The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that UANGEL Corporation (KRX:072130) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for UANGEL

What Is UANGEL's Net Debt?

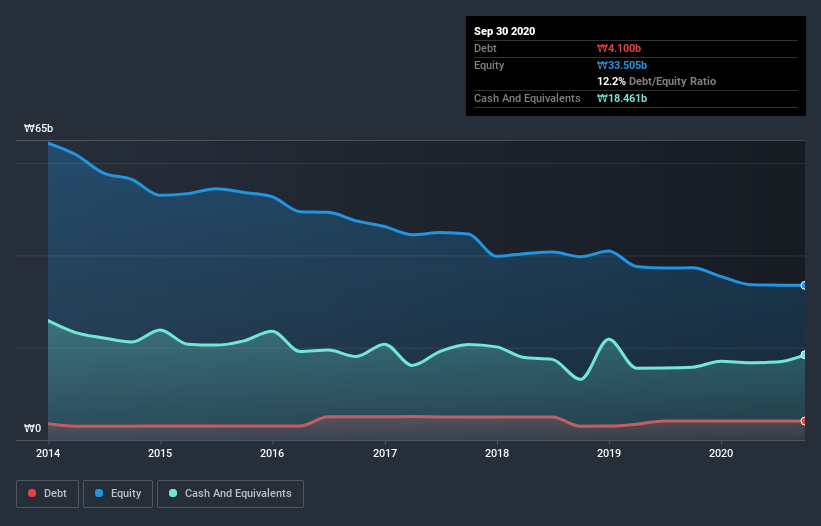

As you can see below, UANGEL had ₩4.10b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, its balance sheet shows it holds ₩18.5b in cash, so it actually has ₩14.4b net cash.

How Strong Is UANGEL's Balance Sheet?

According to the last reported balance sheet, UANGEL had liabilities of ₩7.91b due within 12 months, and liabilities of ₩2.29b due beyond 12 months. Offsetting this, it had ₩18.5b in cash and ₩3.32b in receivables that were due within 12 months. So it actually has ₩11.6b more liquid assets than total liabilities.

This excess liquidity suggests that UANGEL is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that UANGEL has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since UANGEL will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year UANGEL had a loss before interest and tax, and actually shrunk its revenue by 11%, to ₩26b. That's not what we would hope to see.

So How Risky Is UANGEL?

While UANGEL lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow ₩256m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with UANGEL (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade UANGEL, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A072130

UANGEL

Engages in planning, developing, and selling information and communication-related software and systems in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion