- South Korea

- /

- Communications

- /

- KOSDAQ:A040160

If You Had Bought Nuri Telecom (KOSDAQ:040160) Shares A Year Ago You'd Have Earned 51% Returns

Nuri Telecom Co., Ltd. (KOSDAQ:040160) shareholders have seen the share price descend 21% over the month. Looking on the brighter side, the stock is actually up over twelve months. But to be blunt its return of 51% fall short of what you could have got from an index fund (around 55%).

View our latest analysis for Nuri Telecom

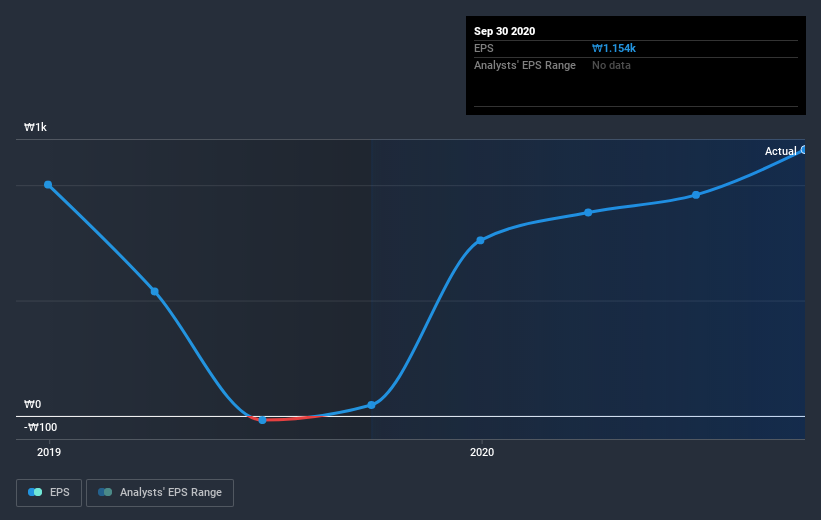

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Nuri Telecom saw its earnings per share (EPS) increase strongly. While that particular rate of growth is unlikely to be sustained for long, it is still remarkable. So we're unsurprised to see the share price gaining ground. We're real advocates of letting inflection points like this guide our research as stock pickers.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Nuri Telecom's earnings, revenue and cash flow.

A Different Perspective

Nuri Telecom shareholders have received returns of 52% over twelve months (even including dividends), which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 4%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for Nuri Telecom. It's always interesting to track share price performance over the longer term. But to understand Nuri Telecom better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Nuri Telecom .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Nuri Telecom or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NuriFlexLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A040160

NuriFlexLtd

Provides optimal IoT solutions for utilities, manufacturing, energy, and public sector in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026