- Switzerland

- /

- Machinery

- /

- SWX:VACN

Insiders Back These 3 High Growth Companies

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating earnings and geopolitical uncertainties, investors are keenly observing the impact of AI advancements and central bank policies on stock performance. Amidst this backdrop, companies with high insider ownership can offer unique insights into potential growth opportunities, as insiders often have a deep understanding of their businesses' long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here's a peek at a few of the choices from the screener.

Selvas AI (KOSDAQ:A108860)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Selvas AI Inc. is a South Korean company specializing in artificial intelligence, with a market cap of ₩389.99 billion.

Operations: The company's revenue segments include Medical Diagnosis Device at ₩16.65 billion, Assistive Technology Equipment at ₩12.53 billion, Artificial Intelligence-Based Technology at ₩7.40 billion, and Artificial Intelligence Application Solution (Including Electronic Dictionary) at ₩16.75 billion.

Insider Ownership: 13.1%

Selvas AI's recent earnings report shows a significant reduction in net loss, improving from KRW 3,101.08 million to KRW 142.48 million year-over-year for the third quarter. Despite highly volatile share prices and no substantial insider trading activity recently, the company is forecasted to achieve profitability within three years with a projected annual profit growth rate above the market average. Revenue growth is expected at 17% per year, surpassing the broader Korean market's growth rate of 9%.

- Get an in-depth perspective on Selvas AI's performance by reading our analyst estimates report here.

- The analysis detailed in our Selvas AI valuation report hints at an inflated share price compared to its estimated value.

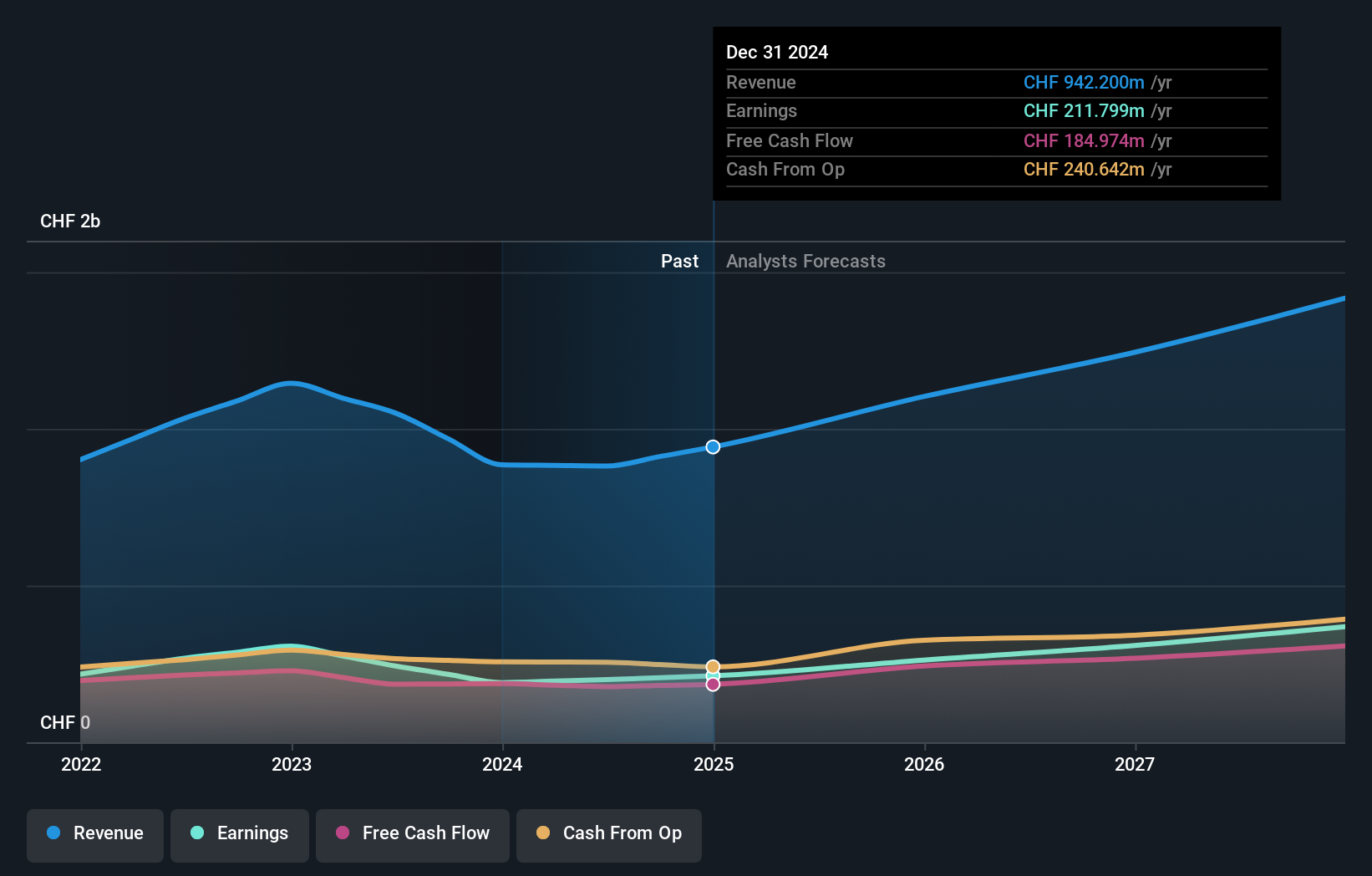

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG, with a market cap of CHF10.59 billion, develops, manufactures, and supplies vacuum valves and related products across Switzerland, Europe, the United States, Asia, and other international markets.

