- South Korea

- /

- Biotech

- /

- KOSE:A068270

Exploring High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

The South Korea stock market has moved higher in five straight sessions, improving almost 90 points or 3.4 percent along the way. The KOSPI now sits just above the 2,600-point plateau and it may tick higher again on Tuesday. With this positive momentum in mind, exploring high growth tech stocks in South Korea can reveal promising opportunities for investors looking to capitalize on the current market conditions and economic indicators favoring technological advancements.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.56 trillion.

Operations: Daejoo Electronic Materials Co., Ltd. focuses on the development, production, and sale of electrical and electronic components, generating a revenue of ₩206.32 billion from these activities. The company operates in multiple regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Daejoo Electronic Materials, a South Korean entity, has demonstrated a notable turnaround by becoming profitable this year, with its earnings expected to surge by 48.7% annually. This growth trajectory outpaces the broader KR market's forecast of 29%. Additionally, the company's revenue is projected to increase at an impressive rate of 42.2% per year, significantly higher than the market average of 10.4%. Despite these positive trends, challenges persist as indicated by its highly volatile share price in recent months and earnings that are not well covered by operating cash flow. The firm's commitment to innovation is evident from its substantial R&D expenses which have strategically positioned it for future advancements in electronic materials technology despite current financial pressures.

- Delve into the full analysis health report here for a deeper understanding of Daejoo Electronic Materials.

Learn about Daejoo Electronic Materials' historical performance.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩18.59 billion.

Operations: ALTEOGEN Inc. generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. The company's focus is on developing innovative biopharmaceutical products such as long-acting biobetters and proprietary antibody-drug conjugates.

ALTEOGEN, a South Korean biotech firm, is poised for significant growth with its revenue expected to surge by 64.2% annually, outstripping the broader market's forecast of 10.4%. This projection aligns with its recent strategic milestone: the approval of Tergase®, a high-purity biologic developed through proprietary Hybrozyme™ Technology, by Korea's MFDS. Despite current unprofitability and shareholder dilution over the past year, earnings are anticipated to skyrocket by nearly 99.5% annually. The company’s substantial investment in R&D underscores its commitment to innovation and positions it well for future advancements in biotechnology, despite financial hurdles that remain.

- Click here and access our complete health analysis report to understand the dynamics of ALTEOGEN.

Assess ALTEOGEN's past performance with our detailed historical performance reports.

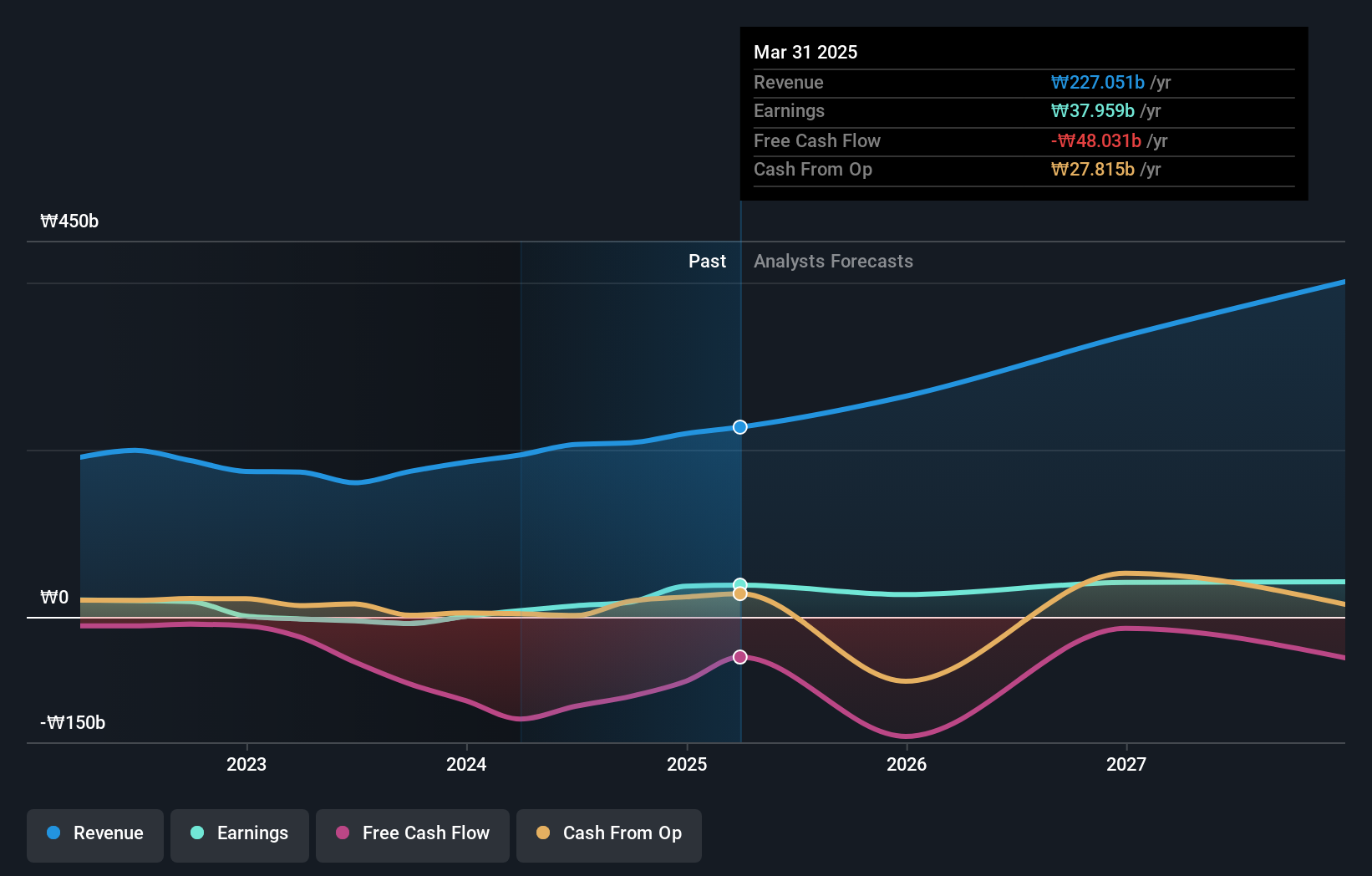

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, focuses on developing and producing protein-based drugs for oncology treatment in South Korea, with a market cap of ₩42.30 trillion.

Operations: Celltrion, Inc. generates revenue primarily from its Bio Medical Supply segment, which contributes ₩3.54 trillion, and Chemical Drugs segment, adding ₩507 billion. The company specializes in developing and manufacturing protein-based oncology drugs in South Korea.

Celltrion, a South Korean biotech leader, is demonstrating robust growth dynamics within the high-tech sector, particularly through its strategic partnerships and product approvals. Recently securing ZYMFENTRA® as a preferred medication under Cigna's formulary and achieving FDA approval in 2023 for two inflammatory conditions marks significant progress. Financially, the company's R&D investment reflects a strong commitment to innovation with expenses up by 25.5% annually, aligning with an expected revenue surge of 59.6% per year. These figures underscore Celltrion’s potential amidst competitive market pressures and illustrate its proactive approach in expanding its biosimilar portfolio globally.

- Click to explore a detailed breakdown of our findings in Celltrion's health report.

Gain insights into Celltrion's past trends and performance with our Past report.

Key Takeaways

- Access the full spectrum of 49 KRX High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A068270

Celltrion

Develops and produces drugs based on proteins for the treatment of oncology in South Korea.

Flawless balance sheet with high growth potential.