Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that KSIGN Co.,Ltd. (KOSDAQ:192250) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is KSIGNLtd's Net Debt?

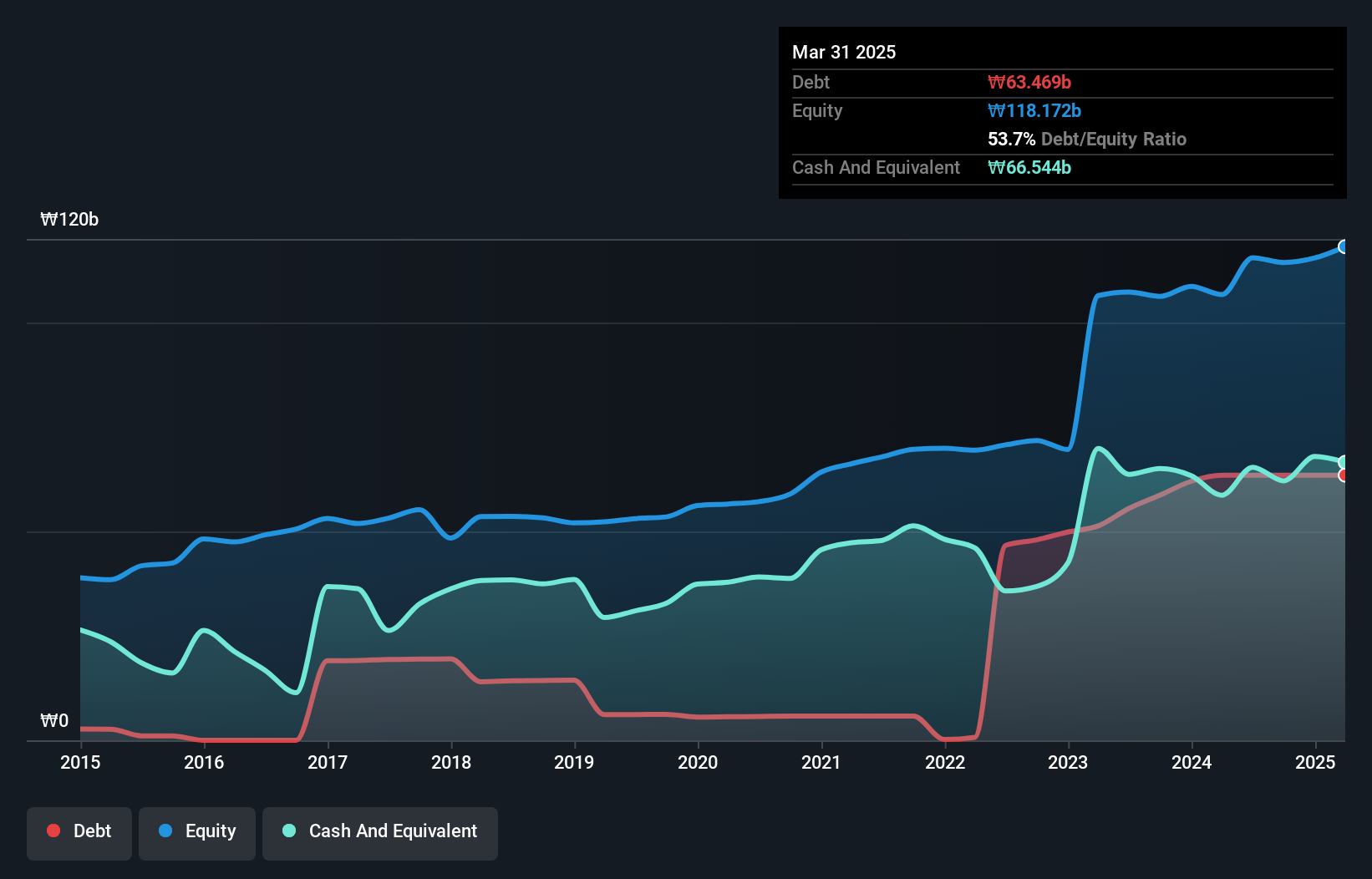

The chart below, which you can click on for greater detail, shows that KSIGNLtd had ₩63.5b in debt in March 2025; about the same as the year before. But it also has ₩66.5b in cash to offset that, meaning it has ₩3.07b net cash.

How Strong Is KSIGNLtd's Balance Sheet?

We can see from the most recent balance sheet that KSIGNLtd had liabilities of ₩76.2b falling due within a year, and liabilities of ₩11.8m due beyond that. Offsetting this, it had ₩66.5b in cash and ₩6.53b in receivables that were due within 12 months. So it has liabilities totalling ₩3.12b more than its cash and near-term receivables, combined.

Given KSIGNLtd has a market capitalization of ₩82.2b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, KSIGNLtd also has more cash than debt, so we're pretty confident it can manage its debt safely.

View our latest analysis for KSIGNLtd

Importantly, KSIGNLtd's EBIT fell a jaw-dropping 62% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is KSIGNLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. KSIGNLtd may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, KSIGNLtd burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that KSIGNLtd has ₩3.07b in net cash. Despite the cash, we do find KSIGNLtd's EBIT growth rate concerning, so we're not particularly comfortable with the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 5 warning signs we've spotted with KSIGNLtd (including 2 which don't sit too well with us) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if KSIGNLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A192250

KSIGNLtd

Develops and supplies software products primarily in South Korea.

Low risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion