While Posco Dx Company Ltd. (KRX:022100) might not have the largest market cap around , it saw significant share price movement during recent months on the KOSE, rising to highs of ₩26,800 and falling to the lows of ₩20,800. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Posco Dx's current trading price of ₩21,950 reflective of the actual value of the mid-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Posco Dx’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Is Posco Dx Still Cheap?

According to our price multiple model, where we compare the company's price-to-earnings ratio to the industry average, the stock currently looks expensive. In this instance, we’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. We find that Posco Dx’s ratio of 42.74x is above its peer average of 17.65x, which suggests the stock is trading at a higher price compared to the IT industry. But, is there another opportunity to buy low in the future? Given that Posco Dx’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

View our latest analysis for Posco Dx

Can we expect growth from Posco Dx?

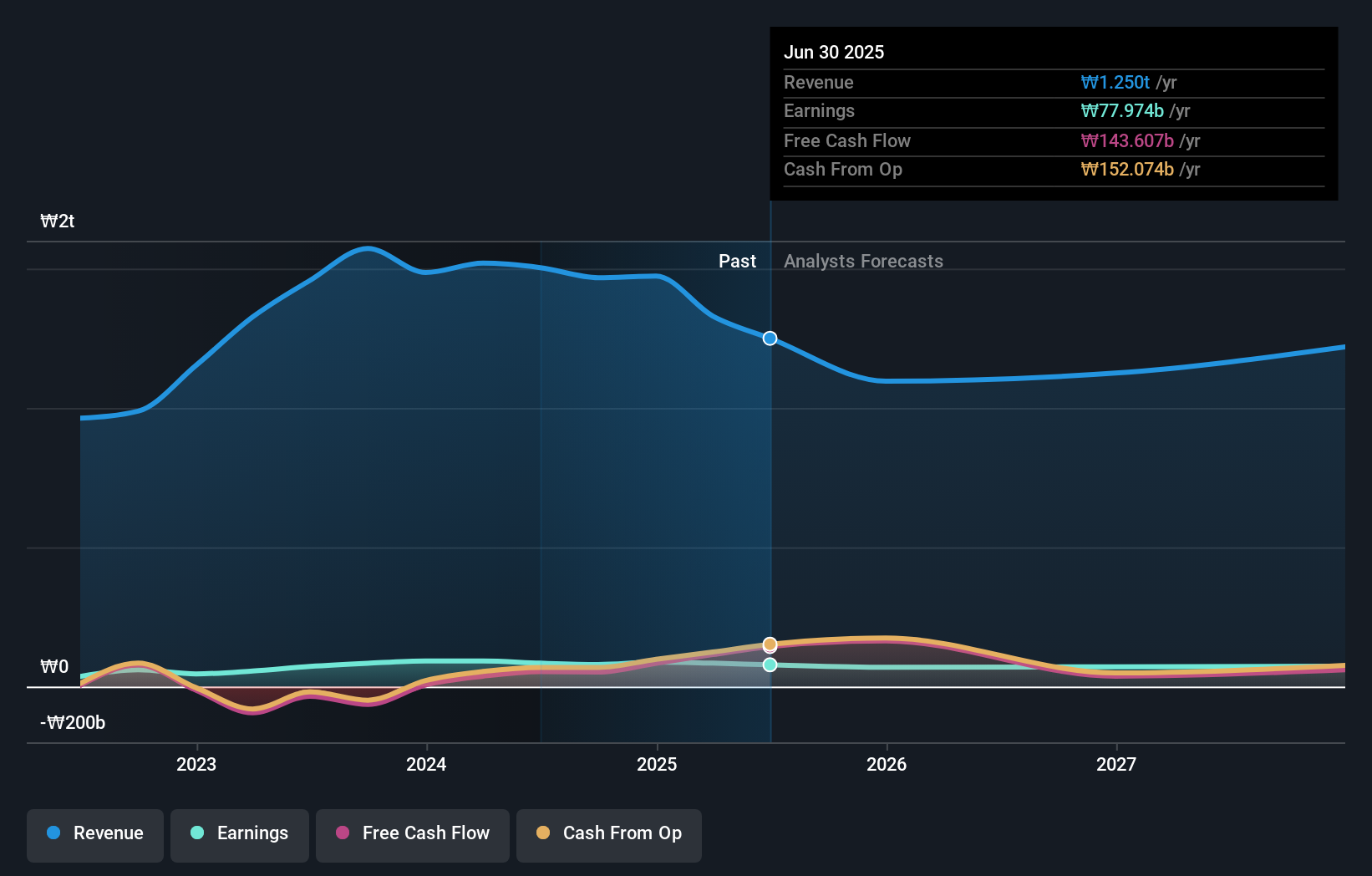

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Though in the case of Posco Dx, it is expected to deliver a negative earnings growth of -7.7%, which doesn’t help build up its investment thesis. It appears that risk of future uncertainty is high, at least in the near term.

What This Means For You

Are you a shareholder? If you believe A022100 is currently trading above its peers, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. Given the uncertainty from negative growth in the future, this could be the right time to de-risk your portfolio. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on A022100 for a while, now may not be the best time to enter into the stock. The price has climbed past its industry peers, in addition to a risky future outlook. However, there are also other important factors which we haven’t considered today, such as the track record of its management. Should the price fall in the future, will you be well-informed enough to buy?

If you want to dive deeper into Posco Dx, you'd also look into what risks it is currently facing. In terms of investment risks, we've identified 1 warning sign with Posco Dx, and understanding this should be part of your investment process.

If you are no longer interested in Posco Dx, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A022100

Posco Dx

Provides ICT solutions to construction and materials industry in South Korea and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026