- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, with U.S. stocks advancing on cooling inflation and strong bank earnings, the focus shifts to high-growth tech stocks that could potentially benefit from these economic conditions. In this environment, identifying promising tech stocks involves looking for those with innovative solutions and robust growth potential that align well with current market trends and investor sentiment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1229 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. specializes in the development and sale of electronic materials across several regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.54 trillion.

Operations: The company focuses on the development, production, and sale of electrical and electronic components, generating revenue of ₩208.25 billion.

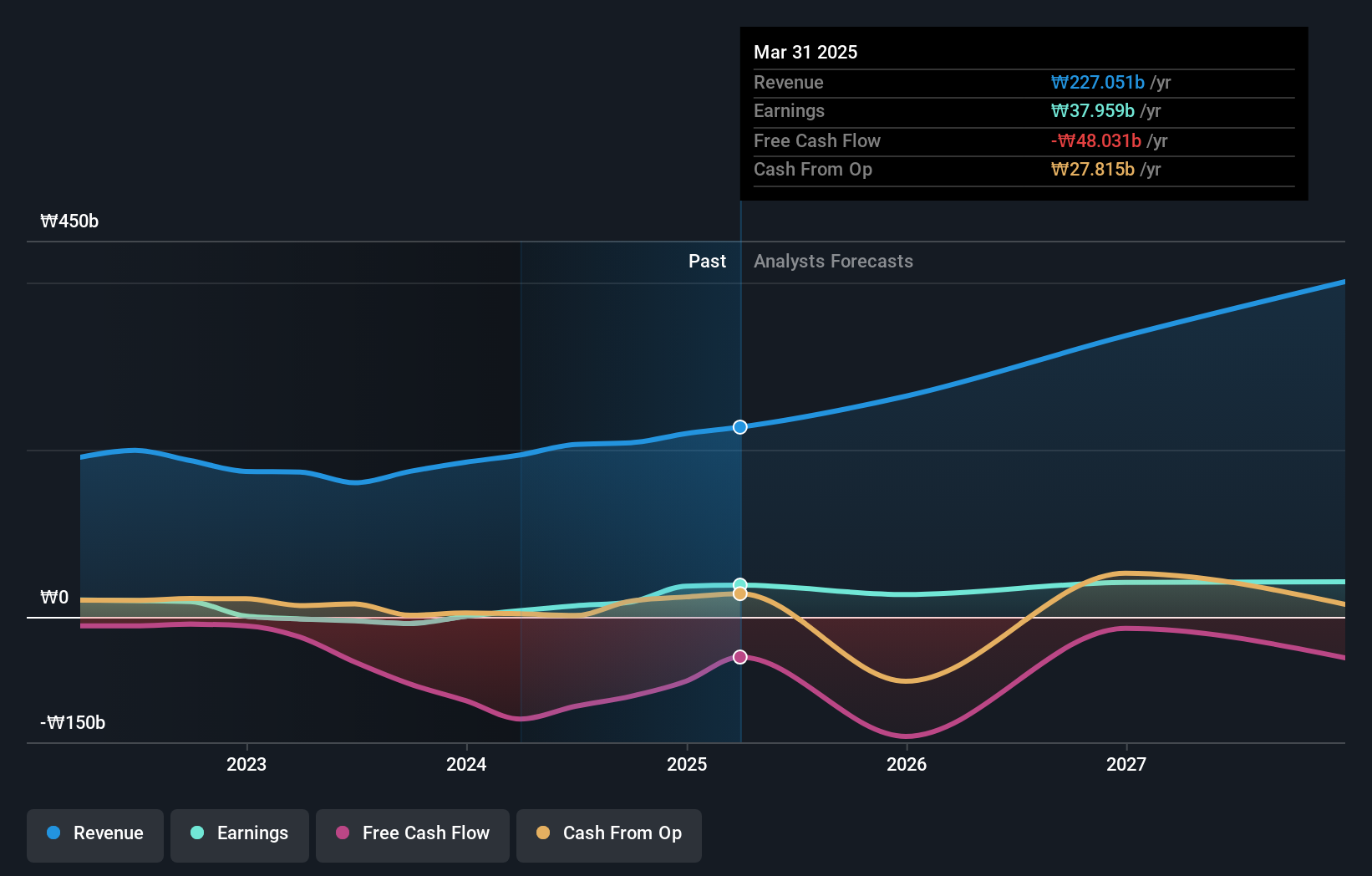

Daejoo Electronic Materials has demonstrated a remarkable turnaround, with third-quarter sales rising to KRW 55.77 billion from KRW 53.84 billion year-on-year and net income soaring to KRW 4.59 billion from just KRW 102.6 million. This performance is underscored by an explosive annual earnings growth forecast of 41%, significantly outpacing the Korean market's average of 28.8%. The company's strategic presentations at international conferences, including the recent Macquarie Asia Conference in New York, signal robust engagement with global investors and hint at sustained aggressive expansion strategies in high-tech materials sectors. With R&D expenses aligned closely with revenue growth trends, Daejoo is positioning itself as a dynamic contender in the tech industry, leveraging its enhanced profitability and high-quality earnings to potentially lead future innovations.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

