- South Korea

- /

- Communications

- /

- KOSDAQ:A050890

Even after rising 16% this past week, SOLiD (KOSDAQ:050890) shareholders are still down 20% over the past three years

While not a mind-blowing move, it is good to see that the SOLiD, Inc. (KOSDAQ:050890) share price has gained 20% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 21% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for SOLiD

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, SOLiD moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

The modest 0.9% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 19% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating SOLiD further; while we may be missing something on this analysis, there might also be an opportunity.

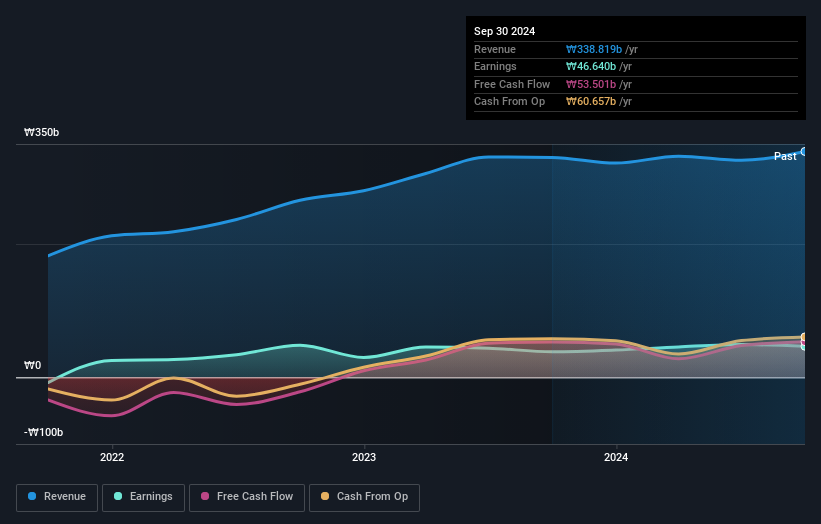

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at SOLiD's financial health with this free report on its balance sheet.

A Different Perspective

SOLiD shareholders are down 3.5% over twelve months (even including dividends), which isn't far from the market return of -3.8%. Longer term investors wouldn't be so upset, since they would have made 1.0%, each year, over five years. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. Is SOLiD cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A050890

SOLiD

Develops, manufactures, and sells parts, products, and equipment for mobile and digital communication networks.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives