- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A093190

Bixolon's (KOSDAQ:093190) Soft Earnings Don't Show The Whole Picture

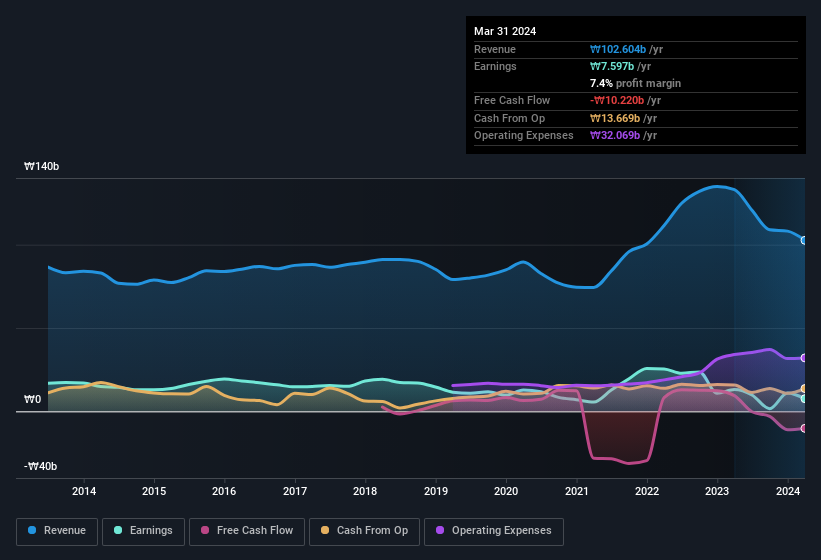

Soft earnings didn't appear to concern Bixolon Co., Ltd's (KOSDAQ:093190) shareholders over the last week. Our analysis suggests that while the profits are soft, the foundations of the business are strong.

Check out our latest analysis for Bixolon

How Do Unusual Items Influence Profit?

For anyone who wants to understand Bixolon's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by ₩1.3b due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Bixolon to produce a higher profit next year, all else being equal.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Bixolon.

Our Take On Bixolon's Profit Performance

Unusual items (expenses) detracted from Bixolon's earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that Bixolon's statutory profit actually understates its earnings potential! And the EPS is up 40% annually, over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing Bixolon at this point in time. For example - Bixolon has 2 warning signs we think you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Bixolon's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Bixolon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A093190

Bixolon

Manufactures print solutions on mobile and stationary devices in South Korea.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026