- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A065650

Should Medifron DBT (KOSDAQ:065650) Be Disappointed With Their 48% Profit?

While Medifron DBT Co., Ltd. (KOSDAQ:065650) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. Looking on the brighter side, the stock is actually up over twelve months. In that time, it is up 48%, which isn't bad, but is below the market return of 79%.

View our latest analysis for Medifron DBT

Medifron DBT isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Medifron DBT's revenue grew by 70%. That's well above most other pre-profit companies. Let's face it the 48% share price gain in that time is underwhelming compared to the growth. When revenue spikes but the share price doesn't we can't help wondering if the market is missing something. It's possible that the market is worried about the losses, or simply that the growth was already priced in. Or, this could be worth adding to your watchlist.

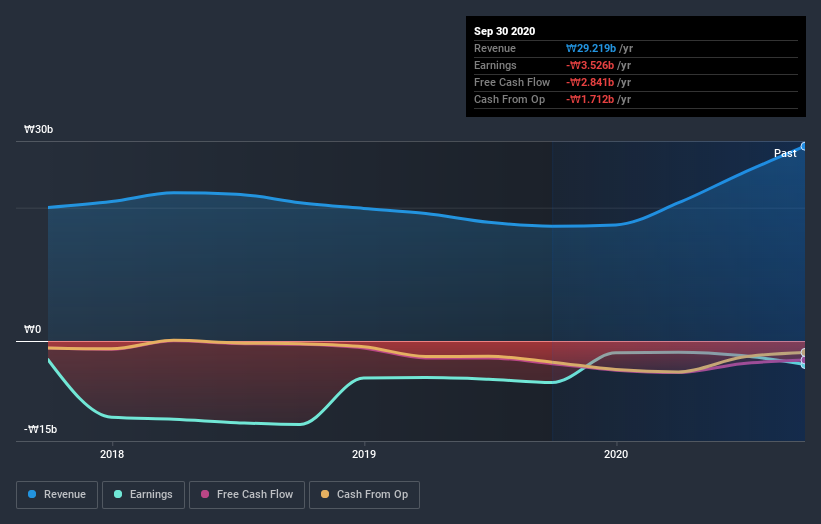

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Medifron DBT's financial health with this free report on its balance sheet.

A Different Perspective

Medifron DBT provided a TSR of 48% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 1.4% per year over five year. It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Medifron DBT (including 1 which shouldn't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Medifron DBT, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A065650

Hyper

A clinical stage biopharmaceutical company, focuses on the development of Alzheimer's disease (AD) and neuropathic pain treatments, and AD diagnostics.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026