- South Korea

- /

- Biotech

- /

- KOSE:A068270

High Growth Tech Stocks In South Korea Including Park Systems

Reviewed by Simply Wall St

The South Korean market has remained flat over the past week, yet it has experienced a 4.1% increase over the last year with earnings projected to grow by 29% annually. In this context, identifying high growth tech stocks like Park Systems involves looking for companies that demonstrate strong potential for innovation and expansion within these promising market conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

Overview: Park Systems Corp. is a global company specializing in the development, manufacturing, and sale of atomic force microscopy (AFM) systems, with a market cap of ₩1.40 trillion.

Operations: The company generates revenue primarily from the sale of atomic force microscopy (AFM) systems, with its Scientific & Technical Instruments segment contributing ₩148.23 billion.

Park Systems, a player in South Korea's high-tech landscape, demonstrates robust growth potential with its revenue projected to increase by 23.2% annually, outpacing the broader Korean market's 10.4%. This surge is underpinned by significant R&D investments that not only fuel innovation but also enhance competitive edge in precision technology sectors crucial for advanced manufacturing and electronics. Furthermore, the company’s earnings are expected to rise at an impressive rate of 34.6% per year, reflecting strong operational efficiencies and market demand dynamics. Despite a challenging past year with earnings contraction of 13.4%, Park Systems' strategic focus on expanding its technological capabilities suggests promising future prospects in the evolving tech industry.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Intellian Technologies, Inc. specializes in providing satellite antennas and terminals both in South Korea and internationally, with a market cap of ₩566.29 billion.

Operations: The company generates revenue primarily through telecommunication equipment sales, amounting to ₩271.45 billion.

Intellian Technologies, amidst South Korea's competitive tech arena, is making significant strides with an expected annual revenue growth of 33.4%, outstripping the broader market's 10.4%. This growth trajectory is bolstered by aggressive R&D investments, accounting for a substantial portion of revenue, which not only drives innovation but also positions the firm advantageously against its peers. Additionally, earnings are anticipated to leap by 89.5% annually, a testament to its operational efficiency and strategic market adaptations. Recent share repurchases underscore confidence in this trajectory; from April to July 2024 alone, Intellian repurchased shares worth approximately KRW 5 billion underlining strong financial health and shareholder value enhancement. These factors collectively paint a promising picture for Intellian's role in shaping future tech advancements in South Korea.

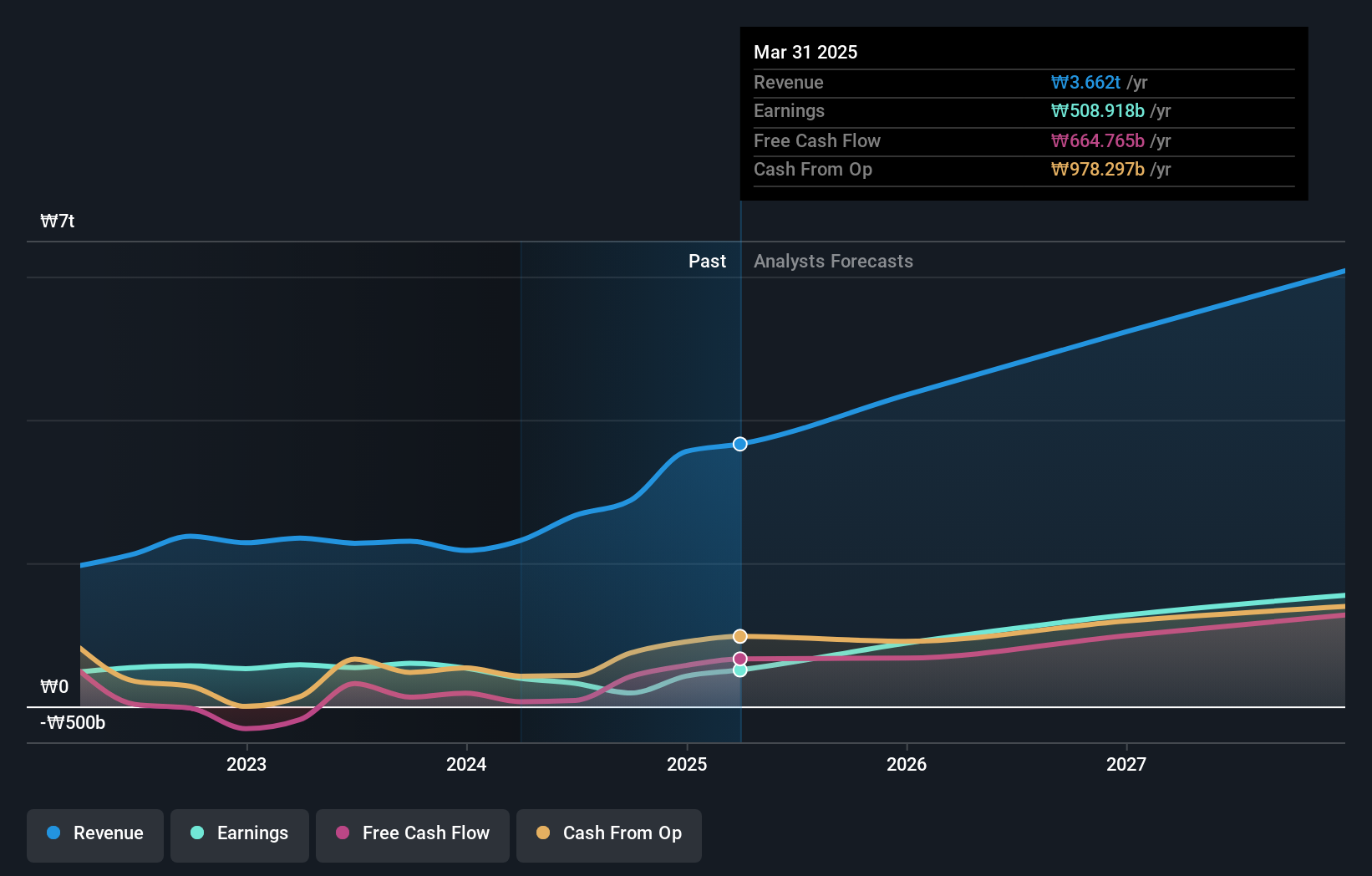

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, focuses on developing and manufacturing protein-based drugs for oncology treatment in South Korea and has a market capitalization of ₩41.37 trillion.

Operations: Celltrion, Inc. generates revenue primarily from its Bio Medical Supply segment, which accounts for ₩3.54 trillion, and Chemical Drugs segment contributing ₩507.02 billion.

Celltrion, a trailblazer in South Korea's biotech sector, is poised for robust growth with projected annual revenue increases of 25.6%, outpacing the domestic market forecast of 10.4%. This surge is underpinned by strategic R&D spending which has escalated to capture new advancements in biologics and biosimilars, crucial for maintaining competitive edge. Furthermore, the company's earnings are expected to skyrocket by 59.5% annually, reflecting strong operational execution and market expansion strategies such as recent agreements with major U.S. healthcare providers that bolster access to its innovative treatments like ZYMFENTRA®. These developments signify Celltrion’s potential to significantly influence both local and global biotechnology landscapes.

- Navigate through the intricacies of Celltrion with our comprehensive health report here.

Evaluate Celltrion's historical performance by accessing our past performance report.

Make It Happen

- Click here to access our complete index of 47 KRX High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A068270

Celltrion

A biopharmaceutical company, engages in the development, production, and sale of various therapeutic proteins for the treatment of oncology diseases.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives