Top Growth Companies With Strong Insider Ownership For January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets have shown a mixed performance with the S&P 500 and Nasdaq Composite closing out another strong year despite some end-of-year volatility. This backdrop of fluctuating indices and economic uncertainty highlights the importance of identifying growth companies with high insider ownership as they often signal confidence from those closest to the business, potentially offering resilience in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

Promotora de Informaciones (BME:PRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Promotora de Informaciones, S.A., along with its subsidiaries, operates in the media industry both in Spain and internationally, with a market capitalization of approximately €350 million.

Operations: The company generates revenue through its Education segment, amounting to €456.72 million.

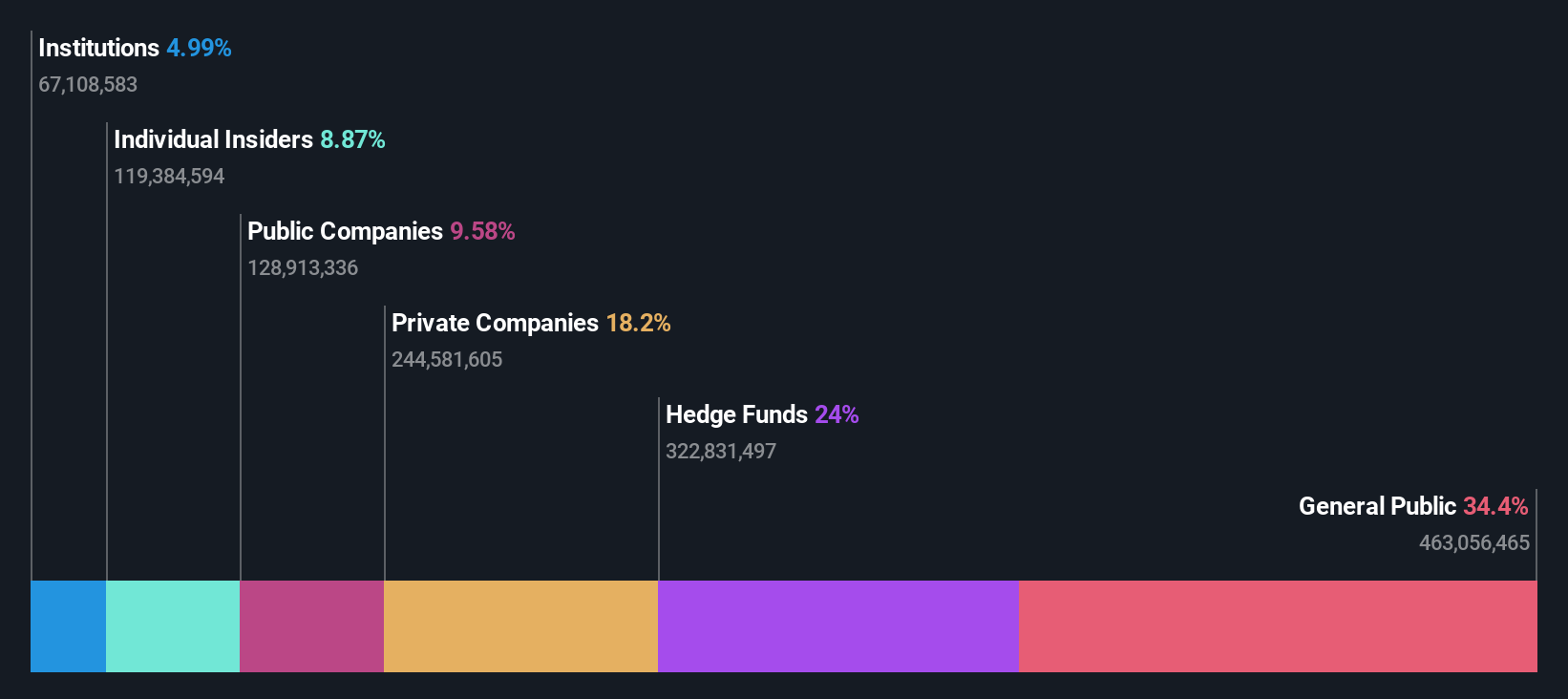

Insider Ownership: 13.3%

Promotora de Informaciones is forecast to achieve significant earnings growth of 125.9% annually, becoming profitable over the next three years, which is above average market growth. Despite a slower revenue growth rate of 6% per year compared to high-growth benchmarks, it surpasses the Spanish market's average. However, recent delisting from OTC Equity due to inactivity and past shareholder dilution may concern investors seeking stability in high insider ownership scenarios.

- Delve into the full analysis future growth report here for a deeper understanding of Promotora de Informaciones.

- The valuation report we've compiled suggests that Promotora de Informaciones' current price could be quite moderate.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd specializes in providing telecom equipment, repeaters, mechanical products, and LED-related equipment, with a market cap of ₩1.57 trillion.

