- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A066900

These 4 Measures Indicate That DAP (KOSDAQ:066900) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies DAP Corporation (KOSDAQ:066900) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for DAP

How Much Debt Does DAP Carry?

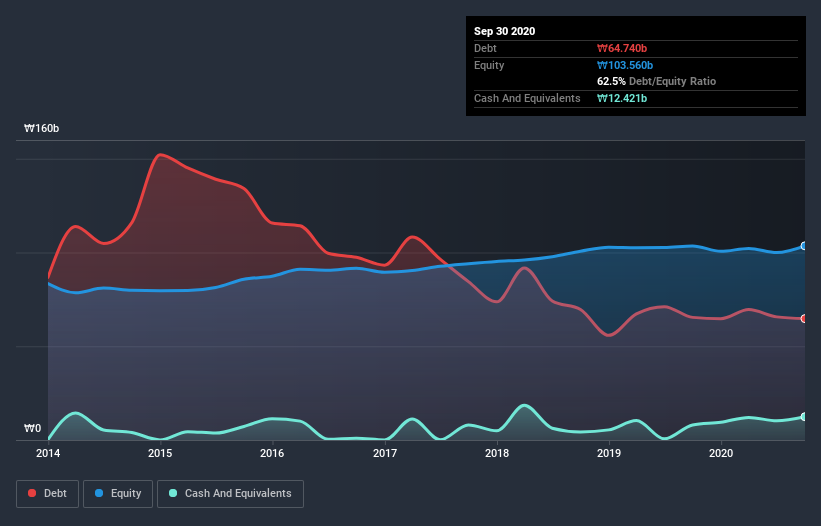

The chart below, which you can click on for greater detail, shows that DAP had ₩64.7b in debt in September 2020; about the same as the year before. On the flip side, it has ₩12.4b in cash leading to net debt of about ₩52.3b.

How Healthy Is DAP's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that DAP had liabilities of ₩89.2b due within 12 months and liabilities of ₩45.9b due beyond that. On the other hand, it had cash of ₩12.4b and ₩40.8b worth of receivables due within a year. So its liabilities total ₩81.9b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of ₩78.7b, we think shareholders really should watch DAP's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

DAP's net debt is sitting at a very reasonable 2.3 times its EBITDA, while its EBIT covered its interest expense just 2.9 times last year. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Unfortunately, DAP's EBIT flopped 18% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since DAP will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, DAP actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

We'd go so far as to say DAP's EBIT growth rate was disappointing. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that DAP's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for DAP you should be aware of, and 2 of them can't be ignored.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading DAP or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A066900

DAP

Engages in the provision of printed circuit boards (PCB) South Korea and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026