- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A082210

Is OPTRONTEC (KOSDAQ:082210) Weighed On By Its Debt Load?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that OPTRONTEC Inc. (KOSDAQ:082210) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is OPTRONTEC's Debt?

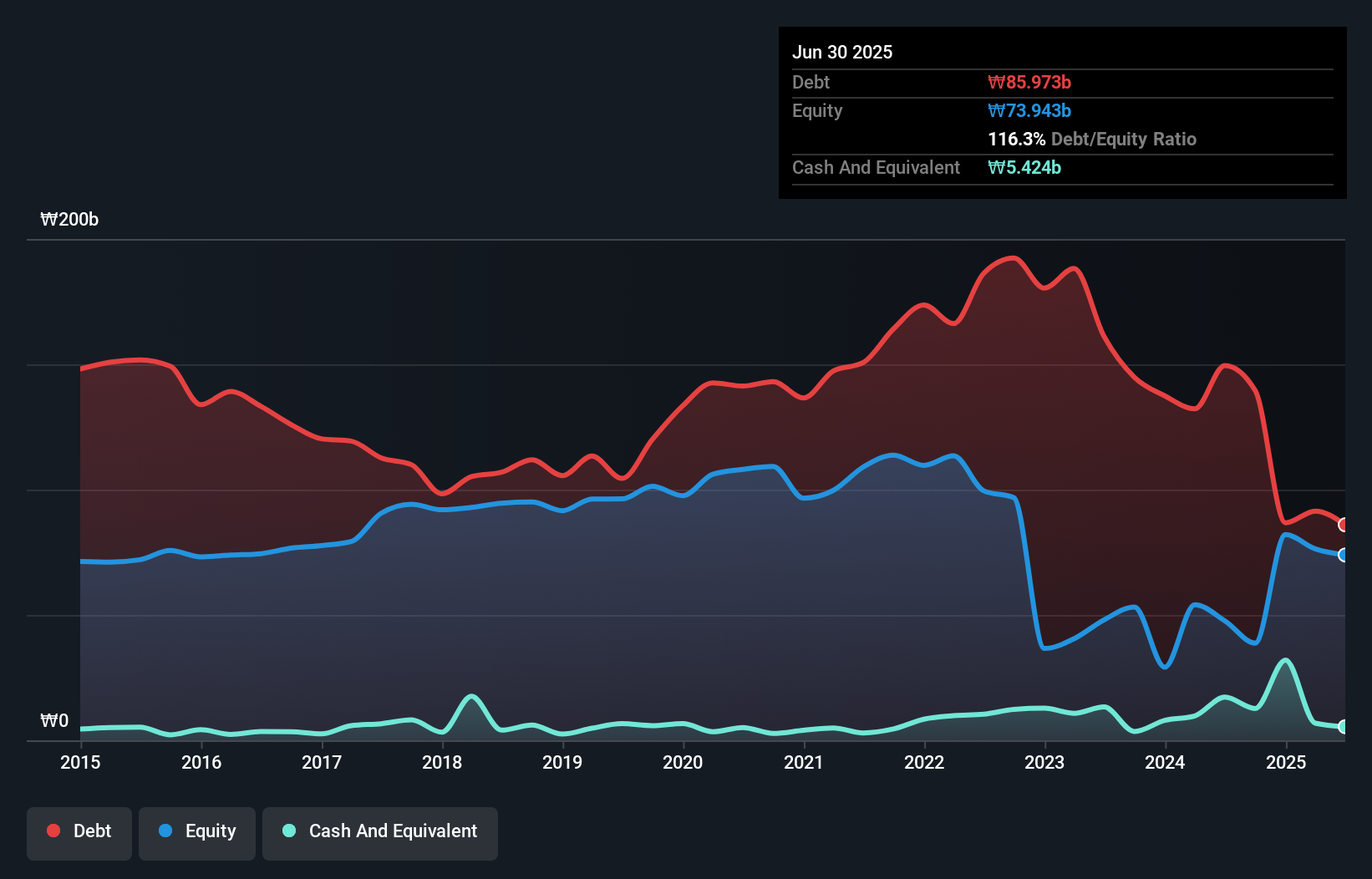

As you can see below, OPTRONTEC had ₩86.0b of debt at June 2025, down from ₩149.5b a year prior. However, it also had ₩5.42b in cash, and so its net debt is ₩80.5b.

How Strong Is OPTRONTEC's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that OPTRONTEC had liabilities of ₩127.6b due within 12 months and liabilities of ₩7.75b due beyond that. Offsetting these obligations, it had cash of ₩5.42b as well as receivables valued at ₩22.1b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩107.8b.

This deficit casts a shadow over the ₩59.0b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, OPTRONTEC would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since OPTRONTEC will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

View our latest analysis for OPTRONTEC

In the last year OPTRONTEC had a loss before interest and tax, and actually shrunk its revenue by 25%, to ₩190b. To be frank that doesn't bode well.

Caveat Emptor

Not only did OPTRONTEC's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping ₩12b. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through ₩23b in negative free cash flow over the last year. That means it's on the risky side of things. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example OPTRONTEC has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A082210

OPTRONTEC

Manufactures and sells optical components in Korea and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026