- China

- /

- Metals and Mining

- /

- SZSE:001337

Unveiling Undiscovered Gems Three Promising Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by volatility, global markets have seen mixed performances with the U.S. stock indices mostly lower due to corporate earnings and AI competition fears, while European markets were buoyed by strong earnings and an ECB rate cut. Amid these fluctuations, investors are increasingly looking toward small-cap stocks with robust fundamentals as potential opportunities, especially in sectors that may benefit from current economic conditions and shifts in market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Posco Dx (KOSE:A022100)

Simply Wall St Value Rating: ★★★★★★

Overview: Posco Dx Company Ltd. offers ICT solutions to the construction and materials industry both in South Korea and internationally, with a market capitalization of approximately ₩2.79 trillion.

Operations: Posco Dx generates revenue primarily from its IT Business Office and EIC Business Office, contributing ₩572.51 billion and ₩805.71 billion respectively. The Logistics Automation Division adds another ₩56.75 billion to the revenue stream, while international operations in China, Vietnam, and Indonesia collectively contribute smaller amounts.

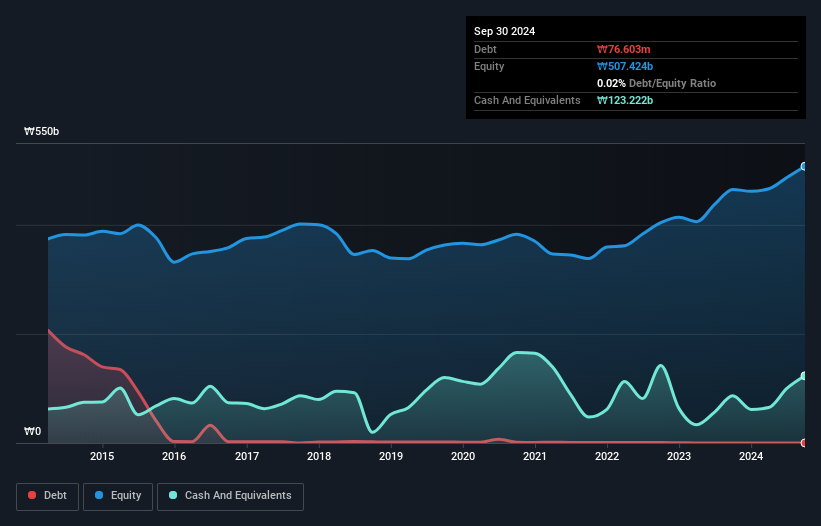

Posco Dx, a promising player in the tech industry, shows a mixed financial landscape. The company has successfully reduced its debt-to-equity ratio from 0.5% to 0.02% over five years, indicating prudent financial management. Despite having high-quality past earnings and being profitable with no cash runway concerns, Posco Dx faced negative earnings growth of -5.2% last year compared to the IT industry's -6.7%. With more cash than total debt and positive free cash flow, it remains financially stable; however, forecasts suggest an average annual earnings decline of 5.2% over the next three years (US$).

- Take a closer look at Posco Dx's potential here in our health report.

Gain insights into Posco Dx's past trends and performance with our Past report.

Medlive Technology (SEHK:2192)

Simply Wall St Value Rating: ★★★★★★

Overview: Medlive Technology Co., Ltd. operates an online professional physician platform in Mainland China and internationally, with a market capitalization of HK$6.34 billion.

Operations: Medlive Technology generates revenue primarily from its healthcare software segment, amounting to CN¥481.94 million. The company's market capitalization stands at HK$6.34 billion.

