In the current global market landscape, while most major stock indexes have seen declines, growth stocks continue to outperform value stocks, as evidenced by the Nasdaq Composite hitting a record high. This environment of fluctuating indices and economic adjustments highlights the importance of identifying growth companies with significant insider ownership, which can indicate confidence in the company's long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

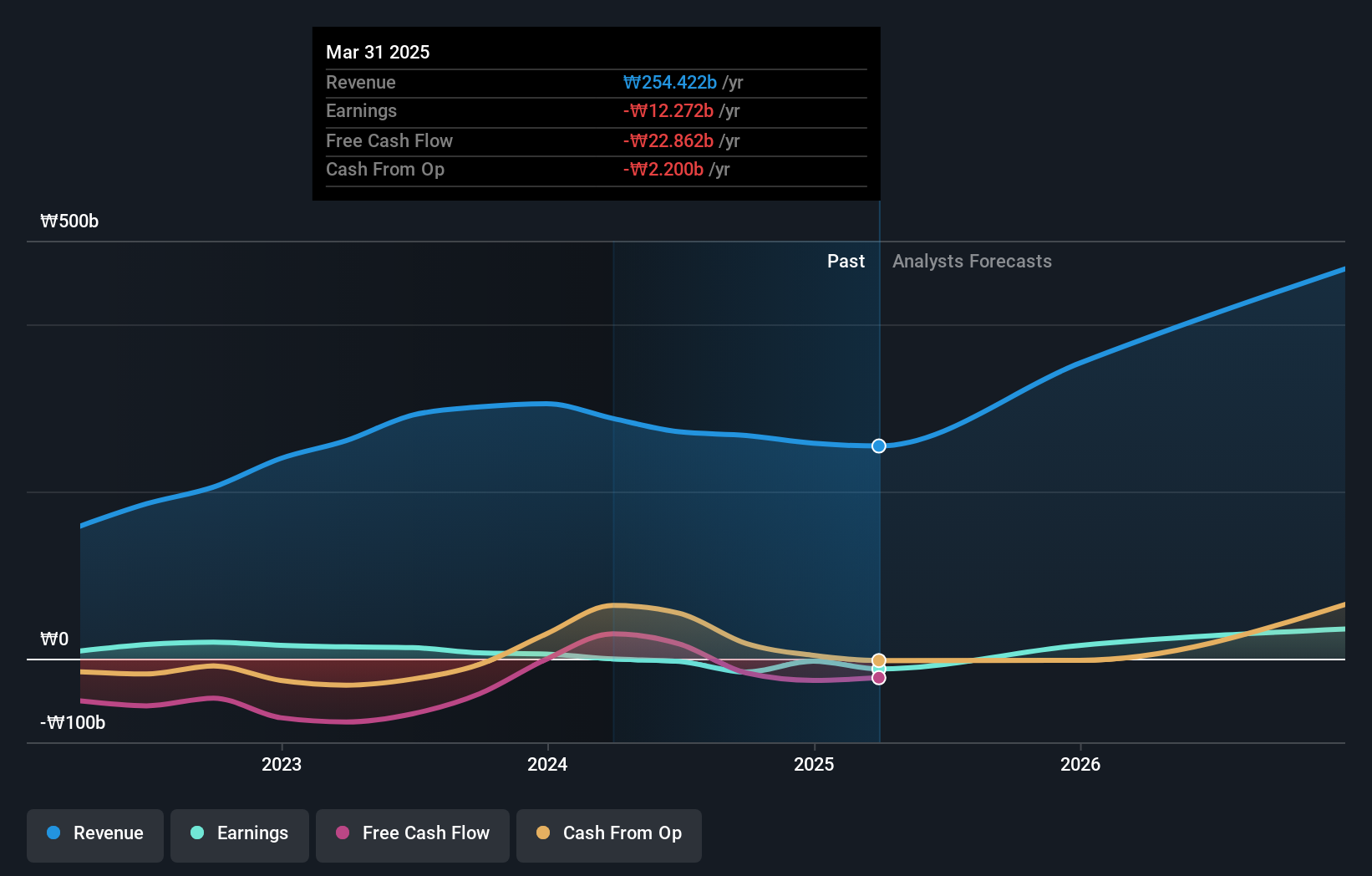

Overview: Intellian Technologies, Inc. operates in the satellite antennas and terminals sector both in South Korea and internationally, with a market cap of approximately ₩397.95 billion.

Operations: The company generates revenue from telecommunication equipment sales amounting to ₩267.04 billion.

Insider Ownership: 18.8%

Intellian Technologies is positioned for robust growth, with revenue forecasted to increase by 36.2% annually, outpacing the Korean market's 9% growth. The company recently secured a significant contract with Telesat for its LEO constellation, highlighting its technological prowess. Despite trading at 55.5% below estimated fair value and lacking recent insider trading activity, Intellian's stock buyback program aims to stabilize prices and enhance shareholder value through a KRW 5 billion repurchase plan.

- Take a closer look at Intellian Technologies' potential here in our earnings growth report.

- Our valuation report here indicates Intellian Technologies may be undervalued.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK3.36 billion.

Operations: The company's revenue is derived from its Main Markets segment at SEK2.78 billion, Other Markets at SEK1.91 billion, and Business Development and Services at SEK17 million.

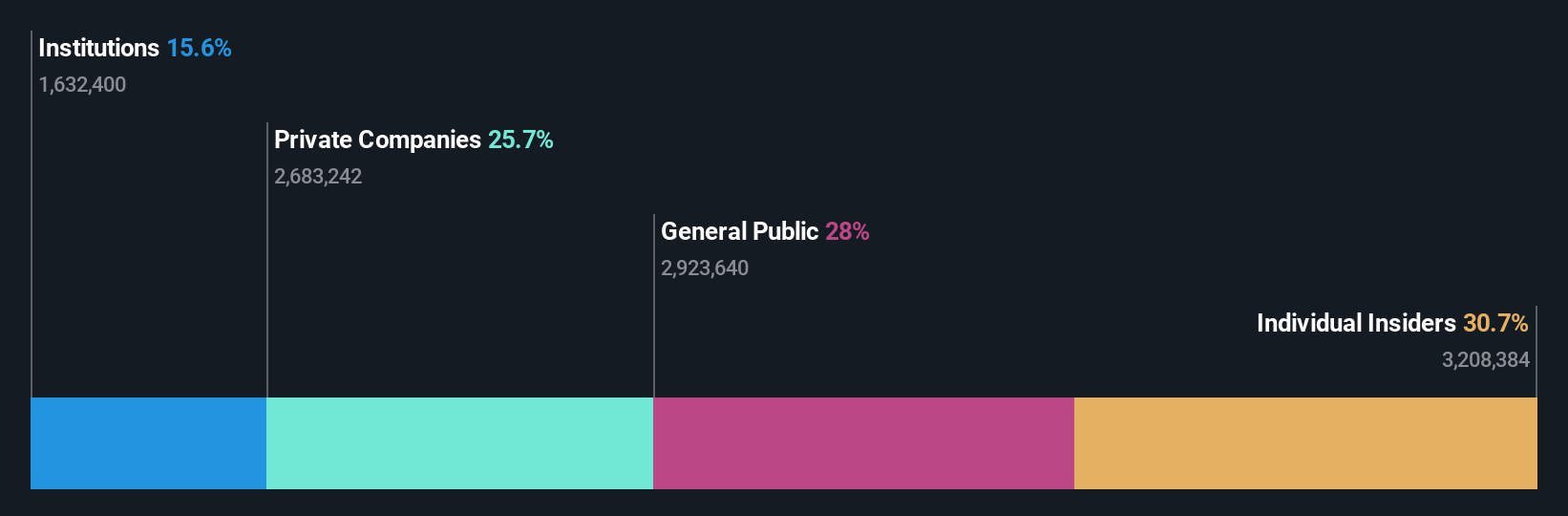

Insider Ownership: 37.8%

HANZA is set for significant earnings growth at 34.5% annually, surpassing the Swedish market's 15.3%. Despite trading at 49.2% below fair value and a decline in profit margins from last year, insider buying activity remains positive with more shares bought than sold recently. The company secured a promising partnership with a German firm, enhancing its manufacturing capabilities in key industries like automotive and aerospace amidst ongoing strategic expansions and management restructuring efforts.

- Click to explore a detailed breakdown of our findings in Hanza's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Hanza shares in the market.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of approximately €254.92 million.

Operations: The company's revenue is primarily derived from its Security Technologies segment, generating €35.20 million, and its HR Benefit & Mobility Platform segment, contributing €184.13 million.

Insider Ownership: 26.6%

Brockhaus Technologies is trading significantly below its estimated fair value, with expected revenue growth of 13.7% annually, outpacing the German market's average. Despite recent earnings showing a net loss of €2.31 million for the nine months ending September 2024, compared to a profit last year, forecasts suggest profitability within three years and substantial earnings growth at 115.87% per year. The company has not experienced substantial insider trading activity recently.

- Dive into the specifics of Brockhaus Technologies here with our thorough growth forecast report.

- According our valuation report, there's an indication that Brockhaus Technologies' share price might be on the cheaper side.

Make It Happen

- Navigate through the entire inventory of 1501 Fast Growing Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

Reasonable growth potential with adequate balance sheet.