- South Korea

- /

- Software

- /

- KOSDAQ:A322180

Investors Appear Satisfied With LS THiRA-UTECH Co., Ltd.'s (KOSDAQ:322180) Prospects

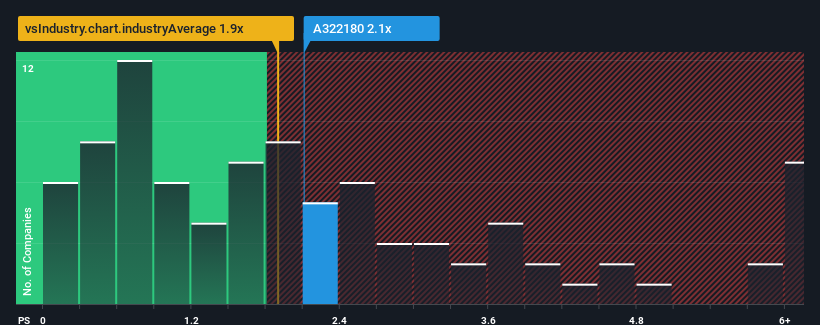

With a median price-to-sales (or "P/S") ratio of close to 1.9x in the Software industry in Korea, you could be forgiven for feeling indifferent about LS THiRA-UTECH Co., Ltd.'s (KOSDAQ:322180) P/S ratio of 2.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 2 warning signs investors should be aware of before investing in LS THiRA-UTECH. Read for free now.See our latest analysis for LS THiRA-UTECH

How LS THiRA-UTECH Has Been Performing

LS THiRA-UTECH has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for LS THiRA-UTECH, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For LS THiRA-UTECH?

In order to justify its P/S ratio, LS THiRA-UTECH would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.7%. This was backed up an excellent period prior to see revenue up by 46% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why LS THiRA-UTECH is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears to us that LS THiRA-UTECH maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you take the next step, you should know about the 2 warning signs for LS THiRA-UTECH that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A322180

LS THiRA-UTECH

Operates as a smart factory and smart logistics specialized solution provider in South Korea.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives