- South Korea

- /

- Software

- /

- KOSDAQ:A108860

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and competitive pressures in the AI sector, major indices like the Nasdaq Composite have experienced notable volatility, while central banks in regions such as Europe adjust interest rates to bolster economic sentiment. Amidst these dynamics, identifying promising high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability to technological advancements and market shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Selvas AI (KOSDAQ:A108860)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Selvas AI Inc. is a South Korean company specializing in artificial intelligence technologies, with a market cap of ₩389.99 billion.

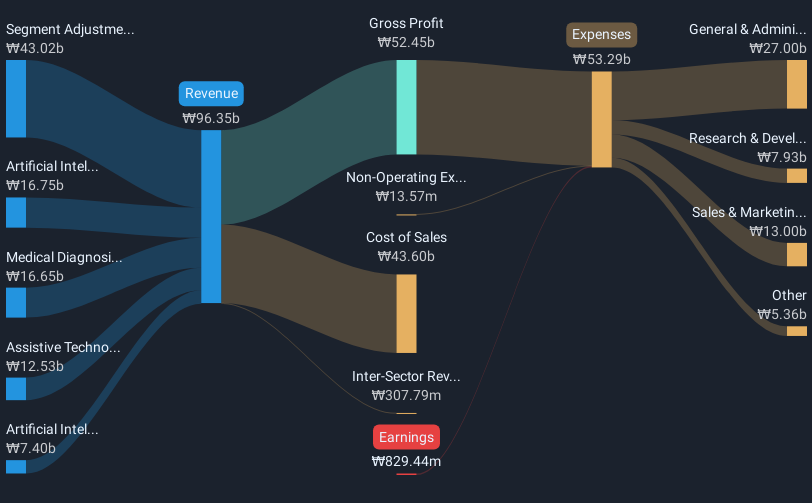

Operations: Selvas AI generates revenue primarily from four segments: Medical Diagnosis Device (₩16.65 billion), Artificial Intelligence Application Solution (₩16.75 billion), Assistive Technology Equipment (₩12.53 billion), and Artificial Intelligence-Based Technology (₩7.40 billion).

Selvas AI, despite its current unprofitability, shows promising signs with a forecasted earnings growth of 91.2% per year and an anticipated shift to profitability within the next three years. This potential turnaround is underscored by a significant reduction in net losses—from KRW 3.1 billion to KRW 142.48 million year-over-year—and improved revenue projections growing at 17% annually, outpacing the Korean market's average of 9%. The firm's commitment to innovation is evident from its R&D expenses which are strategically aligned with emerging tech trends, positioning Selvas AI favorably for future industry demands. These factors collectively suggest a resilient adaptability and a strategic focus on long-term growth in the high-tech sector.

- Click to explore a detailed breakdown of our findings in Selvas AI's health report.

Understand Selvas AI's track record by examining our Past report.

Cicor Technologies (SWX:CICN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cicor Technologies Ltd., with a market cap of CHF288.63 million, develops and manufactures electronic components, devices, and systems on a global scale through its subsidiaries.

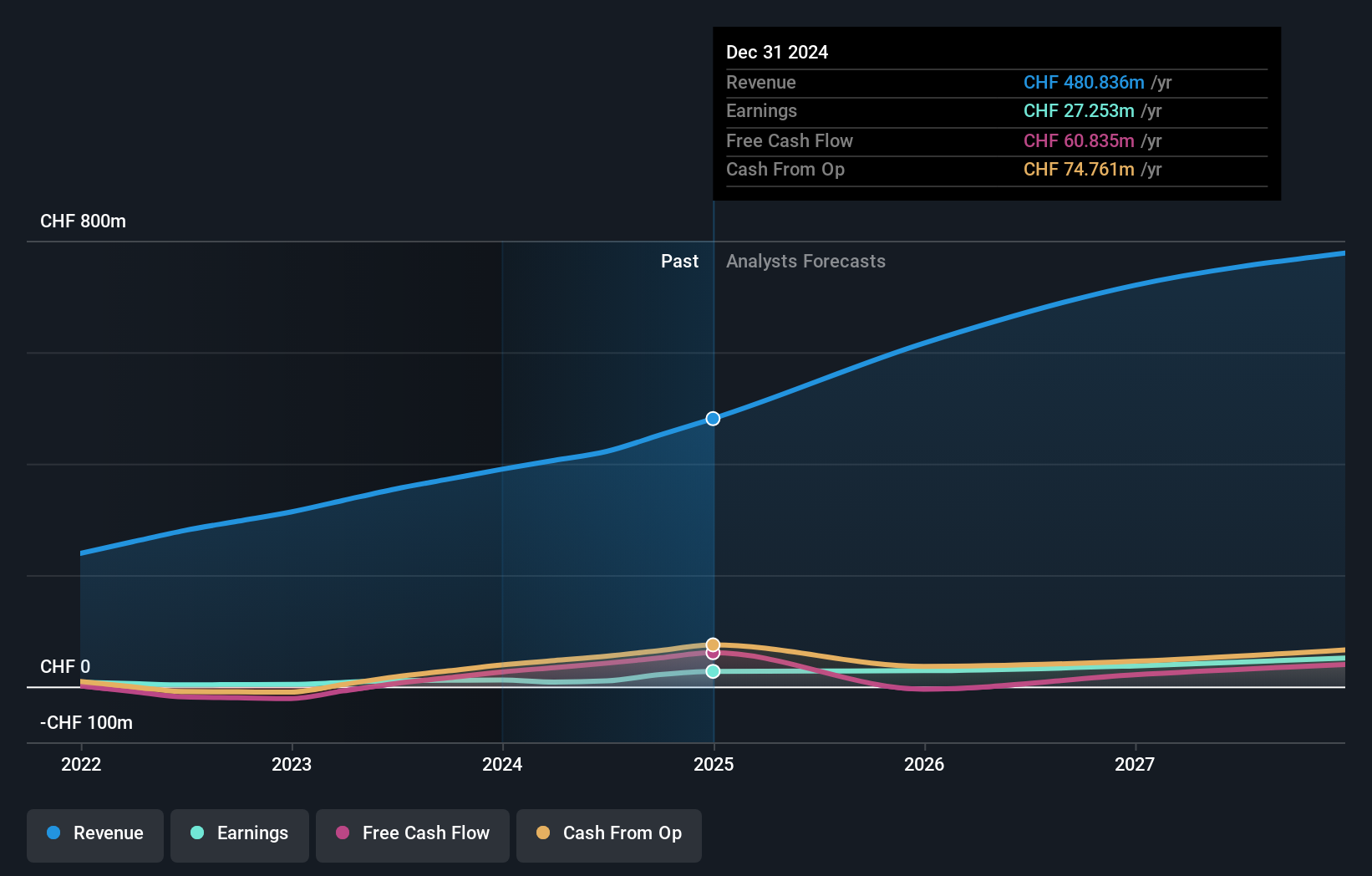

Operations: Cicor Technologies generates revenue primarily from its Advanced Substrates (AS) Division and Electronic Manufacturing Services (EMS) Division, with the EMS Division contributing CHF377.46 million and the AS Division contributing CHF46.24 million.

Cicor Technologies, amid recent M&A discussions and a significant nomination as a supplier for advanced electronic devices in aerospace, illustrates its strategic positioning in high-demand sectors. Despite a slight dip in earnings growth by 4.5% over the past year, it's noteworthy that Cicor's revenue is expected to outpace the Swiss market with an annual increase of 7%. This growth trajectory is bolstered by its R&D commitment, aligning with industry advancements and ensuring sustained competitiveness. The company’s active pursuit of acquisitions underscores its ambition to expand influence and capabilities within tech-intensive markets.

- Take a closer look at Cicor Technologies' potential here in our health report.

Assess Cicor Technologies' past performance with our detailed historical performance reports.

AT & S Austria Technologie & Systemtechnik (WBAG:ATS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, with a market cap of €512.43 million, manufactures and distributes printed circuit boards across Austria, Germany, the rest of Europe, China, the rest of Asia, and the Americas.

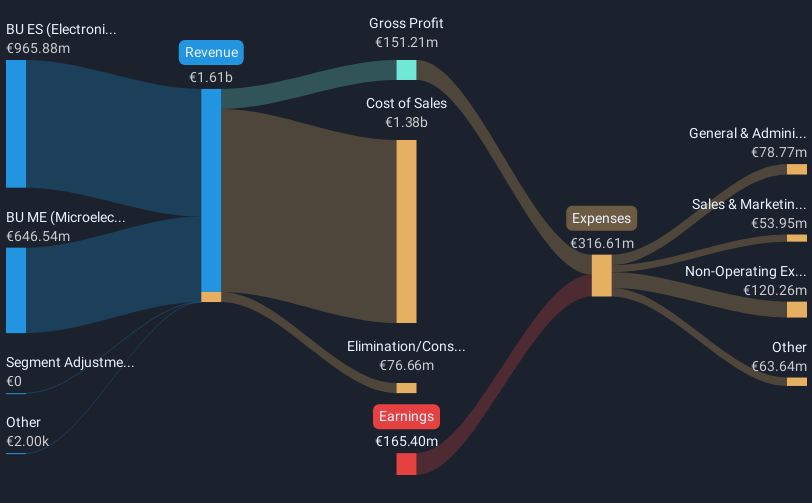

Operations: The company generates revenue primarily from two segments: Microelectronics (€646.54 million) and Electronics Solutions (€965.88 million). The Electronics Solutions segment contributes a larger portion to the overall revenue stream.

AT & S Austria Technologie & Systemtechnik, amidst leadership changes and lowered financial forecasts, is navigating challenging waters. The company recently adjusted its revenue expectations for FY 2026-27 to €2.1 billion from a previous estimate of €3.0 billion, reflecting strategic recalibrations. Despite these adjustments, AT&S's commitment to innovation remains robust with R&D expenses maintaining a steady pace in alignment with industry demands. This dedication is critical as the company aims for profitability within three years, supported by an anticipated earnings growth of 108%. These developments underscore AT&S's resilience and adaptability in a rapidly evolving tech landscape.

Seize The Opportunity

- Unlock our comprehensive list of 1230 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A108860

Selvas AI

Operates as an artificial intelligence (AI) company in South Korea.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives