- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A092460

Hanla IMS Co., Ltd. (KOSDAQ:092460) Looks Just Right With A 26% Price Jump

Hanla IMS Co., Ltd. (KOSDAQ:092460) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 42%.

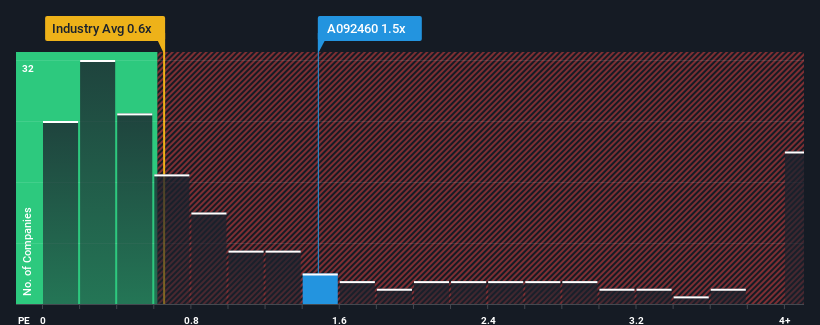

Following the firm bounce in price, you could be forgiven for thinking Hanla IMS is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.5x, considering almost half the companies in Korea's Electronic industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

We've discovered 3 warning signs about Hanla IMS. View them for free.See our latest analysis for Hanla IMS

How Hanla IMS Has Been Performing

Recent times have been quite advantageous for Hanla IMS as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hanla IMS will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Hanla IMS?

The only time you'd be truly comfortable seeing a P/S as high as Hanla IMS' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. The latest three year period has also seen an excellent 84% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 4.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Hanla IMS' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Hanla IMS shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Hanla IMS can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Hanla IMS is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on Hanla IMS, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hanla IMS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A092460

Hanla IMS

Provides integrated systems in South Korea, Singapore, China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026