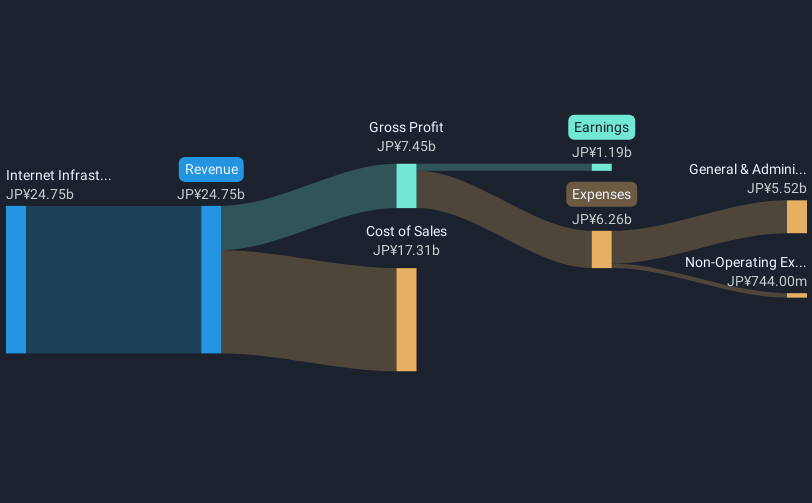

Overview: SAKURA Internet Inc., with a market cap of ¥173.20 billion, offers cloud computing services in Japan.

Operations: The company's primary revenue stream is from its Internet Infrastructure Business, generating ¥24.75 billion. The focus on cloud computing services positions it within a growing sector in Japan's technology landscape.

SAKURA Internet, amidst a robust tech landscape, has signaled strong growth trajectories with an annual revenue increase projected at 36.9% and earnings growth forecast at 50.8%, significantly outstripping the broader Japanese market's average. At the recent KIS Global Investors Conference, the firm outlined strategies that are likely to bolster its market position further, supported by R&D investments tightly correlated with these revenue trends. This focus on innovation is critical as it navigates a highly competitive sector where technological advancements are paramount for maintaining an edge.

- Click here to discover the nuances of SAKURA Internet with our detailed analytical health report.

Explore historical data to track SAKURA Internet's performance over time in our Past section.

Cybozu (TSE:4776)

Simply Wall St Growth Rating: ★★★★★☆

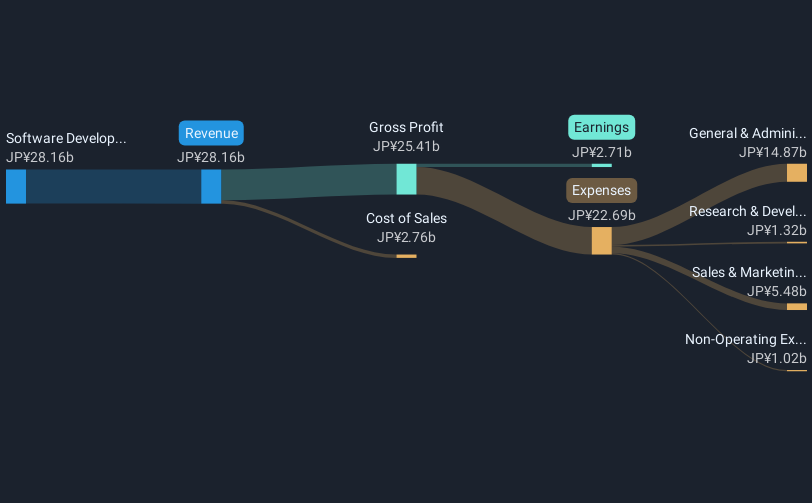

Overview: Cybozu, Inc. is a company that develops, sells, and operates groupware solutions across several countries including Japan, China, Vietnam, Taiwan, Malaysia, Australia, and the United States with a market capitalization of ¥118.65 billion.

Operations: The company generates revenue primarily through its software development and sales segment, amounting to ¥28.16 billion. It operates in multiple international markets, focusing on groupware solutions.

Cybozu demonstrates a promising trajectory in the tech sector, with its earnings growth outpacing the software industry average at 39.3% compared to 12.1%. This performance is supported by significant R&D investments, which are crucial as the company competes in a rapidly evolving technological landscape. Notably, Cybozu has also actively returned value to shareholders through recent stock repurchases totaling ¥2.93 billion for 1.41 million shares, underscoring confidence in its financial health and commitment to shareholder interests. These strategic moves highlight Cybozu's robust position and potential for sustained growth amidst challenging market dynamics.

- Delve into the full analysis health report here for a deeper understanding of Cybozu.

Examine Cybozu's past performance report to understand how it has performed in the past.

Make It Happen

- Delve into our full catalog of 1229 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Exceptional growth potential low.