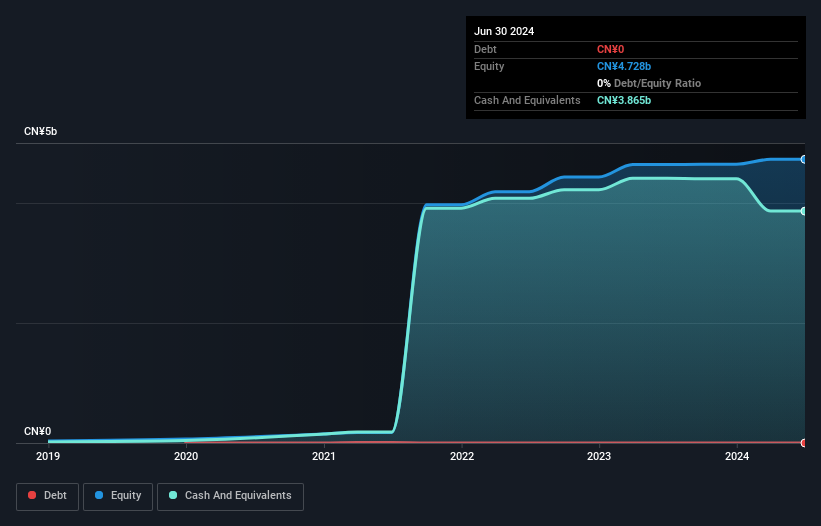

Medlive Technology, a promising player in the healthcare services arena, showcases robust financial health with zero debt over the past five years. The company has demonstrated impressive earnings growth of 53.5% last year, outpacing the industry average of 10.4%. Its price-to-earnings ratio stands at 22.4x, slightly below the industry norm of 23.4x, suggesting potential value for investors. Recent developments include a renewed agreement with M3 to extend digital marketing services until December 2027, indicating steady business relationships and revenue streams from customized digital surveys and content creation tailored for medical professionals.

- Click to explore a detailed breakdown of our findings in Medlive Technology's health report.

Assess Medlive Technology's past performance with our detailed historical performance reports.

Sichuan Gold (SZSE:001337)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Gold Co., Ltd. is involved in the gold mining industry and has a market capitalization of CN¥9.06 billion.

Operations: The primary revenue stream for Sichuan Gold comes from the production and sale of gold concentrate and alloy gold, generating CN¥657.78 million. The company's financial performance is notably influenced by its gross profit margin, which stands at 19.5%.

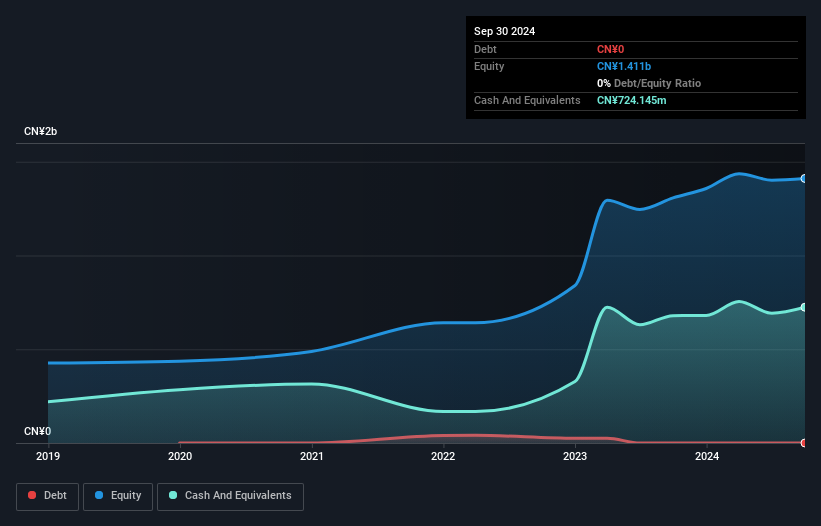

Gold from Sichuan shines brightly in the investment landscape, boasting impressive earnings growth of 28% over the past year, outpacing its industry peers. This company stands debt-free, a rarity that enhances its financial stability and reduces risk. High-quality earnings further underscore its robust performance, while free cash flow remains positive at US$189 million as of September 2024. Despite significant capital expenditures reaching US$149 million, the firm manages to maintain healthy financials without reliance on borrowed funds. The combination of these factors positions it as a noteworthy contender in the mining sector's competitive arena.

Turning Ideas Into Actions

- Click this link to deep-dive into the 4688 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001337

Flawless balance sheet with solid track record.

Market Insights

Community Narratives