Operations: The company's revenue is primarily derived from its EMS Sector, contributing ₩1.79 billion, and the Semiconductor Sector, which adds ₩187.83 million.

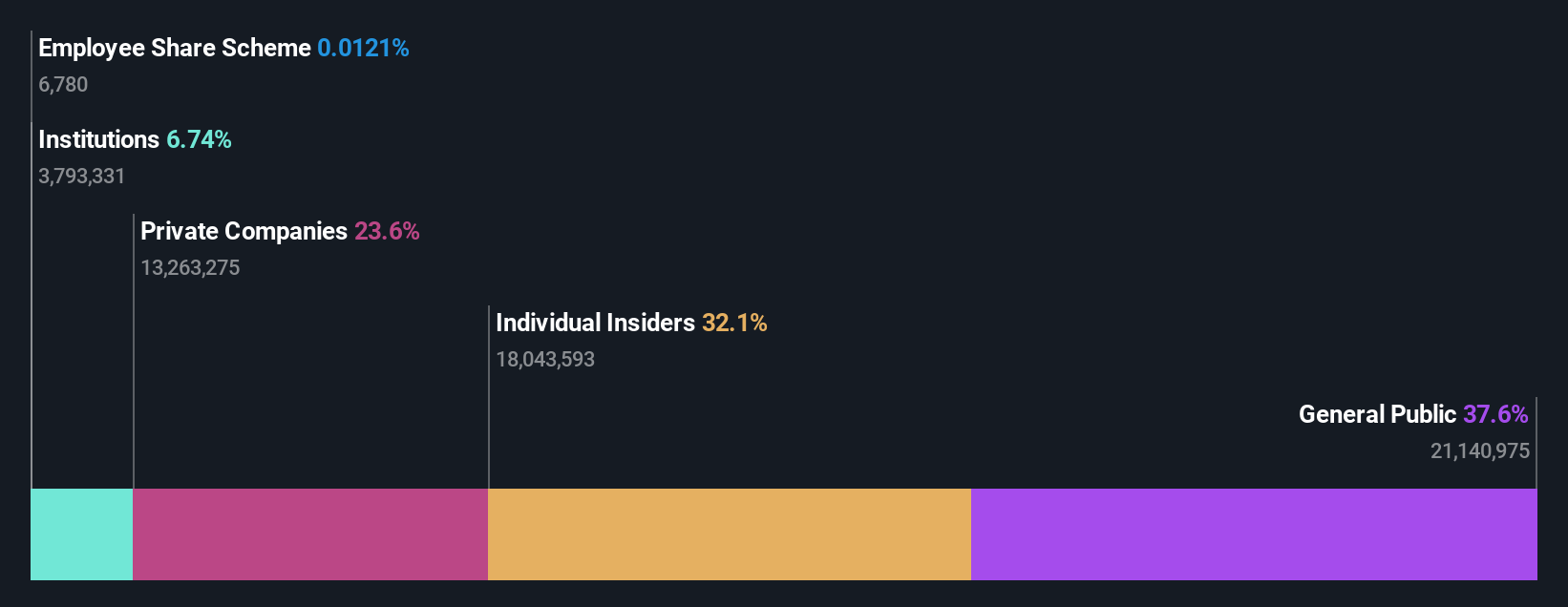

Insider Ownership: 30.9%

Seojin System Ltd. is trading significantly below its fair value, suggesting potential undervaluation compared to peers. The company is poised for robust growth, with earnings projected to rise by 39.9% annually over the next three years, outpacing the Korean market's average. Revenue growth is also expected to be strong at 35.4% per year, although past shareholder dilution and insufficient debt coverage by operating cash flow may pose risks for investors prioritizing financial stability in high insider ownership contexts.

- Dive into the specifics of Seojin SystemLtd here with our thorough growth forecast report.

- According our valuation report, there's an indication that Seojin SystemLtd's share price might be on the cheaper side.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows globally with a market cap of CHF10.32 billion.

Operations: VAT Group's revenue is primarily derived from its Valves segment, contributing CHF783.51 million, and its Global Service segment, which adds CHF163.83 million.

Insider Ownership: 10.2%

VAT Group is trading well below its estimated fair value, indicating potential undervaluation. Its earnings are projected to grow significantly at 21.6% annually over the next three years, surpassing Swiss market averages. While revenue growth is expected at 16.4% per year, it remains slower than earnings growth rates. Despite no substantial insider trading activity in recent months, the high forecasted return on equity and robust profit growth prospects highlight its appeal for investors interested in high insider ownership contexts.

- Navigate through the intricacies of VAT Group with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that VAT Group's share price might be on the expensive side.

Next Steps

- Reveal the 1500 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PRS

Promotora de Informaciones

Engages in the exploitation of media in Spain and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026