- South Korea

- /

- Communications

- /

- KOSDAQ:A056360

Is Comunication WeaverLtd (KOSDAQ:056360) Weighed On By Its Debt Load?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Comunication Weaver Co.,Ltd. (KOSDAQ:056360) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Comunication WeaverLtd

What Is Comunication WeaverLtd's Debt?

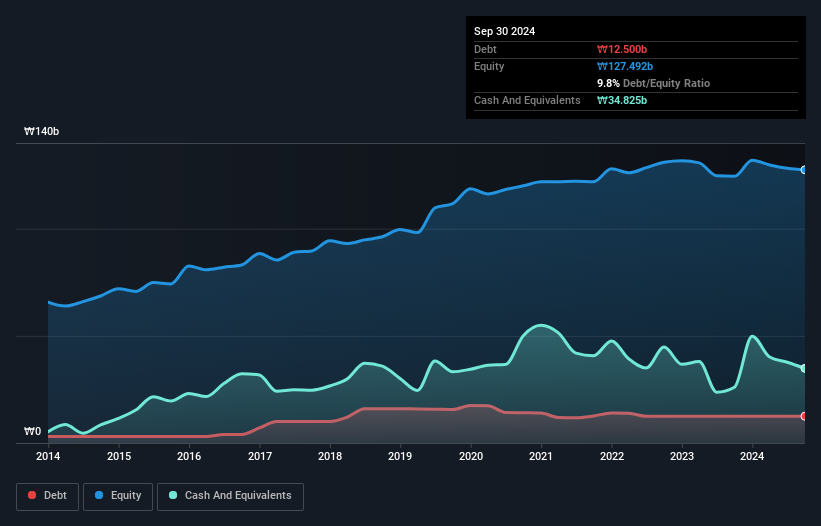

As you can see below, Comunication WeaverLtd had ₩12.5b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. But on the other hand it also has ₩34.8b in cash, leading to a ₩22.3b net cash position.

How Healthy Is Comunication WeaverLtd's Balance Sheet?

The latest balance sheet data shows that Comunication WeaverLtd had liabilities of ₩22.7b due within a year, and liabilities of ₩1.24b falling due after that. Offsetting these obligations, it had cash of ₩34.8b as well as receivables valued at ₩5.93b due within 12 months. So it actually has ₩16.8b more liquid assets than total liabilities.

It's good to see that Comunication WeaverLtd has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Comunication WeaverLtd boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is Comunication WeaverLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Comunication WeaverLtd made a loss at the EBIT level, and saw its revenue drop to ₩66b, which is a fall of 16%. That's not what we would hope to see.

So How Risky Is Comunication WeaverLtd?

While Comunication WeaverLtd lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of ₩3.8b. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Comunication WeaverLtd (1 is significant) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A056360

Comunication WeaverLtd

Develops, manufactures, and supplies fiber optic transmission systems to state-owned corporate and financial industries in South Korea.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)