- South Korea

- /

- Entertainment

- /

- KOSE:A352820

3 KRX Growth Companies With High Insider Ownership And Up To 99% Earnings Growth

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 1.4% decline, while remaining flat overall in the past year. In this context of anticipated 30% annual earnings growth, companies with high insider ownership and significant earnings potential can be particularly appealing for investors seeking promising opportunities.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd. operates in the telecom equipment industry, offering products such as repeaters, mechanical products, and LED equipment, with a market cap of ₩1.60 billion.

Operations: The company's revenue segments include the EMS Division generating ₩1.52 billion and the Semiconductor segment contributing ₩169.98 million.

Insider Ownership: 30.5%

Earnings Growth Forecast: 52.1% p.a.

Seojin System Ltd. demonstrates substantial growth potential with earnings forecasted to grow significantly at 52.05% annually, outpacing the broader Korean market's expected growth. Despite a volatile share price and recent shareholder dilution, the company trades well below its estimated fair value. Recent private placements totaling ₩100 billion signal strategic financial maneuvers aimed at strengthening capital structure, although interest payments remain inadequately covered by earnings. The lack of insider trading activity suggests stable insider confidence in future prospects.

- Take a closer look at Seojin SystemLtd's potential here in our earnings growth report.

- Our expertly prepared valuation report Seojin SystemLtd implies its share price may be lower than expected.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that develops long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩17.85 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, amounting to ₩90.79 billion.

Insider Ownership: 26.6%

Earnings Growth Forecast: 99.5% p.a.

ALTEOGEN Inc. is poised for significant growth, with revenue expected to rise 64.2% annually, surpassing the Korean market's average. The recent MFDS approval of Tergase® marks a pivotal transition to commercialization, leveraging its high purity and low immunogenicity advantages. Despite past shareholder dilution and share price volatility, the company trades significantly below estimated fair value. Profitability is projected within three years, reflecting above-average market growth expectations without substantial insider trading activity recently noted.

- Click to explore a detailed breakdown of our findings in ALTEOGEN's earnings growth report.

- Our valuation report unveils the possibility ALTEOGEN's shares may be trading at a premium.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

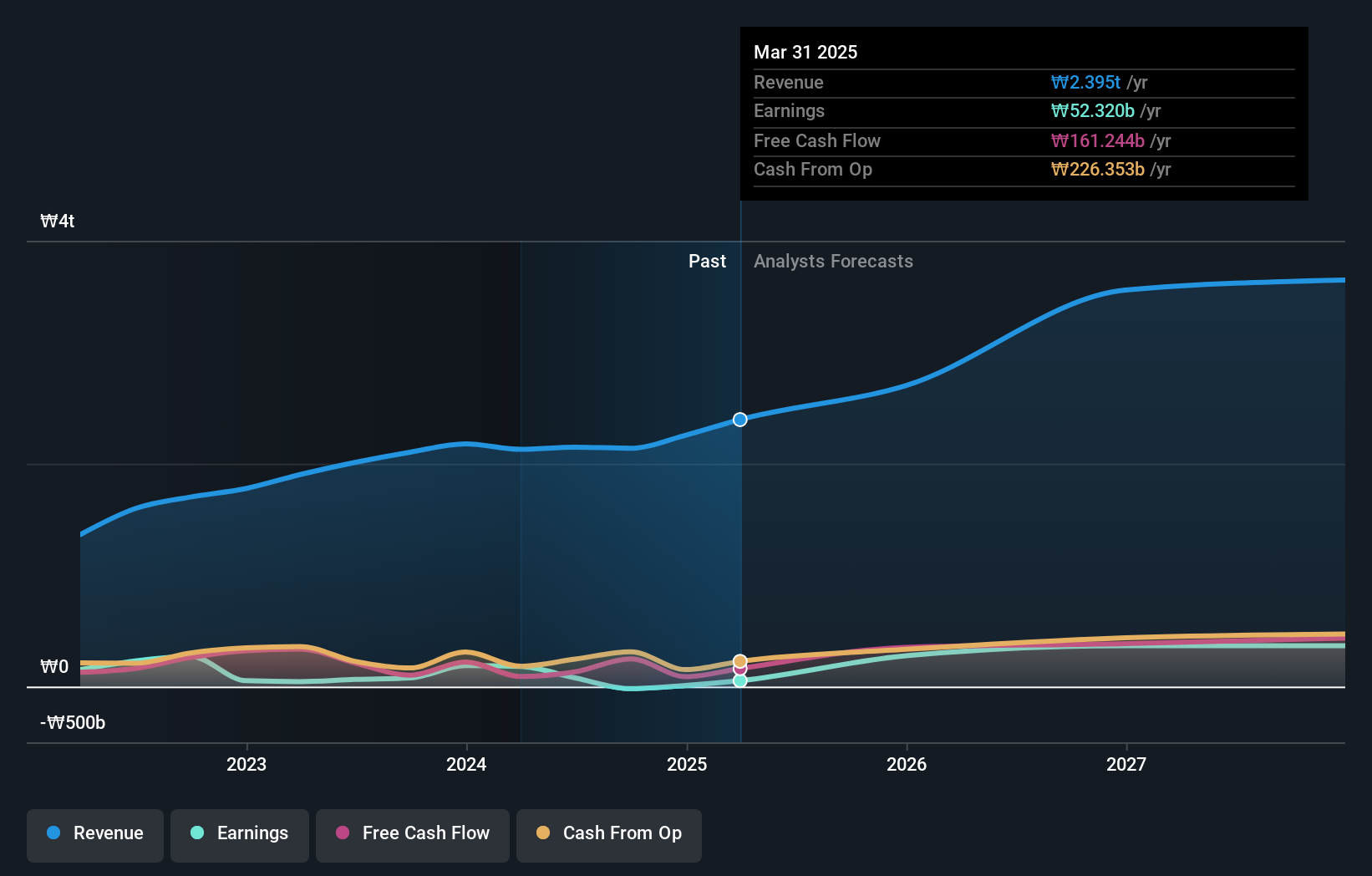

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩7.09 trillion.

Operations: The company's revenue is primarily derived from three segments: Label (₩1.28 trillion), Platform (₩361.12 billion), and Solution (₩1.24 trillion).

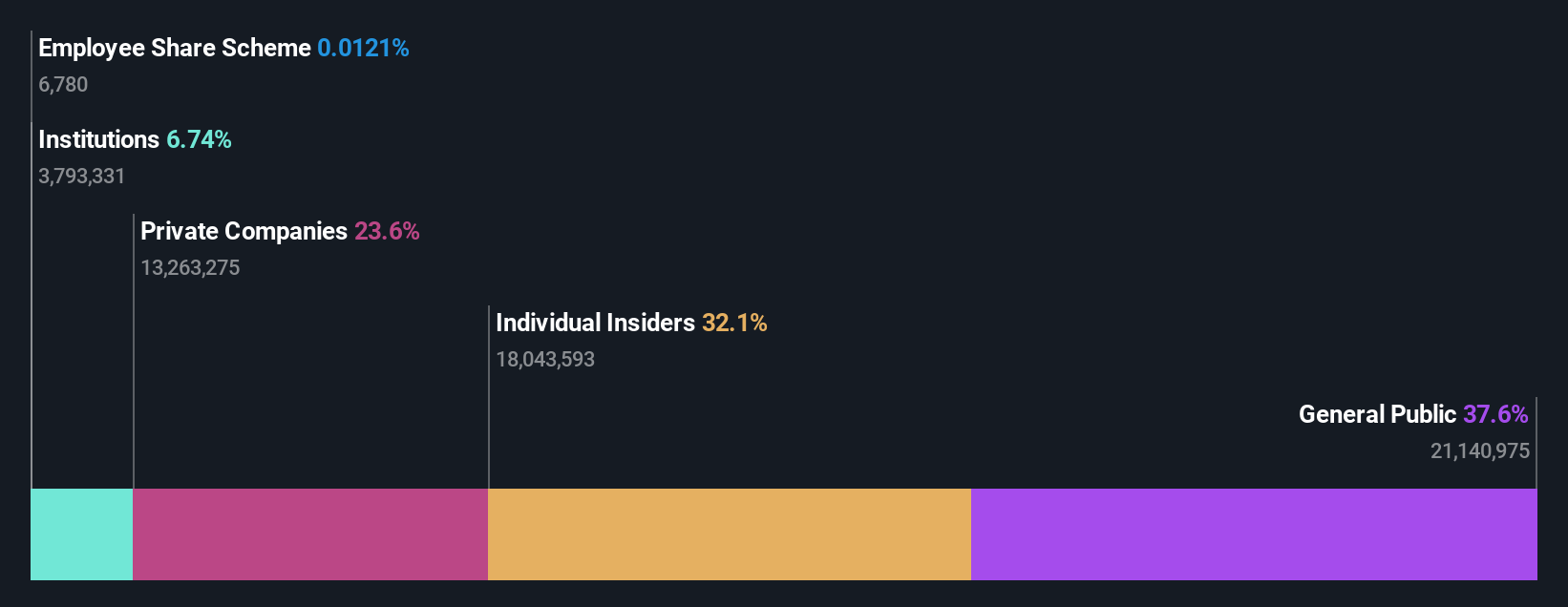

Insider Ownership: 32.5%

Earnings Growth Forecast: 42.2% p.a.

HYBE demonstrates strong growth potential, with earnings forecasted to grow significantly at 42.2% annually, outpacing the Korean market. Despite recent fluctuations in net income and earnings per share due to large one-off items, the company trades below its estimated fair value by 27.4%. The recent completion of a share buyback program for KRW 26.09 billion aims to stabilize stock prices. Analysts anticipate a substantial price increase, though insider trading activity remains minimal recently.

- Dive into the specifics of HYBE here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of HYBE shares in the market.

Key Takeaways

- Take a closer look at our Fast Growing KRX Companies With High Insider Ownership list of 86 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion