- South Korea

- /

- Interactive Media and Services

- /

- KOSE:A020120

Industry Analysts Just Made A Huge Upgrade To Their KidariStudio, Inc. (KRX:020120) Revenue Forecasts

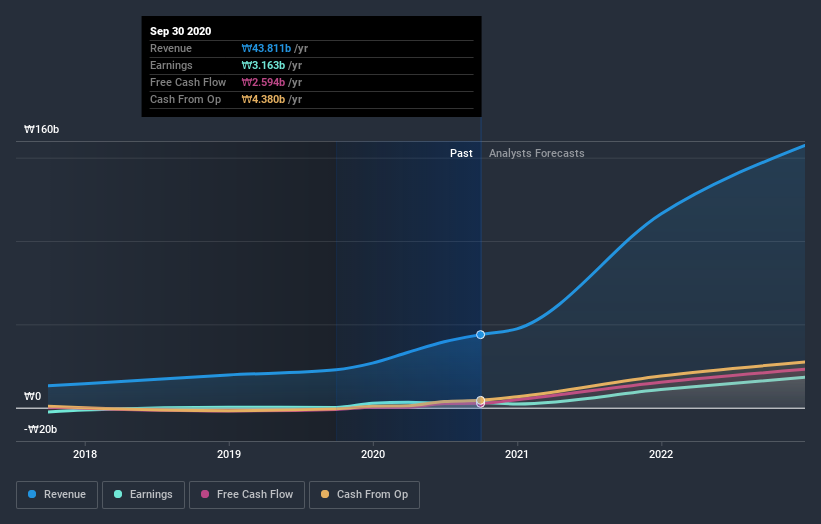

Celebrations may be in order for KidariStudio, Inc. (KRX:020120) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts have sharply increased their revenue numbers, with a view that KidariStudio will make substantially more sales than they'd previously expected. Investors have been pretty optimistic on KidariStudio too, with the stock up 25% to ₩13,900 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

Following the latest upgrade, the current consensus, from the twin analysts covering KidariStudio, is for revenues of ₩116m in 2021, which would reflect a stressful 100% reduction in KidariStudio's sales over the past 12 months. Statutory earnings per share are presumed to shoot up 101% to ₩363. Prior to this update, the analysts had been forecasting revenues of ₩85m and earnings per share (EPS) of ₩359 in 2021. There's clearly been a surge in bullishness around the company's sales pipeline, even if there's no real change in earnings per share forecasts.

Check out our latest analysis for KidariStudio

Analysts increased their price target 50% to ₩18,000, perhaps signalling that higher revenues are a strong leading indicator for KidariStudio's valuation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with the forecast 100% revenue decline a notable change from historical growth of 8.6% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 8.9% annually for the foreseeable future. It's pretty clear that KidariStudio's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most obvious conclusion from this consensus update is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at KidariStudio.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for KidariStudio going out as far as 2022, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading KidariStudio or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KidariStudio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A020120

KidariStudio

Develops and distributes media content in South Korea and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026