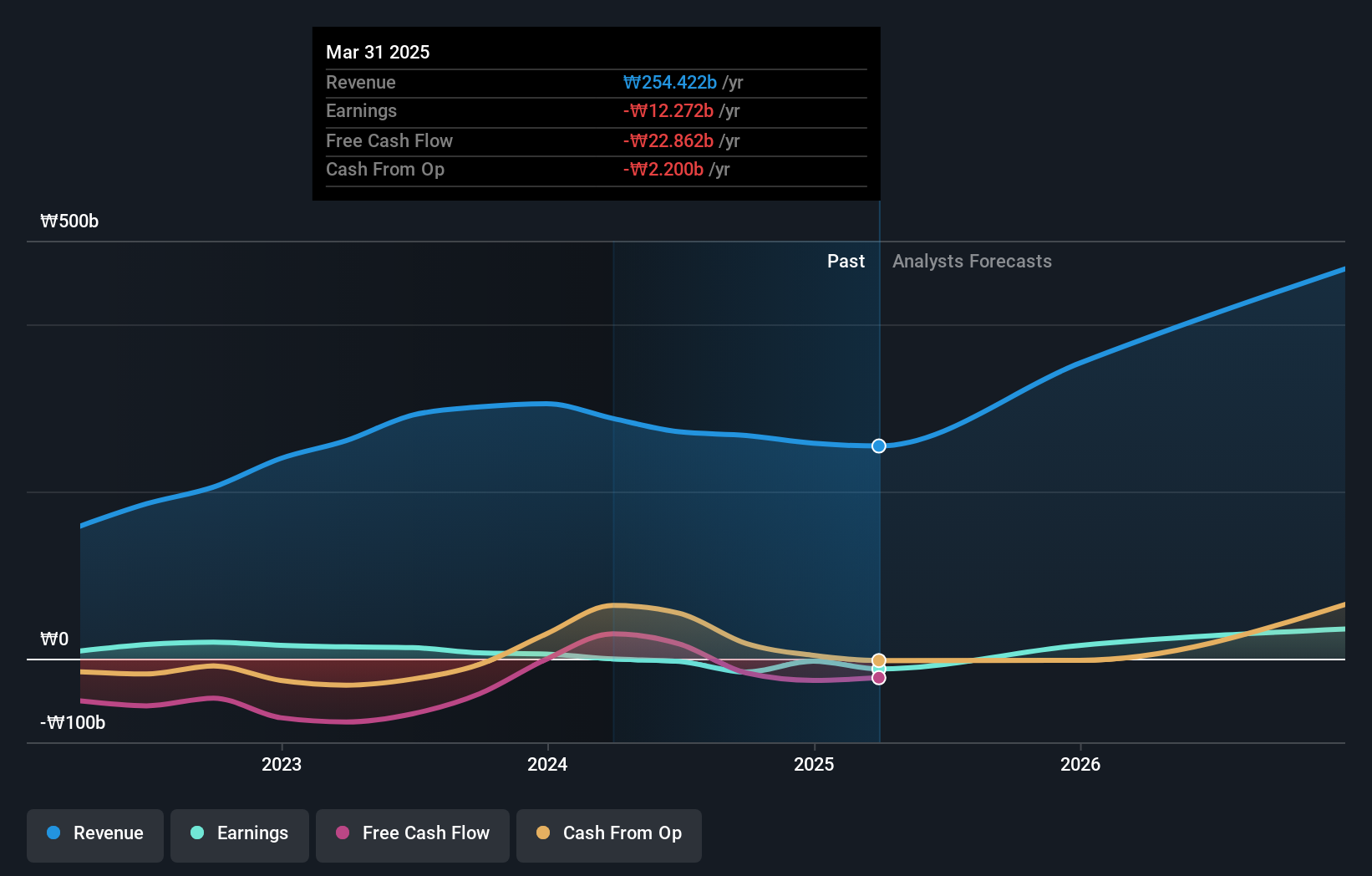

Overview: Intellian Technologies, Inc. is a company that specializes in providing satellite antennas and terminals both in South Korea and globally, with a market capitalization of ₩394.82 billion.

Operations: Intellian Technologies generates revenue primarily from telecommunication equipment sales, amounting to ₩267.04 billion. The company's operations focus on delivering satellite communication solutions across various markets worldwide.