Operations: The company's revenue segments are comprised of Valves generating CHF783.51 million and Global Service contributing CHF163.83 million.

Insider Ownership: 10.2%

VAT Group's earnings are projected to grow at 20% annually, outpacing the Swiss market's average of 11.8%, while revenue is expected to rise by 13.3% per year, surpassing the market's 4.3%. The company's Return on Equity is forecasted to be very high in three years at 40.5%. Recent company presentations featured CFO Fabian Chiozza, but there has been no substantial insider trading activity over the past three months.

- Take a closer look at VAT Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, VAT Group's share price might be too optimistic.

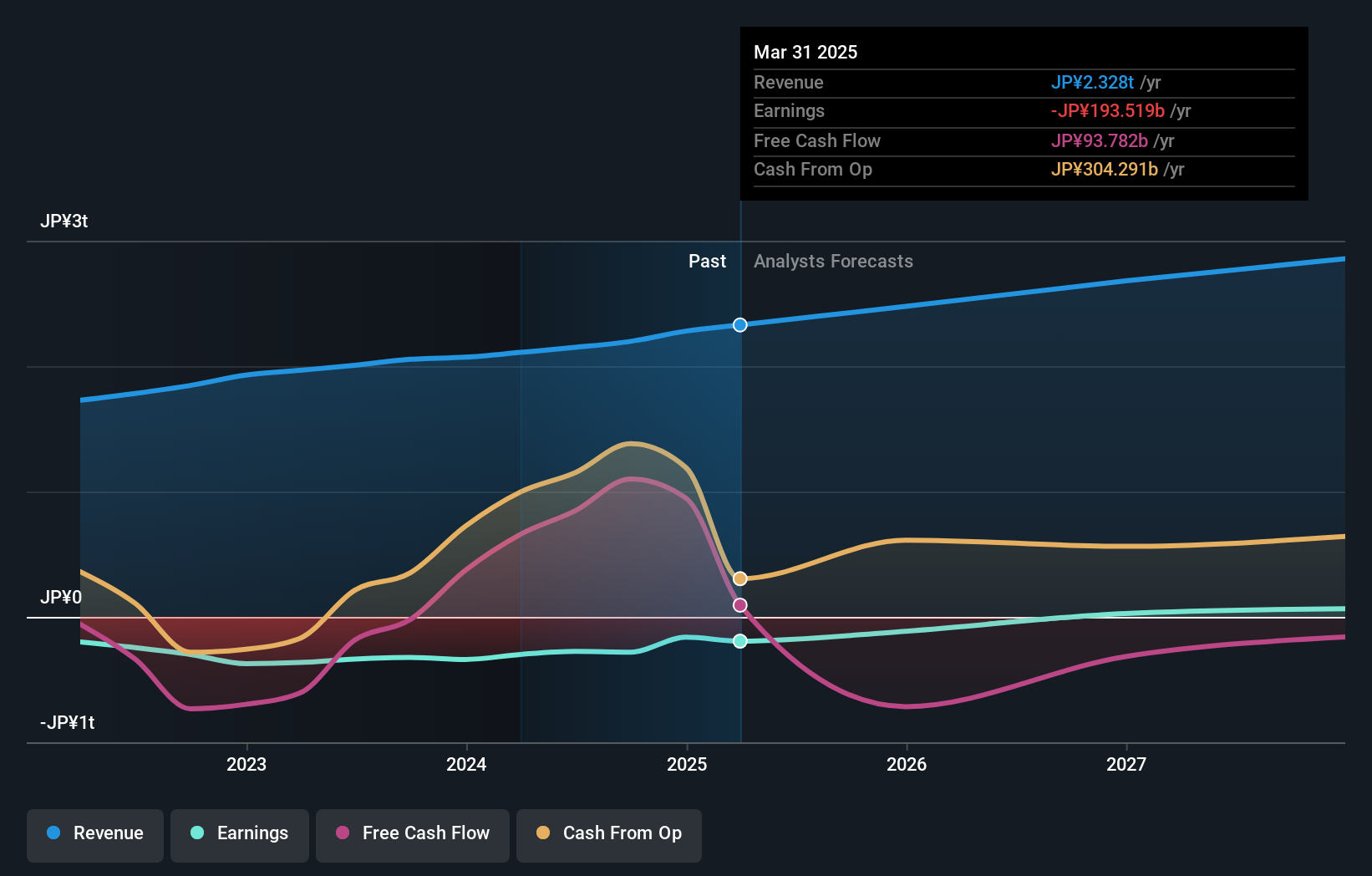

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors both in Japan and internationally with a market cap of ¥2.08 trillion.

Operations: The company's revenue segments consist of Internet Services at ¥1.25 billion, Fin Tech at ¥796 million, and Mobile at ¥400 million.

Insider Ownership: 27.7%

Rakuten Group is trading significantly below its estimated fair value, indicating potential undervaluation. The company is expected to see revenue growth of 6.8% annually, outpacing the Japanese market average of 4.2%, and it aims to become profitable within three years, suggesting above-market profit growth potential. Recent strategic moves include a $550 million fixed-income offering and leadership changes with Masayuki Hosaka's retirement as Vice Chairman in March 2025.

- Navigate through the intricacies of Rakuten Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Rakuten Group is trading behind its estimated value.

Taking Advantage

- Click here to access our complete index of 1476 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VACN

VAT Group

Develops, manufactures, and sells vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives