- South Korea

- /

- Tech Hardware

- /

- KOSDAQ:A052400

The three-year loss for Kona ILtd (KOSDAQ:052400) shareholders likely driven by its shrinking earnings

Kona I Co.,Ltd. (KOSDAQ:052400) shareholders should be happy to see the share price up 13% in the last week. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 53% in the last three years. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

On a more encouraging note the company has added ₩25b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Kona ILtd

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

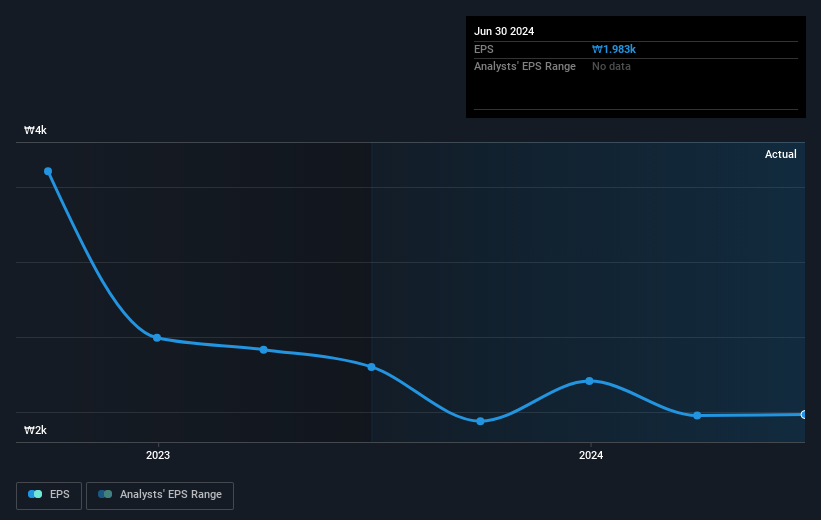

During the three years that the share price fell, Kona ILtd's earnings per share (EPS) dropped by 4.2% each year. The share price decline of 22% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 8.30.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market gained around 6.8% in the last year, Kona ILtd shareholders lost 17% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Kona ILtd you should be aware of.

But note: Kona ILtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kona ILtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A052400

Kona ILtd

Provides solutions and platforms for the financial technology market in South Korea and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026