- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

Investors Interested In Daejoo Electronic Materials Co., Ltd.'s (KOSDAQ:078600) Revenues

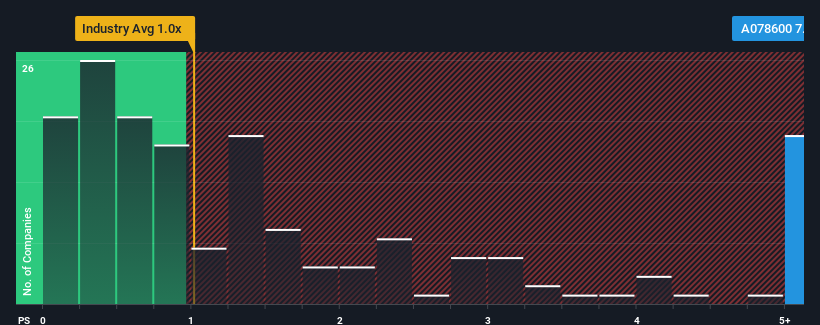

When close to half the companies in the Electronic industry in Korea have price-to-sales ratios (or "P/S") below 1x, you may consider Daejoo Electronic Materials Co., Ltd. (KOSDAQ:078600) as a stock to avoid entirely with its 7.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Daejoo Electronic Materials

What Does Daejoo Electronic Materials' P/S Mean For Shareholders?

Recent times have been advantageous for Daejoo Electronic Materials as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Daejoo Electronic Materials.Do Revenue Forecasts Match The High P/S Ratio?

Daejoo Electronic Materials' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.3% last year. The latest three year period has also seen a 20% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 40% each year over the next three years. With the industry only predicted to deliver 14% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Daejoo Electronic Materials' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Daejoo Electronic Materials' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Daejoo Electronic Materials shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Daejoo Electronic Materials (2 are a bit unpleasant!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Solid track record and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026