Intellian Technologies, amidst a challenging market, has announced a strategic share repurchase program valued at KRW 5 billion to stabilize its stock price and enhance shareholder value, signaling confidence in its financial health. This move coincides with the company securing a significant contract with Telesat to supply Gateway Antenna Systems for the Lightspeed LEO constellation—a testament to Intellian's advanced engineering capabilities and its strategic positioning in satellite communications technology. Despite current unprofitability, revenue growth projections are robust at 36.2% annually, outpacing the South Korean market's 9% growth rate significantly. Moreover, earnings are expected to surge by an impressive 119.1% per year as Intellian transitions towards profitability within three years, underscoring potential future strength in both operational performance and market competitiveness.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) is a company that develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market capitalization of SEK18.25 billion.

Operations: The company generates revenue primarily through its communications software segment, which accounted for SEK1.78 billion.

Truecaller, a leader in communication safety and efficiency, is demonstrating robust growth with its innovative Customer Experience Solution suite. This suite, featuring Verified Business Caller ID and Call Reason, enhances trust and transparency in client communications—a critical factor for partnerships like those with Commercial International Bank to improve banking security. Truecaller's commitment to R&D is evident as expenses surged by 21% year-over-year, supporting the development of these advanced solutions that cater to an increasing demand for secure communication platforms. The company's strategic focus on enhancing user experience and safety through technology not only solidifies its market position but also drives a projected annual revenue growth of 21% and earnings growth of 23.6%, outpacing the broader Swedish market significantly.

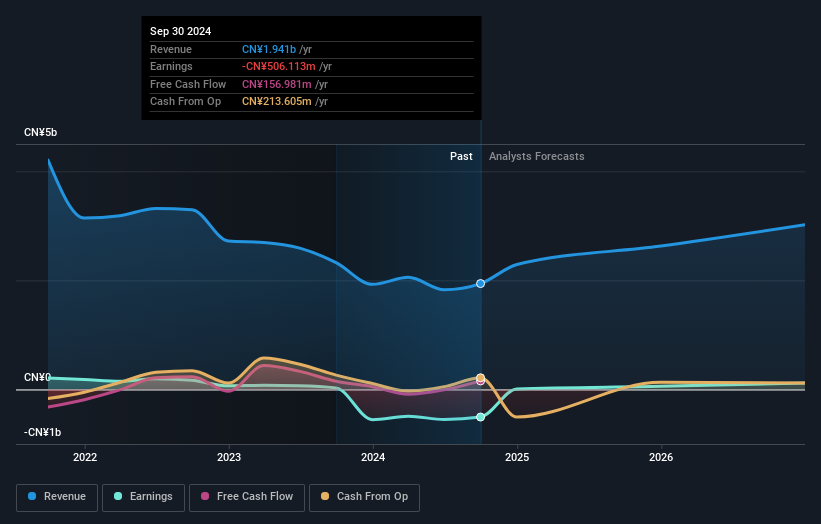

Sun Create Electronics (SHSE:600990)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sun Create Electronics Co., Ltd focuses on the research, design, manufacture, and marketing of radar and security systems with a market cap of CN¥6.53 billion.

Operations: The company's primary revenue stream is from its electronic industry segment, generating CN¥1.94 billion. Sun Create Electronics Co., Ltd specializes in radar and security systems, leveraging its expertise in research and development to drive sales within this sector.

Sun Create Electronics, amidst a challenging market, reported a significant reduction in net loss to CNY 40.44 million from CNY 87.56 million year-over-year, reflecting improved operational efficiency and cost management. Despite being currently unprofitable, the firm is on a trajectory toward profitability with expected earnings growth of an impressive 117.4% annually. The company's commitment to innovation is underscored by its R&D investments which are crucial for sustaining long-term growth in the competitive tech landscape; this strategic focus aligns with its anticipated revenue increase of 17.8% per year, outperforming the Chinese market average of 13.7%.

Turning Ideas Into Actions

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1284 more companies for you to explore.Click here to unveil our expertly curated list of 1287 High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600990

Sun Create Electronics

Engages in the research and development, design, manufacture, and marketing of radar and security systems.

Reasonable growth potential with imperfect balance sheet.